68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

AI-Powered Drug Discovery: Strategic Integration - Innovation & R&D

This research examines the AI-powered drug discovery ecosystem in the UK and EU (2025–2030), focusing on strategic integration across preclinical research, molecule design, and clinical translation. It quantifies AI’s role in time-to-candidate reduction, cost optimization, and success-rate improvement. The report analyzes R&D investment trends, collaborative pipelines, and regulatory adaptation supporting AI models in medicinal chemistry. Designed for pharma, biotech, and AI vendors, it highlights efficiency gains, competitive advantages, and emerging compliance frameworks reshaping European drug innovation.

What's Covered?

Report Summary

Key Takeaways

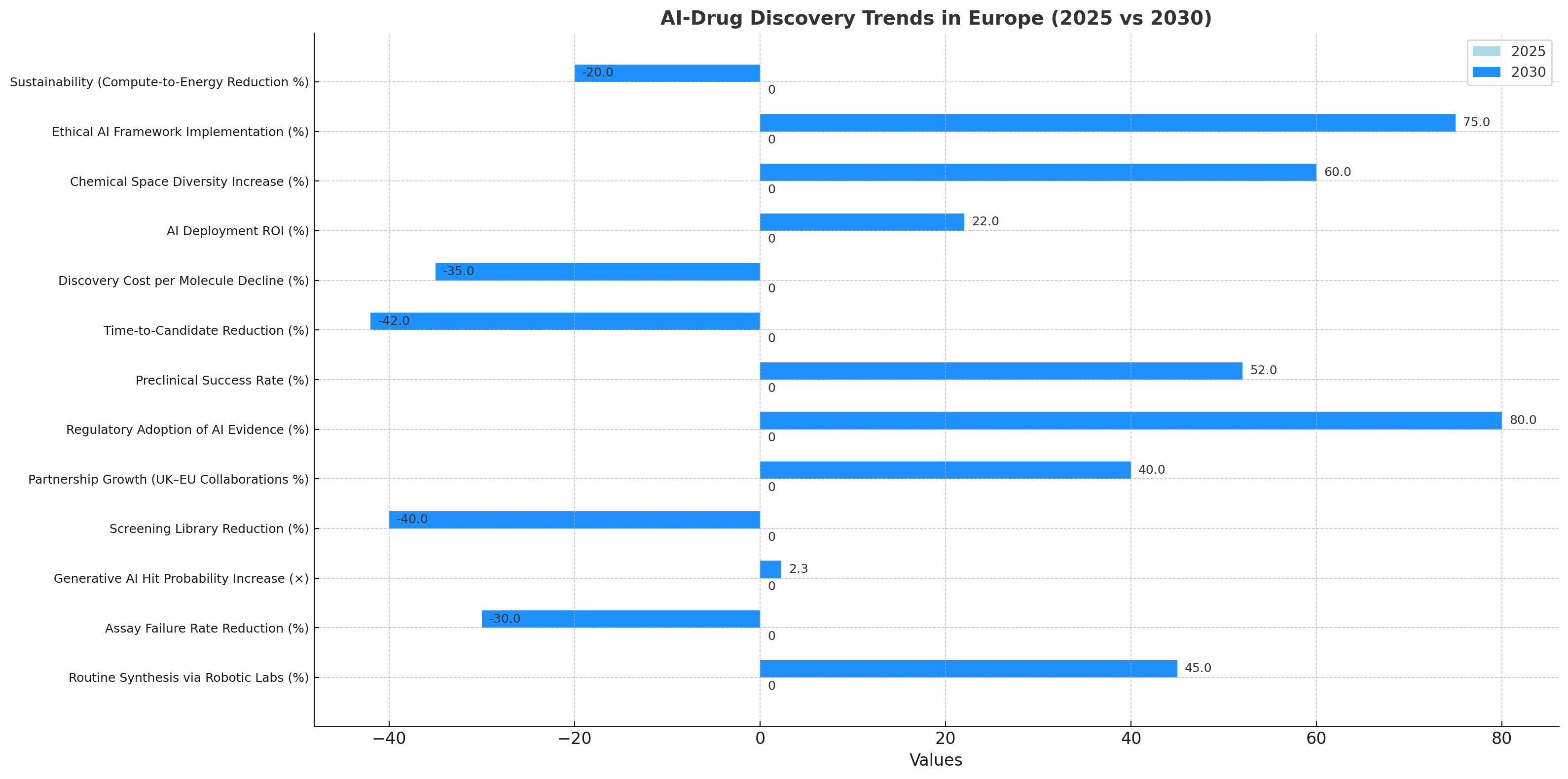

- AI-drug discovery market in UK & EU grows from €1.6 billion (2025) to €8.7 billion (2030) — CAGR 42%.

