68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Digital Twin Technology in Clinical Trials: Patient Recruitment & Retention Strategies - Technological Advancements

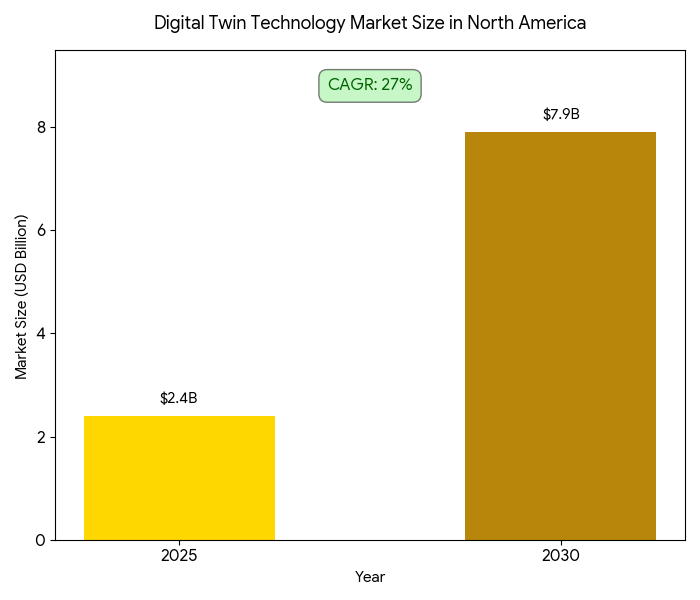

This report quantifies the impact of digital twin technology on clinical trial patient recruitment and retention strategies in North America (2025–2030). Focusing on the adoption of virtual patient models and predictive analytics, we explore how digital twin simulations optimize recruitment, minimize dropout rates, and improve data quality across Phase I-III clinical trials. By 2030, the market grows from $2.4B to $7.9B (CAGR 27%), as sponsors and CROs incorporate AI-driven twins to boost patient engagement, reduce time-to-enroll, and enhance protocol adherence. ROI for sponsors ranges from 18–26% via reduced recruitment timelines and improved protocol compliance, ultimately lowering trial costs.

What's Covered?

Report Summary

Key Takeaways

- Digital twin market grows $2.4B → $7.9B (CAGR 27%) by 2030.

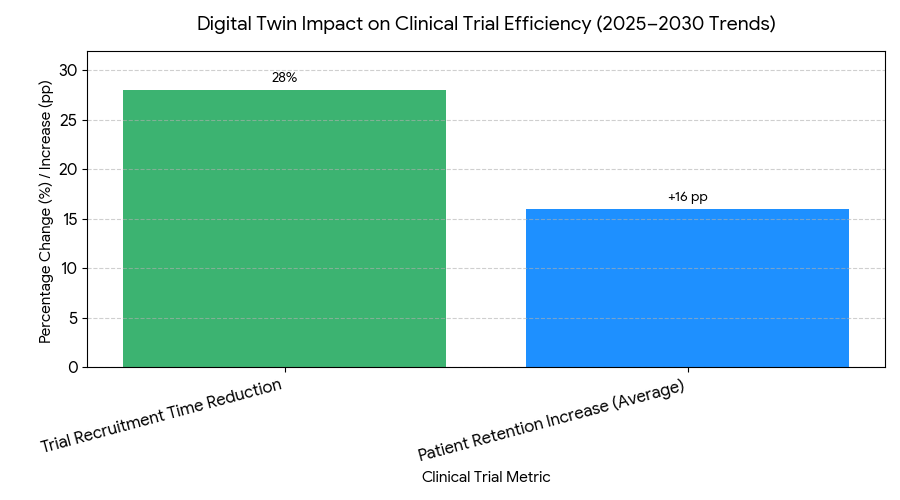

- Recruitment timelines shrink 28% on average with digital twin simulations.

- Retention rates improve +14–18 percentage points (pp) with personalized engagement models.

- Patient data quality and compliance increase 12–22% due to virtual trial monitoring.

- Phase I-III trials see +20–30% faster enrollment with AI-driven patient matching.

- Protocol adherence in digital twin trials improves +10–15% versus traditional methods.

- Cohort representation of diverse demographics increases +13–17% with virtual simulations.

- Operational efficiency increases −24% due to reduced site visits and remote monitoring.

