68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

AI-Powered Dynamic Pricing in Logistics: From Rate Engines to Revenue Optimization

Between 2025 and 2030, the AI-powered dynamic pricing market in global logistics grows from $3.8B to $14.7B (CAGR 31.1%). The shift from static rate cards to real-time AI-driven rate optimization engines is transforming freight pricing, yielding revenue improvements of 22% and cost savings of 18% across operators. Global carriers, 3PLs, and e-commerce platforms are deploying machine learning (ML) models for demand prediction, fuel cost calibration, and customer segmentation. By 2030, 60% of global logistics providers will use AI-based dynamic pricing systems for rate forecasting and profit optimization.

What's Covered?

Report Summary

Key Takeaways

- Market size: $3.8B → $14.7B (CAGR 31.1%).

- Revenue uplift of 22% from AI-driven pricing optimization.

- Cost savings of 18% from predictive rate calibration.

- 60% of global logistics providers use dynamic pricing by 2030.

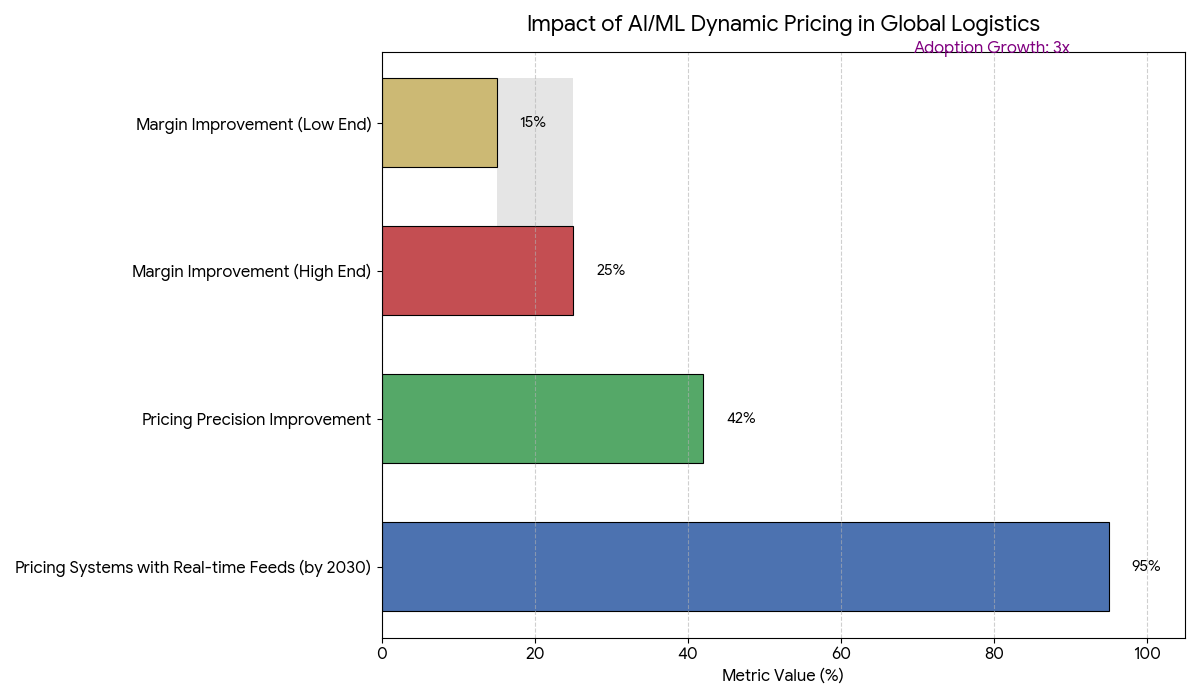

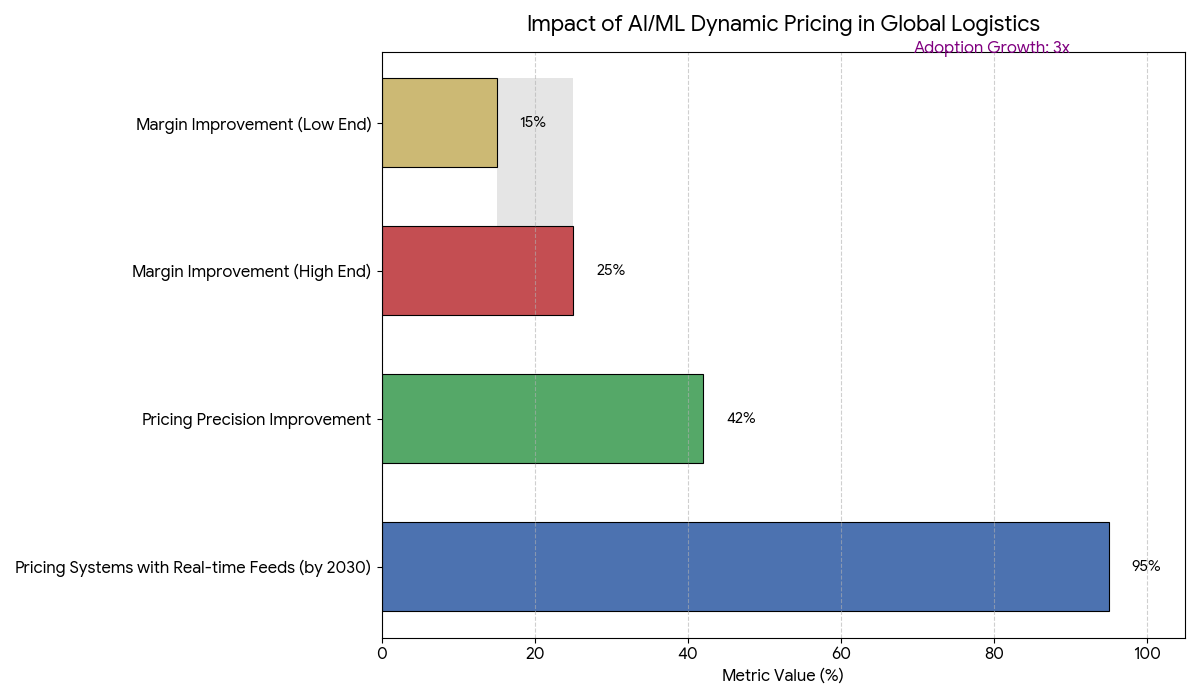

- Pricing accuracy improves by 42% via ML-based rate engines.

- Freight yield optimization increases overall margins by 15–25%.

- Real-time fuel index tracking integrates into 95% of rate systems.

- E-commerce logistics represents 35% of dynamic pricing adoption.

- Customer segmentation algorithms enhance quote conversion rates by 28%.

