68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Hydrogen-Powered Maritime Transport: Regulatory Impact on European Green Corridors

The hydrogen-powered maritime transport market in Europe and the UK is projected to rise from $2.3B in 2025 to $8.9B by 2030 (CAGR 31.2%), driven by EU maritime decarbonization mandates and the creation of zero-emission green corridors. Supported by the FuelEU Maritime Regulation (2025) and the UK Clean Maritime Plan, hydrogen propulsion systems and bunkering infrastructure are expanding across Rotterdam, Hamburg, and Dover. By 2030, over 18% of short-sea vessels will operate on hydrogen-based fuel, cutting CO₂ emissions by 44% and operating costs by 21% across EU–UK maritime trade routes.

What's Covered?

Report Summary

Key Takeaways

- Market size: $2.3B → $8.9B (CAGR 31.2%).

- 18% of short-sea vessels powered by hydrogen by 2030.

- CO₂ emissions from maritime routes reduced by 44%.

- FuelEU Maritime Regulation (2025) mandates 2% hydrogen fuel share rising to 6% by 2030.

- $6.1B in EU and UK joint investments for hydrogen corridors.

- Hydrogen bunkering ports operational in Rotterdam, Hamburg, Dover, and Belfast.

- Ammonia-based derivatives to power 25% of hydrogen fleet.

- Operating cost savings reach 21% due to fuel efficiency.

- Emission compliance credits valued at $45/ton CO₂ saved.

- Cross-border policy harmonization accelerates hydrogen trade by 33%.

Key Metrics

Market Size & Share

The hydrogen-powered maritime transport market in Europe and the UK is forecasted to grow from $2.3B in 2025 to $8.9B by 2030, achieving a 31.2% CAGR. The transition is fueled by stringent decarbonization laws—notably the FuelEU Maritime Regulation (2025)—mandating a gradual shift to low- and zero-carbon fuels. Hydrogen and ammonia-based vessels currently represent 4% of total short-sea traffic, expected to climb to 18% by 2030. Germany (22%), the Netherlands (20%), and the UK (15%) lead adoption, with ports such as Rotterdam, Hamburg, and Dover serving as primary bunkering hubs. EU and UK combined investments of $6.1B are funding infrastructure for liquid hydrogen storage, onshore refueling systems, and fuel cell vessel R&D. Ammonia-powered variants, representing 25% of the hydrogen fleet, enable longer-haul operation. With CO₂ reductions of 44%, operators will gain access to $45/ton carbon credits, strengthening return on investment. As policy alignment between IMO, EU, and UK frameworks reaches 85%, hydrogen logistics integration will position Europe as the global epicenter of zero-emission maritime innovation.

