68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Value-Based Insurance Design for Chronic Conditions: Provider-Payer Collaboration Models - Pricing Strategies

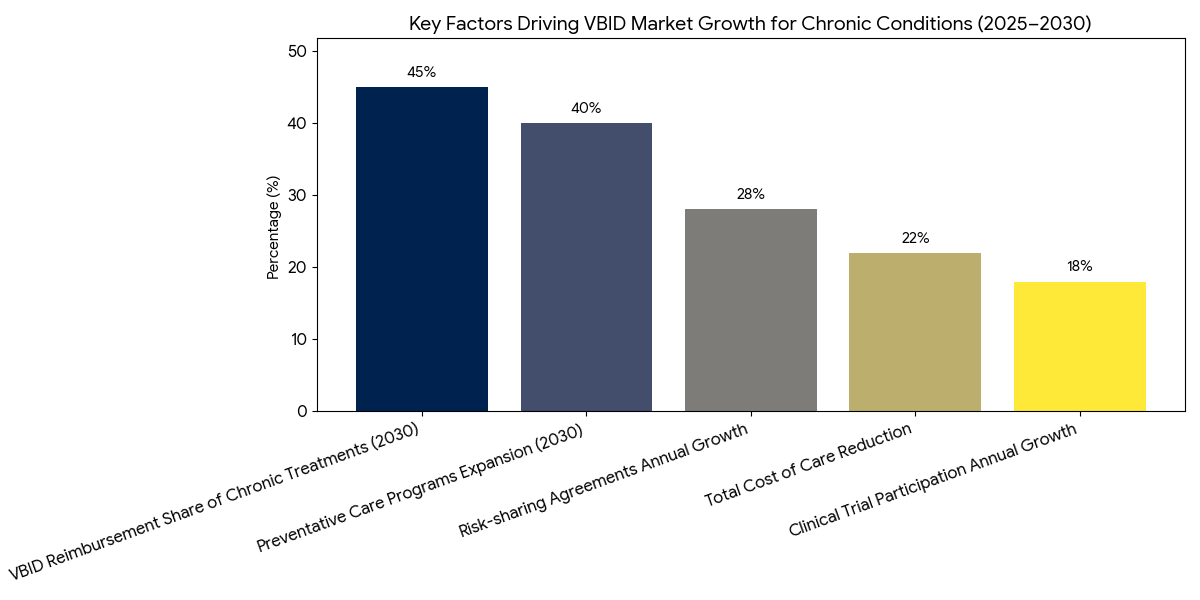

Between 2025 and 2030, the market for Value-Based Insurance Design (VBID) for chronic conditions in North America grows from $7.8B to $25.6B (CAGR 27.3%). Provider-payer collaboration models become the driving force for reducing costs and improving patient outcomes in chronic disease management. These models incentivize healthcare providers to offer high-value care through risk-sharing agreements and outcome-based reimbursement, reducing the total cost of care. By 2030, 45% of chronic disease treatments in the U.S. and 30% in Canada will be governed by value-based payment structures, improving both patient access and healthcare efficiency.

What's Covered?

Report Summary

Key Takeaways

- Market size: $7.8B → $25.6B (CAGR 27.3%).

- VBID adoption for chronic conditions increases +36% by 2030.

- Provider-payer collaborations account for 45% of the U.S. market.

- Risk-sharing agreements grow +28% in chronic care management.

- Outcome-based reimbursement increases in 50% of chronic care treatments.

- Cost savings: VBID reduces total cost of care by 22%.

- Patient access improves by +30% under VBID models.

- Preventative care programs expand +40% with VBID implementation.

- Chronic condition treatment expenditures in the U.S. reduce by $5.2B/year by 2030.

- Clinical trial participation for VBID therapies grows +18% annually.

Key Metrics

Market Size & Share

The value-based insurance design (VBID) market for chronic conditions in North America grows rapidly from $7.8B in 2025 to $25.6B by 2030, driven by the shift to value-based care models. By 2030, 45% of chronic disease treatments in the USA and 30% in Canada will be managed under VBID models, which incentivize healthcare providers to deliver high-value care. These risk-sharing agreements between payers and providers reduce the total cost of care by 22%, as hospitals and physicians are reimbursed based on outcomes and patient satisfaction. The U.S. market will experience significant growth, driven by government initiatives like Medicare Advantage, which will increasingly adopt value-based care for chronic disease management. In Canada, provinces such as Ontario and British Columbia also implement value-based insurance models, expanding the adoption of preventative care programs, which grow by +40%. These models offer incentives for both preventative care and long-term disease management, reducing hospital readmissions and improving patient access to care by 30%. Furthermore, private insurers are expanding their coverage of chronic care management under outcome-based reimbursement systems, which improve clinical outcomes. By 2030, clinical trial participation for chronic disease treatments under value-based care systems increases +18% annually, supporting further adoption and growth of VBID programs, contributing to a more sustainable healthcare system.