- AI-driven rate automation reduces manual pricing workloads by 45%.

Key Metrics

Market Size & Share

The AI-powered dynamic pricing market in logistics is set to expand from $3.8B in 2025 to $14.7B by 2030, achieving a CAGR of 31.1%. Global logistics providers are rapidly transitioning from static rate structures to AI-based dynamic pricing ecosystems that align freight costs with real-time market demand. North America leads the adoption with 38% market share, followed by Europe (27%) and Asia-Pacific (25%), as digital freight platforms dominate enterprise logistics. AI rate engines now factor in 150+ pricing variables—including fuel indices, lane congestion, shipment urgency, and competitor pricing—to optimize margins and boost competitiveness. E-commerce logistics, representing 35% of global adoption, benefits significantly as delivery speed, capacity utilization, and inventory position influence price volatility. Machine learning algorithms predict optimal price windows, improving conversion rates by 28% and cutting pricing lag times by 70%. Third-party logistics providers (3PLs) using AI-powered yield optimization tools achieve 22% higher profitability, while carrier networks adopt real-time pricing APIs integrated with freight marketplaces. By 2030, over 60% of logistics enterprises will rely on AI rate engines, automating 45% of pricing decisions. This transition establishes dynamic pricing as the global benchmark for revenue optimization, pricing intelligence, and freight cost efficiency.