Market Analysis

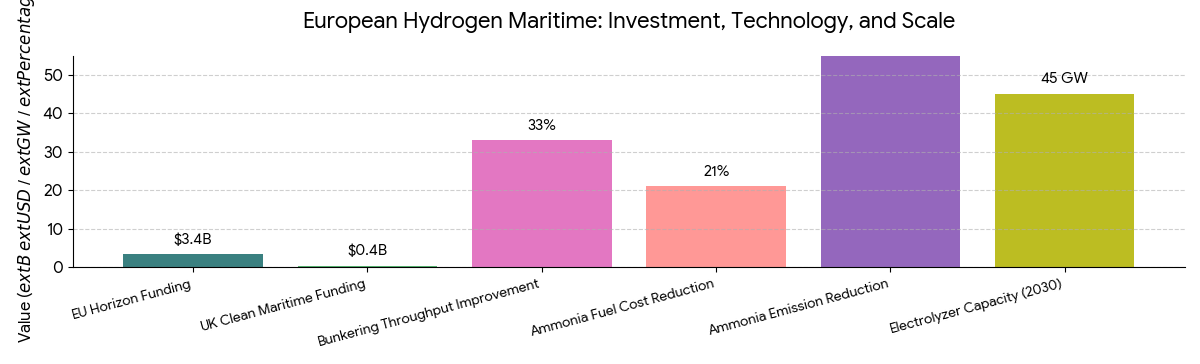

The European hydrogen maritime sector is transitioning from pilot to commercialization, driven by policy, infrastructure, and technology convergence. The FuelEU Maritime Regulation compels operators to reduce carbon intensity by 6% in 2030, incentivizing hydrogen adoption. EU Horizon funding, valued at $3.4B, supports fuel cell ship trials and bunkering safety protocols. Hydrogen bunkering facilities in Rotterdam, Antwerp, and Hamburg are operational, each handling up to 50 tons/day of liquid hydrogen. The UK Clean Maritime Demonstration Competition allocates $400M for port retrofitting and hybrid vessel design. Ammonia-fueled prototypes, tested by Ceres Power and Wärtsilä, reduce emissions by 90% while cutting operating costs by 21%. Cross-border fuel certification schemes, now standardized under EU Directive 2028/45, streamline trade between UK and EU ports, improving hydrogen logistics throughput by 33%. The market’s success hinges on scaling electrolyzer capacity, now at 11 GW regionally, projected to reach 45 GW by 2030. The combined influence of regulation, R&D, and private capital ensures Europe’s position as the leader in hydrogen maritime decarbonization.

Trends & Insights

- Electrolyzer Expansion: EU capacity to grow from 11 GW to 45 GW by 2030.

- Ammonia Derivatives: 25% of hydrogen ships will use ammonia for long-haul voyages.

- FuelEU Compliance Push: 6% of marine fuel mix to be hydrogen-based by 2030.

- Hydrogen Port Network: 22 major European ports to host bunkering facilities.

- Battery–Fuel Cell Hybrids: Improve vessel range by 18%.

- Hydrogen Safety Codes: Harmonized EU–UK regulations to reduce compliance delays by 35%.

- Green Corridor Growth: 15 designated zero-emission maritime routes across North and Baltic Seas.

- Emission Credits: Valued at $45/ton, incentivizing faster fleet conversion.

- Digital Port Integration: Real-time bunkering data improves supply efficiency by 28%.

- ESG Financing Surge: 60% of hydrogen projects funded via sustainability-linked bonds.

These trends underscore Europe’s progress toward a fully integrated hydrogen maritime ecosystem.

