68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Voice Commerce Security Frameworks: Biometric Authentication & Regional Language Support in Emerging Markets

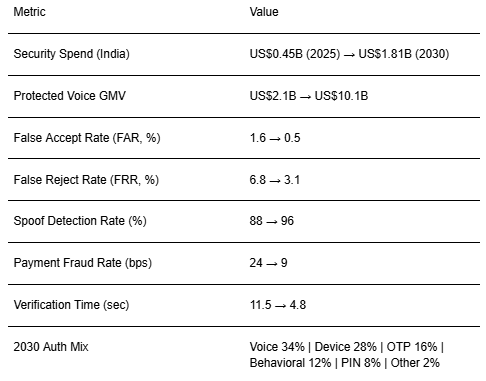

Secure voice commerce at scale requires more than accurate speech: it needs trustworthy identity, fraud controls, and inclusive multilingual UX. Between 2025 and 2030, India’s investment in voice security biometric authentication, anti‑spoofing, risk engines, and consented data controls is modeled to grow from ~US$0.45B to ~US$1.81B. Over the same period, GMV transacted under protected, biometric‑verified flows rises from ~US$2.1B to ~US$10.1B as merchants and platforms converge on layered defenses and language coverage. The security stack is layered: (1) enrollment and consent privacy‑first voiceprints and device biometrics; (2) verification passive voice biometrics, liveness/anti‑spoofing, and behavioral signals; (3) risk‑based orchestration step‑up with OTP/link, UPI PIN, or device biometrics when confidence is low; (4) multilingual NLU code‑switching and dialect‑aware prompts to avoid FRR spikes; (5) audit & observability immutable logs, redaction, and bias metrics. Our modeled KPI shifts: False Accept Rate (FAR) falls from ~1.6% to ~0.5%; False Reject Rate (FRR) from ~6.8% to ~3.1%; spoof detection improves from ~88% to ~96%; payment fraud rate compresses from ~24 to ~9 bps; and verification time drops from ~11.5s to ~4.8s with passive checks and device cryptography.

What's Covered?

Report Summary

Key Takeaways

1. Layered security cuts fraud without hurting conversion: passive voice + device + step‑up.

2. Multilingual prompts and code‑switching models reduce FRR and abandonment.

3. Anti‑spoofing and liveness are mandatory for broadcast and replay threats.

4. Risk‑based orchestration selects the lightest step‑up needed for trust.

5. On‑device templates and encryption minimize data exposure; rotate keys.

6. Equity dashboards track KPI parity by language, gender, and accent.

7. UPI/PIN and tokenized cards integrate securely with voice flows.

8. CFO dashboard: fraud bps, FAR/FRR, spoof detect %, verify seconds, protected GMV.

Key Metrics

Market Size & Share

India’s spend on voice security biometrics, risk engines, anti‑spoofing, and audit rises from ~US$0.45B to ~US$1.81B (2025–2030) in our model. Protected voice GMV scales from ~US$2.1B to ~US$10.1B as merchants standardize enrollment, consent, and layered auth. The line figure charts both trajectories.

Share accrues to platforms with on‑device templates, strong anti‑spoofing, and multilingual models. Execution risks: replay/broadcast attacks, enrollment friction, and dialect gaps. Mitigations: passive biometrics, liveness checks, phonetic fallbacks, and step‑up orchestration with device biometrics or UPI.

Market Analysis

Security and UX must improve together. We model FAR falling from ~1.6% to ~0.5%, FRR from ~6.8% to ~3.1%, spoof detection rising from ~88% to ~96%, payment fraud rate compressing from ~24 to ~9 bps, and verification time dropping from ~11.5s to ~4.8s by 2030. Enablers: passive voice biometrics with liveness, behavioral signals, multilingual NLU, and risk engines integrated with UPI/tokenized cards. Barriers: mic quality variance, background noise, and code‑switching complexity.

Financial lens: quantify avoided chargebacks and operational savings (shorter calls, fewer escalations) vs security capex/opex; measure conversion lift from faster verification. The bar chart summarizes directional improvements under a layered framework.

Trends & Insights

1) Passive voice biometrics + device crypto become default; PIN/OTP move to step‑up. 2) Anti‑spoofing extends to broadcast, TTS, and deepfake vectors. 3) Code‑switching models reduce FRR in Hindi‑English blends and regional languages. 4) On‑device templates minimize exposure; federated learning updates models privately. 5) Consent UX standardizes with clear recording scopes and deletion controls. 6) Equity dashboards enter security SLAs. 7) UPI and wallets expose voice‑native flows with signed intents. 8) Smart displays blend visual confirmation for higher‑risk steps. 9) Attack surfaces shift to account recovery harden flows. 10) Regulators emphasize explainability and audit trails over black‑box decisions.

Segment Analysis

Grocery/Bill Pay: high frequency; optimize verification speed and completion. Beauty/Personal Care: upsell via voice profiles; ensure consented data use. Electronics: higher risk; require liveness and device step‑up. Fashion: address/account changes need step‑up and visual checks. Travel & Tickets: time‑sensitive; pre‑verified profiles cut friction. Across segments, define risk tiers, step‑up thresholds, and language coverage; track FAR/FRR, spoof detect %, fraud bps, verification time, and completion by category.

Geography Analysis

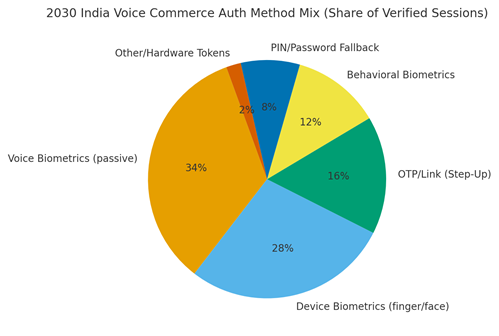

By 2030, India’s verified voice sessions are modeled to authenticate via Voice Biometrics (~34%), Device Biometrics (~28%), OTP/Link Step‑Up (~16%), Behavioral Biometrics (~12%), PIN/Password Fallback (~8%), and Other (~2%). Metro regions lean into device biometrics and smart displays; Tier‑2/3 rely more on OTP/IVR with gradual voice template enrollment. The pie figure reflects the auth mix.

Execution: stage enrollment and consent campaigns by language; guarantee parity across Hindi, Tamil, Telugu, Bengali, Marathi, and more; and benchmark fraud and completion by region. Reallocate security spend quarterly to channels with the biggest fraud compression per dollar.

Competitive Landscape

Assistant ecosystems, telcos, and security vendors compete to secure voice journeys. Differentiation vectors: (1) biometric accuracy with anti‑spoofing, (2) multilingual coverage and code‑switching robustness, (3) verification speed and step‑up UX, (4) privacy posture (on‑device, encryption, retention), (5) analytics and audit depth. Procurement guidance: demand per‑language FAR/FRR SLAs, spoof benchmarks (TTS/deepfake), key‑management policies, and UPI/wallet integrations. Competitive KPIs: FAR, FRR, spoof detect %, fraud bps, verification time, protected GMV, and uptime.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071