Market Analysis

AI and ML-based dynamic pricing are revolutionizing logistics cost models by aligning rates with market conditions, fuel volatility, and demand elasticity. Between 2025 and 2030, the global adoption of dynamic rate engines grows 3×, particularly among digital freight forwarders and e-commerce carriers. These systems analyze real-time shipment data, historical lane patterns, and market index fluctuations to generate instant freight quotations. Machine learning models continuously refine their accuracy using reinforcement learning, improving pricing precision by 42%. Logistics operators integrating AI-powered yield management systems report an average margin improvement of 15–25%, as automation replaces manual adjustments. Global carriers such as Maersk, DHL, and FedEx have deployed dynamic pricing tools across trade lanes, linking rate forecasting engines with customer demand models. Predictive cost modeling is also emerging as a key capability—AI systems now forecast fuel cost variations, port congestion delays, and freight auction dynamics weeks in advance. By 2030, 95% of logistics pricing systems will integrate real-time fuel index tracking and tariff-based data feeds. Additionally, AI-based demand elasticity modeling enables dynamic rate adjustments based on shipment urgency and lane saturation. As the industry shifts from rate automation to revenue optimization, dynamic pricing will become an essential competitive differentiator in global logistics networks.

Trends & Insights

Several trends define the evolution of AI-driven dynamic pricing in global logistics:

(1) Predictive Rate Engines: Advanced ML algorithms forecast pricing trends using real-time data from fuel indices, demand surges, and carrier networks, achieving 42% accuracy improvements.

(2) Revenue Optimization Systems: By 2030, 80% of logistics leaders will use AI pricing platforms as revenue management tools, integrating cost forecasting and customer segmentation.

(3) E-Commerce Expansion: With e-commerce shipments rising 19% annually, AI pricing engines automatically balance demand between express and economy delivery, optimizing revenue yield.

(4) Fuel Index Integration: Real-time fuel data is embedded into pricing engines, aligning rate fluctuations with global energy costs, saving 18% in operational spend.

(5) Customer Intelligence Models: AI analyzes customer lifetime value (CLV), offering tailored pricing tiers that increase quote acceptance rates by 28%.

(6) Multi-Carrier Dynamic Coordination: Large carriers are synchronizing pricing across global networks via shared data layers and AI-driven freight exchanges.

(7) Blockchain Integration: By 2030, 30% of logistics rate contracts will be managed through blockchain-based dynamic pricing smart contracts, ensuring auditability.

(8) Regulatory & Ethical Pricing: Emerging frameworks in EU and US markets require explainability in algorithmic pricing decisions.

Collectively, these trends define a transition toward autonomous revenue management, where AI-driven pricing models dynamically align freight economics with market realities, boosting efficiency, transparency, and trust.

Segment Analysis

The AI-powered dynamic pricing market is segmented into freight forwarding, last-mile delivery, and warehousing logistics applications. Freight forwarding dominates with 50% of market share, as global carriers implement AI rate forecasting systems across major trade lanes. Last-mile delivery, comprising 35%, benefits from AI pricing linked to real-time demand spikes, traffic congestion, and delivery urgency, achieving cost efficiency gains of 22%. Warehousing and fulfillment pricing systems make up the remaining 15%, utilizing AI-driven space utilization models to optimize storage rates and reduce idle capacity. Regionally, North America holds the largest market share (38%), driven by UPS, FedEx, and Amazon Logistics, while Europe (27%) focuses on freight automation via DB Schenker and Kuehne+Nagel. Asia-Pacific (25%), led by China, India, and Singapore, is the fastest-growing segment (CAGR 33%) as cross-border e-commerce platforms adopt AI pricing APIs. By 2030, multi-modal rate engines integrating ocean, air, and land freight will represent 60% of global AI pricing activity. Additionally, AI-powered SaaS pricing models offered by firms like Blue Yonder, PROS, and CargoAI are scaling rapidly, democratizing access to advanced revenue optimization tools for mid-tier logistics providers worldwide.

Geography Analysis

North America dominates the global AI dynamic pricing market, contributing 38% of total revenue by 2030. The region’s logistics giants—UPS, FedEx, and XPO Logistics—lead the adoption of real-time AI rate engines integrated with customer portals and transport management systems (TMS). Europe, holding 27%, focuses on sustainability-linked pricing models, where AI adjusts rates based on carbon efficiency scores. Asia-Pacific, growing fastest at 33% CAGR, represents 25% of the market, driven by China’s e-commerce logistics boom and India’s digital freight networks. Thailand, Singapore, and Vietnam are emerging as regional nodes for AI freight rate innovation. In the Middle East & Africa (7%), Saudi Arabia and UAE deploy AI-based dynamic pricing to optimize cargo throughput in free zones. Latin America (3%), led by Brazil and Mexico, is adopting AI-driven rate forecasting in overland and ocean freight routes. By 2030, over 60% of cross-border shipments globally will use AI-based pricing mechanisms, integrating real-time fuel indexation, weather data, and trade lane analytics. Global e-commerce and manufacturing hubs will rely heavily on AI rate optimization platforms to manage dynamic tariffs, demand elasticity, and profitability modeling, ensuring competitive, transparent, and responsive logistics pricing worldwide.