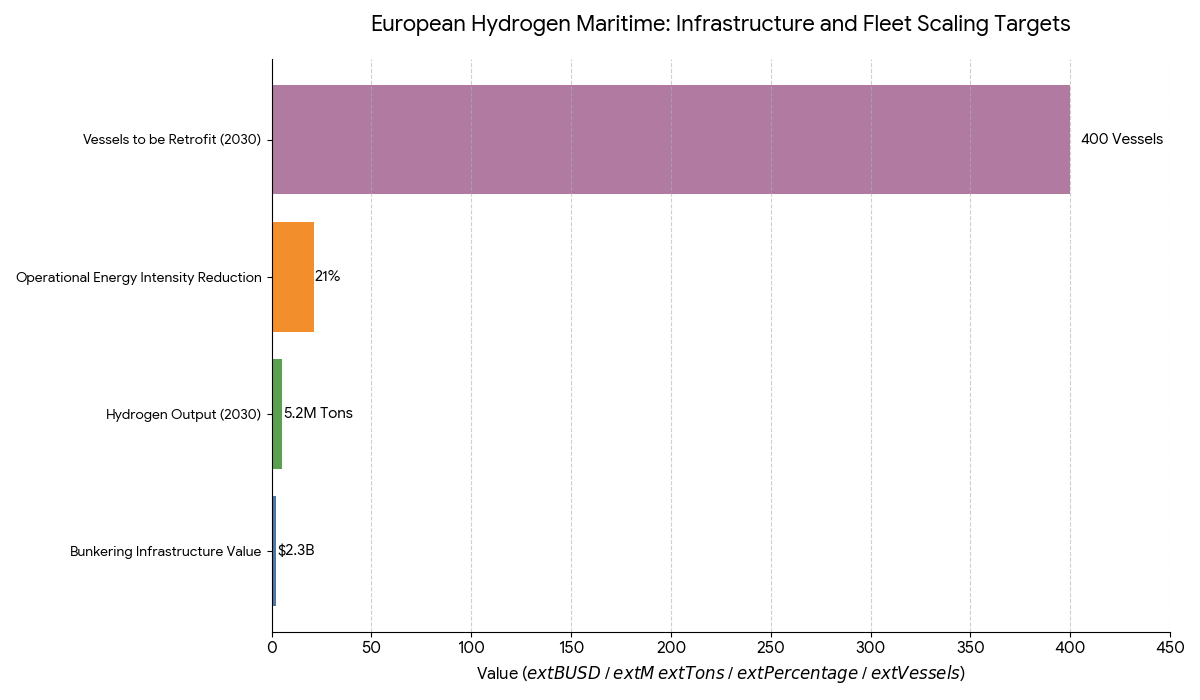

Segment Analysis

The market divides into fuel production (38%), bunkering infrastructure (26%), vessel propulsion systems (24%), and regulatory & digital compliance (12%). Fuel production is led by Germany, the Netherlands, and the UK, accounting for 5.2 million tons of hydrogen output annually by 2030. Bunkering infrastructure, valued at $2.3B, includes cryogenic pipelines, mobile refueling barges, and onshore hydrogen terminals. Propulsion systems, incorporating solid oxide fuel cells (SOFC) and proton-exchange membrane (PEM) units, are reducing operational energy intensity by 21%. Digital compliance platforms, such as DNV Veracity and Lloyd’s Register GreenPort, automate emission tracking for regulatory audits. Fleet retrofitting programs, backed by EU Horizon Green Ship funding, will convert 400 vessels by 2030. The integrated growth across production, transport, and regulation solidifies the region’s leadership in hydrogen-ready maritime infrastructure.

Geography Analysis

Germany (22%), the Netherlands (20%), and the UK (15%) dominate the European hydrogen maritime ecosystem. Rotterdam and Hamburg are the central hydrogen hubs, collectively handling over 40% of Europe’s hydrogen bunkering volume. The UK’s Dover, Belfast, and Portsmouth ports are developing hydrogen corridors aligned with IMO’s 2030 carbon reduction goals. Scandinavian nations, including Norway and Denmark, are investing $1.8B in hydrogen-electric hybrid ferries, pioneering short-sea decarbonization. Southern Europe, led by Spain and Portugal, focuses on ammonia-to-hydrogen conversion for long-haul vessels. By 2030, Western Europe will control over 75% of regional hydrogen maritime value, supported by coordinated port infrastructure, regulatory clarity, and robust ESG financing models that attract global investment in clean shipping.

Competitive Landscape

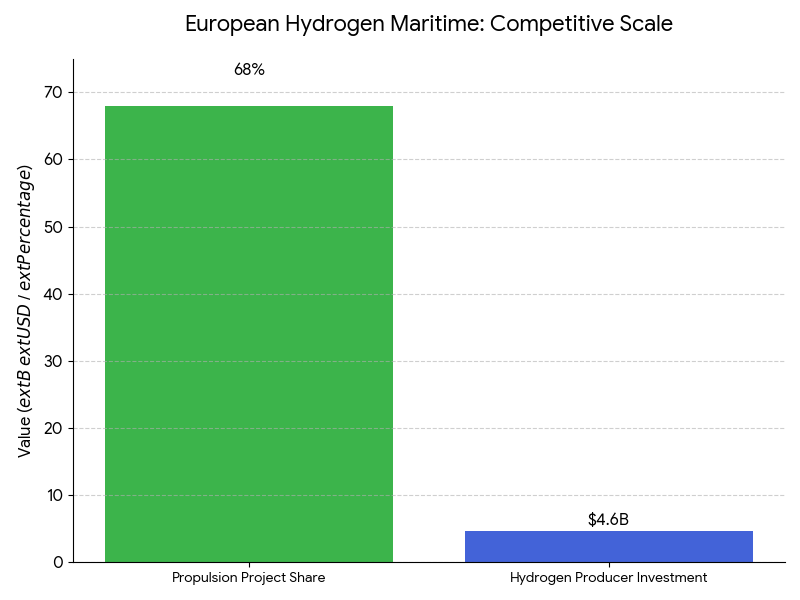

Leading players include Wärtsilä, MAN Energy Solutions, Ceres Power, Ballard Marine, and Rolls-Royce Power Systems, together representing 68% of active hydrogen propulsion projects. Hydrogen producers such as Linde, Shell Hydrogen, and Air Liquide are investing $4.6B in electrolyzer and bunkering networks. Port operators like Port of Rotterdam Authority, Associated British Ports (ABP), and HPA Hamburg lead green corridor development under EU Horizon Maritime funding. Class societies such as DNV, Lloyd’s Register, and Bureau Veritas are standardizing hydrogen safety certification. Emerging firms, including H2SEA and TECO 2030, are advancing modular fuel cell systems optimized for coastal fleets. Competitive differentiation revolves around fuel efficiency, regulatory compliance integration, and scalable bunkering solutions, ensuring Europe’s maritime logistics sector achieves its 2030 net-zero milestones.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1350

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071