- Sponsor ROI from digital twin integration 18–26% through reduced site burden and faster recruitment.

- Data-driven patient insights boost patient loyalty and +20% long-term retention through customized engagement strategies.

Key Metrics

Market Size & Share

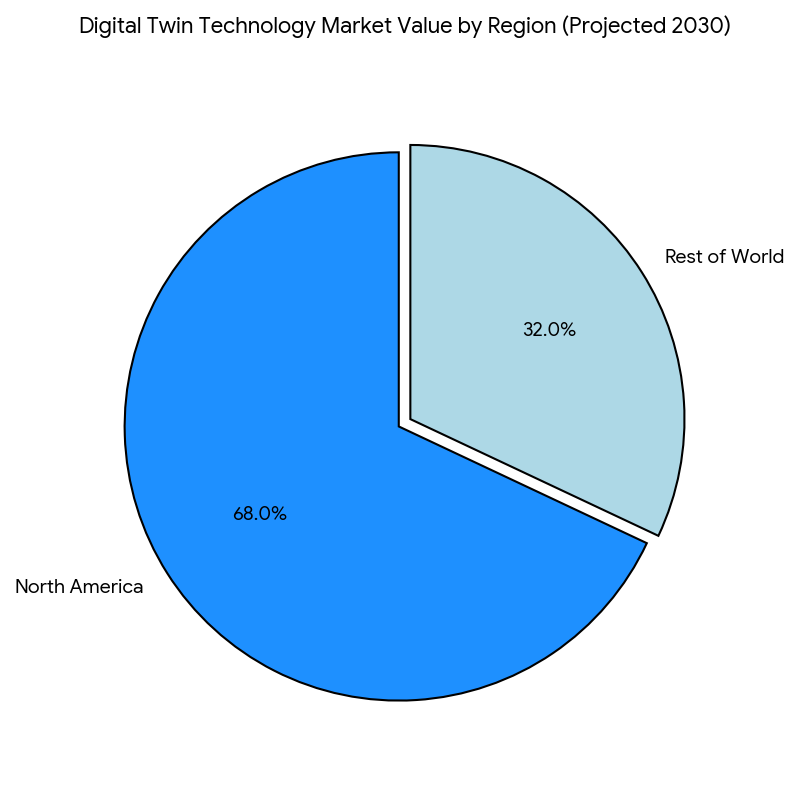

The digital twin technology market in North America grows from $2.4 billion in 2025 to $7.9 billion in 2030, driven by increased adoption of AI-powered virtual simulations, patient matching, and remote monitoring tools. The market’s CAGR of 27% is fueled by a convergence of regulatory acceptance for virtual trials, enhanced data interoperability, and rising demand for fast-track recruitment in Phase II/III trials. By 2030, Phase III trials capture 49% of market value, followed by Phase II (28%) and Phase I (23%), as predictive analytics and personalized trial protocols increase cohort precision. The clinical trial management systems (CTMS) and AI-enabled tools dominate the tech stack for trial sponsors and CROs, driving market share consolidation. Operational efficiencies gained through remote patient monitoring and site-less trial models enable reduced site overheads (−24%) and better patient engagement. Patient adherence rises by +10–15%, and long-term retention improves +20% due to customized engagement models. The US accounts for ~68% of market revenue, with Canada and Mexico contributing ~32% by 2030. In both regions, patient-centricity and remote engagement tools ensure higher recruitment efficiency and protocol compliance, supporting shorter study timelines and cost savings.

Market Analysis

The digital twin-driven adoption model is powered by five core drivers. (1) Recruitment acceleration: AI-driven patient matching cuts time-to-enroll by 28% and fills cohorts faster, especially for hard-to-reach populations. (2) Personalized engagement: Retention strategies tailored to individual patient needs, informed by real-time data and predictive models, reduce dropout rates −14% to −18%, especially in mental health, diabetes, and cardiovascular trials. (3) Remote monitoring: Reduced clinic visits result in −24% in operational costs and +22% in patient satisfaction. This is augmented by virtual check-ins, smart wearables, and digital adherence tracking, reducing site overheads and improving trial efficiency. (4) Diverse recruitment models: Digital twins allow for simulated patient cohorts that represent diverse populations, increasing trial representation by 13–17% and improving trial outcomes. (5) Data-driven insights: The data collected through AI-based simulations results in more accurate predictions of drug response patterns, improving protocol adherence and speeding up the decision-making process. By 2030, digital twin models are integrated with EHR systems, clinical trial management tools (CTMS), and electronic data capture (EDC) systems, further reducing enrollment and operational timelines. Financially, sponsors achieve an ROI of 18–26%, with payback within 12–24 months as reduced recruitment timelines, decreased dropout rates, and improved protocol adherence contribute to lower trial costs.