Competitive Landscape

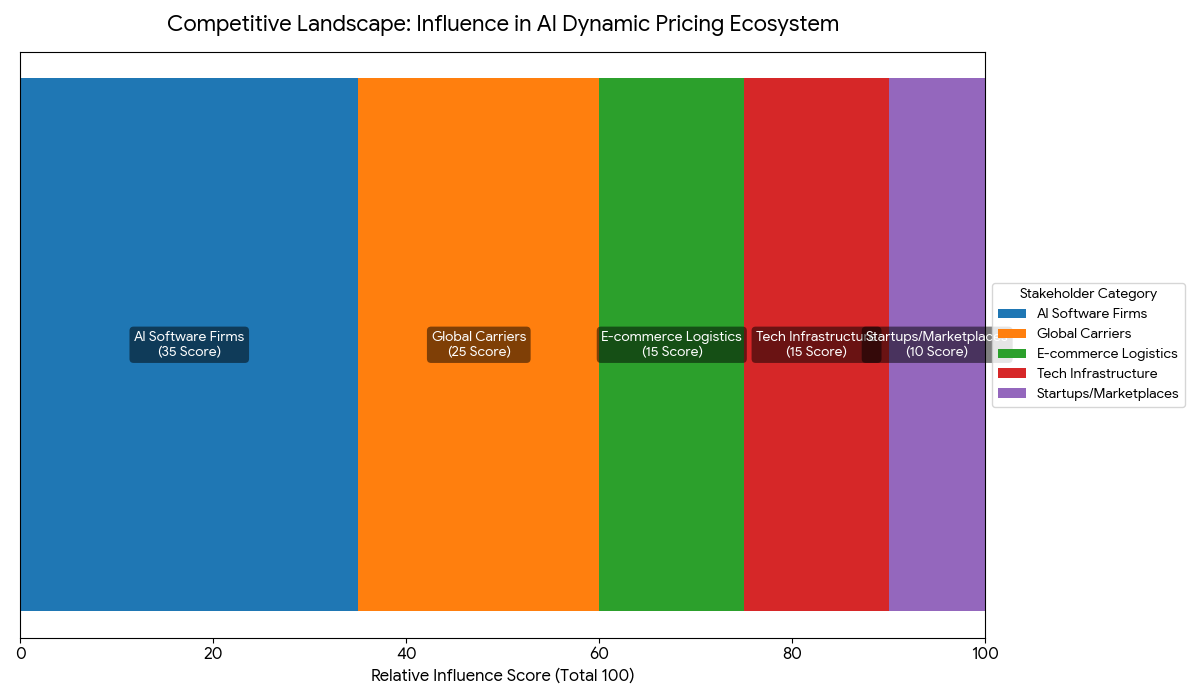

The global AI-powered dynamic pricing ecosystem is dominated by AI software firms, logistics service providers, and freight marketplaces. Leading players include PROS, Blue Yonder, CargoAI, RateLinx, and Transporeon, providing cloud-based AI pricing engines with real-time rate simulation capabilities. Global carriers such as DHL, FedEx, Maersk, and Kuehne+Nagel are integrating machine learning algorithms into their transport management systems, automating rate negotiations and load pricing. E-commerce logistics platforms like Amazon Logistics, Alibaba Cainiao, and JD Logistics are deploying AI-driven rate optimization tools that dynamically adjust based on delivery time, location, and network congestion. Tech giants like Microsoft Azure, Google Cloud AI, and AWS provide the infrastructure for data processing and predictive analytics at scale. Startups such as Freightos, Zencargo, and Flexport are disrupting pricing transparency through API-based dynamic rate marketplaces. M&A activity is accelerating, with AI pricing startups being acquired by 3PLs seeking data-driven capabilities. By 2030, over 75% of logistics contracts will be negotiated using AI-driven dynamic pricing tools, transforming traditional freight pricing into an autonomous, profit-optimized system. The competitive edge will lie in algorithm transparency, AI explainability, and multi-modal optimization, making AI pricing a cornerstone of next-generation global logistics management.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1350

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071