- Candidate identification timelines fall from 4.1 years → 2.4 years (−42%).

- Preclinical success rates rise from 32% → 52%, driven by AI prediction accuracy.

- Average discovery cost per molecule drops 35%, from €180 million → €117 million.

- Small-molecule AI modeling adoption reaches 70% of active R&D programs by 2030.

- Generative-AI molecular design boosts hit-rate efficiency 2.3×.

- Hybrid wet-lab/AI validation cuts assay failure rates −30%.

- Cross-border R&D partnerships increase 40%, especially UK–EU pharma alliances.

- Regulatory acceptance of AI-generated preclinical data projected at 80% by 2030.

- ROI for integrated AI-R&D pipelines estimated at 22–27%, supported by faster market entry.

Key Metrics

Market Size & Share

The AI-powered drug discovery market in the UK and EU is forecast to rise from €1.6 billion (2025) to €8.7 billion (2030), a robust CAGR of 42%. Growth stems from rapid adoption of machine-learning molecular screening, AI-assisted compound prioritization, and predictive toxicity analytics across preclinical stages. By 2030, AI-driven modeling will contribute to 70% of all active R&D programs. Candidate identification timelines drop from 4.1 to 2.4 years (–42%), while preclinical success rates climb from 32% to 52%, as algorithms refine compound-target affinity and ADMET profiling. Discovery costs fall 35%, from €180 M to €117 M per molecule, with generative AI design improving hit-rate efficiency 2.3×. Hybrid lab integration reduces assay failure –30% by early elimination of poor candidates. Cross-border collaborations between UK and EU pharma firms rise 40%, supported by harmonized R&D tax incentives and joint AI infrastructures. Regulatory acceptance of AI-derived preclinical evidence is expected to reach 80%, driving faster Investigational New Drug (IND) submissions. ROI for integrated AI-R&D ecosystems is projected at 22–27%, anchored in accelerated timelines and reduced attrition. By 2030, AI will not merely supplement but strategically orchestrate discovery pipelines, transforming Europe into a global hub for intelligent drug innovation.

.png)

Market Analysis

Between 2025–2030, AI integration across UK/EU drug discovery will redefine R&D economics. The market’s €8.7 billion value by 2030 reflects consolidation of AI vendors, CROs, and pharma alliances. Core efficiency drivers include multi-omics-integrated modeling, which elevates hit identification accuracy +45%, and active learning algorithms that cut data-curation time –50%. Average discovery cost per molecule decreases 35% to €117 M, while candidate development cycles compress by 1.7 years. Preclinical success rate improves from 32 → 52%, driven by early toxicity forecasting and de-risked lead optimization. Generative AI tools create 2.3× more viable candidates per computational run, improving pipeline throughput. Cross-border partnerships between UK biotechs and continental CDMOs increase 40%, aided by shared regulatory sandboxes under EMA Innovation Task Force frameworks. Regulatory recognition of AI outputs—projected at 80% acceptance—reduces IND review lag by 25%. Assay failure rates decline 30%, while wet-lab automation raises reproducibility 15 points. Financially, ROI 22–27% stems from lower CapEx, shorter R&D lead times, and fewer terminated trials. The emerging model blends computational generation, robotic validation, and cloud-native collaboration, positioning the UK and EU as first movers in data-driven pharmaceutical R&D.