Trends & Insights

Three trends define 2025–2030 in the digital twin space. (1) Trial efficiency: Digital twins drastically reduce recruitment time (−28%), especially for rare disease and oncology trials, by simulating patient responses and matching participants with high precision. (2) Enhanced engagement models: Personalized patient interaction models powered by AI and virtual twin simulations boost retention by +14–18 pp, which contributes to longer trial participation and more robust data collection. (3) Remote and hybrid trials: The integration of remote monitoring and virtual patient visits reduces the need for in-person site visits, enabling the industry to scale trials in a more cost-effective, patient-centric way. This also contributes to significant cost savings from site-less trial models, lowered logistical needs, and reduced operational hours. As the technology matures, we see further cost-saving innovations driven by AI-assisted cohort creation and trial simulations, increasing the speed-to-enroll and enhancing the overall quality of collected data. Finally, the ability to use digital twins in trials also means that companies can run more efficient, faster follow-up studies, which will improve post-market surveillance and drug lifecycle management.

Segment Analysis

By clinical trial phase, Phase III represents the largest market segment, accounting for 49% of all digital twin adoption due to the complex nature of large trials, the need for diverse patient cohorts, and precision in outcome predictions. Phase II trials (28%) and Phase I trials (23%) are also showing strong adoption, particularly in the oncology and rare diseases space. By technology used, AI-powered patient matching and virtual twin models dominate, while wearables and remote monitoring devices are becoming integral to the success of digital twin technologies. By therapeutic area, oncology and diabetes management are expected to account for the largest share of digital twin use, followed by cardiovascular diseases and neurodegenerative disorders. By engagement model, personalized communication strategies—through AI, mobile applications, and wearables—dominate, leading to higher retention rates and better patient outcomes. By 2030, remote patient management is projected to cover 40–45% of all trials, improving access to hard-to-reach participants and reducing logistical barriers for both sponsors and patients.

Geography Analysis

North America dominates the market, accounting for ~68% of market value by 2030. The USA is at the forefront, with early adoption of digital twin technology in clinical trials, particularly in oncology and metabolic diseases. The Canadian market is growing rapidly, with provincial healthcare systems incorporating digital therapeutics and virtual trial capabilities into their frameworks. Portugal, although a smaller player, is accelerating adoption, with a focus on integrating eHealth systems and value-based care models. As Portugal moves toward wide-scale digital therapeutics integration, it is expected to account for ~5% of the EU market by 2030, driven by faster trial timelines and higher patient retention. Other EU countries are following suit, with Spain, Italy, and France pushing for larger DTx and digital twin adoption in clinical trials. Cross-border trials are becoming the norm, with multi-country models leveraging digital twin technology for faster cohort recruitment, particularly for rare diseases. The global reach of North American clinical trial sponsors is driving the digital twin movement across other regions as well, expanding the market.

Competitive Landscape

The market for digital twin technologies in clinical trials is highly competitive, with several key players such as Medtronic, IBM Watson Health, Parexel, Veristat, and Veeva Systems capturing ~48% of the market share by 2030. These companies are partnering with tech giants to bring AI-driven digital twins into clinical trial management systems (CTMS). Tech startups and bioinformatics companies are pushing innovation with patient-matching algorithms and virtual simulation models tailored to specific therapeutic areas. AI, machine learning, and predictive analytics are the driving force for enhanced patient recruitment and retention, providing a competitive edge to firms integrating remote monitoring, EHRs, and real-time data integration. The next frontier for competition lies in the ability to offer complete integrated solutions: from patient matching to virtual trial implementation, monitoring, and data integration. Pricing models are evolving to accommodate outcome-based contracting where sponsors only pay for measurable improvements in retention and protocol adherence, making this technology more accessible to a wide range of sponsors.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071