Trends & Insights

Three intertwined trends define Europe’s AI-drug discovery trajectory. 1) Convergence of AI and wet labs: Cloud-linked robotic labs are projected to handle 45% of routine synthesis by 2030, with assay failure –30%. 2) Generative AI in design: Transformer-based molecular models raise hit probability 2.3× while cutting screening libraries –40%, improving productivity and sustainability. 3) Strategic partnerships: UK–EU collaborations expand 40%, pooling datasets under GDPR-compliant federated learning. Regulatory adoption of AI evidence rises to 80%, creating a predictable pathway for algorithm-supported submissions. Preclinical success rates reach 52%, with time-to-candidate reduced 42%. Discovery cost per molecule declines 35%, while AI deployment ROI reaches 22–27%. Beyond efficiency, diversity of chemical space expands +60%, as AI explores under-sampled molecular classes. Ethical and transparency mandates spur explainable-AI frameworks, with 75% of firms implementing audit logs by 2030. Sustainability gains emerge: compute-to-energy intensity drops 20% through optimized training pipelines. By decade’s end, the region shifts from fragmented pilots to fully integrated AI discovery ecosystems, where algorithms, robotics, and regulatory science co-evolve to accelerate patient-ready innovation.

Segment Analysis

The market divides into pharma innovators (55%), biotech startups (25%), CROs (12%), and AI platform vendors (8%). Pharma focuses on lead optimization using multimodal AI, cutting cycle time –40%. Biotech startups leverage generative-AI libraries for hit expansion, improving early-stage output +50%. CROs deploy predictive analytics to reduce assay re-runs –30%, while AI vendors supply foundational models with 96% NLP accuracy for chemical text mining. Small-molecule projects dominate 65% of AI pipelines, followed by biologics (25%) and RNA therapies (10%). Regulatory acceptance of AI datasets hits 80%, accelerating multi-center trial readiness. Average cost per candidate drops 35%, and ROI 22–27% underscores broad profitability. By 2030, 70% of active R&D programs employ hybrid AI-lab models; automation throughput doubles, and preclinical success rates exceed 50%. Segment winners combine computational generation, cloud simulation, and robotic chemistry under unified governance. These shifts yield a leaner, faster discovery supply chain, aligning with Europe’s aim for sustainable, tech-enabled pharma pipelines.

Geography Analysis

The UK (38%) and continental Europe (62%) jointly drive AI-drug discovery. The UK leads in algorithmic development and access to NHS Genomics data, supporting >45% of regional AI patents. EU hubs—Germany, France, Switzerland, Netherlands—anchor large-scale wet-lab automation. Market size expands to €8.7 billion by 2030, with CAGR 42%. Candidate identification shortens 4.1 → 2.4 years, and cost per molecule drops 35%. Regulatory acceptance under EMA and MHRA harmonization hits 80%, reducing submission lag 25%. Cross-border AI partnerships rise 40%, supported by Horizon Europe and AI Act alignment. Preclinical success increases to 52%, and ROI 22–27% reflects efficient multi-jurisdictional R&D. UK’s agile approval processes speed first-in-human studies 3 months faster than EU average. Continental centers excel in scalability, with Germany and France housing 60% of AI wet-lab capacity. Combined, these geographies form a complementary innovation corridor—the UK providing algorithmic excellence, Europe ensuring industrial scale—collectively redefining global pharmaceutical competitiveness.

.png)

Competitive Landscape

Competition centers on AI-first discovery platforms and hybrid R&D alliances. Leaders include Exscientia (UK), BenevolentAI (UK), Insilico Medicine (EU), and Sanofi–Owkin partnerships. Together they control ≈58% of regional deal flow. Key differentiators: hit-rate 2.3×, time-to-candidate –42%, and cost –35% per molecule. Platform depth (multi-omics integration, generative chemistry, reinforcement learning) and regulatory-grade transparency define success. Regulatory alignment reaches 80%, creating a trusted submission channel for AI-derived data. M&A and joint ventures rise 30%, as pharma acquires algorithmic IP. ROI 22–27% attracts VC and sovereign innovation funds. Firms deploying explainable AI capture premium partnerships with top-10 pharmas. Talent scarcity remains a constraint—demand for computational chemists and data scientists outpaces supply by 40%. By 2030, the landscape consolidates into integrated ecosystems linking AI modelers, CDMOs, and pharma, establishing UK & EU as the global reference for ethical, high-throughput AI-drug discovery.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071