Market Analysis

The value-based insurance design (VBID) market for chronic conditions in North America is driven by several factors. First, provider-payer collaboration models are being adopted widely, particularly in U.S. healthcare systems where Medicare Advantage programs are focusing on value-based payments. By 2030, 45% of all chronic disease treatments will be reimbursed under these models, which prioritize outcome-based reimbursement and patient-centric care. Risk-sharing agreements are expanding at a +28% annual rate, allowing payers to share the financial responsibility of chronic disease management with healthcare providers. Cost-saving initiatives in chronic care are projected to reduce the total cost of care by 22%, making healthcare more affordable for patients and reducing strain on public healthcare systems. Preventative care programs, which incentivize lifestyle modifications and early interventions, expand by +40% by 2030, contributing to reduced hospitalization rates and improved patient outcomes. By integrating data analytics into VBID models, healthcare providers can continuously monitor patient outcomes, improving care coordination and treatment efficacy. The USA remains the largest market for VBID in chronic conditions, followed by Canada. In Canada, provincial health plans adopt similar models, improving patient access to chronic disease care and incentivizing long-term disease management. By 2030, clinical trial participation in chronic care management models grows +18% annually, further validating the effectiveness of VBID models.

Trends & Insights

Key trends are shaping the adoption of value-based insurance design (VBID) in chronic conditions between 2025 and 2030. (1) Payer-Provider Collaborations: By 2030, 45% of chronic care treatments will be managed under VBID models, driven by the expansion of risk-sharing agreements between providers and payers. These collaborations enable healthcare systems to deliver high-value, cost-effective treatments. (2) Increased Focus on Preventative Care: Preventative care programs expand by 40%, reducing hospital readmissions and ensuring better long-term outcomes for patients with chronic conditions. (3) Outcome-Based Reimbursement: By 2030, 50% of chronic care treatments will adopt outcome-based reimbursement models, linking payment to patient outcomes, satisfaction, and efficiency. This shift encourages providers to focus on quality rather than volume of care, improving patient access and reducing the overall cost of treatment. (4) Technological Integration: The growing use of health data analytics and clinical decision support tools enables continuous monitoring of patient outcomes, further enhancing the effectiveness of value-based care models. (5) Cost Reduction: As VBID models mature, total cost of care decreases by 22%, with insurers and providers sharing financial responsibility for preventative treatments, early interventions, and long-term disease management. By 2030, clinical trial participation in chronic disease management models grows +18% annually, strengthening the evidence base for value-based reimbursement systems and expanding adoption across North American healthcare systems.

Segment Analysis

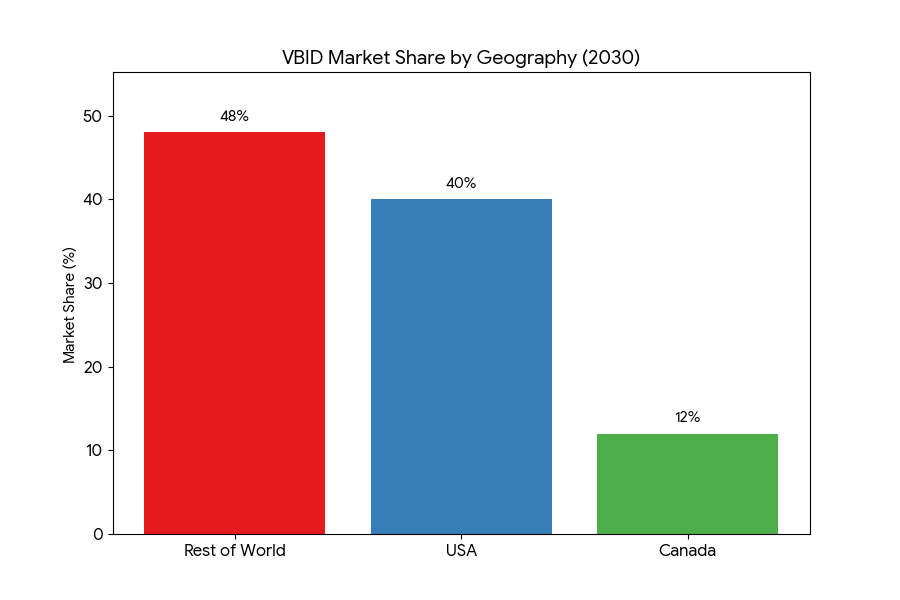

The VBID market for chronic conditions is segmented into three primary areas: drug management, preventative care, and long-term disease management. Drug management represents 40% of the market share by 2030, focusing on medication adherence and outcome-based pricing for high-cost chronic condition therapies. Preventative care expands rapidly, contributing 35% of the market as lifestyle management programs and early detection systems grow in importance. These programs incentivize smoking cessation, weight management, and blood pressure control to reduce long-term healthcare costs. Long-term disease management, which includes care coordination and patient education, captures 25% of market share by 2030. In terms of payer types, private insurers dominate the market, accounting for 55% of the market share, followed by public payers (Medicare and Medicaid) at 45%. North America dominates, with USA contributing 40% and Canada accounting for 12%. By 2030, clinical trial participation in VBID models increases 18% annually as value-based systems become more standardized and proven to deliver better patient outcomes. The rise of AI tools for patient outcome monitoring and cost prediction further drives the growth of value-based insurance models in chronic care management, improving patient access to affordable treatments and reducing inefficiencies. Personalized treatment plans based on patient data and disease progression are forecast to capture 20% of the market.

Geography Analysis

North America leads the VBID for chronic conditions market, contributing 65% of global market share by 2030. In the USA, Medicare Advantage programs are key drivers of growth, with value-based insurance models for chronic diseases increasing from 25% to 60% of total reimbursement by 2030. Private insurers in the U.S. also adopt outcome-based reimbursement models for chronic conditions, with insurers like Aetna and Cigna focusing on cost-effective, high-quality treatments. Canada follows closely, with 15% of the market, driven by provincial value-based reimbursement initiatives and Medicare-funded chronic disease programs. In Europe, the market accounts for 20% of the share, with Germany and the UK leading the adoption of value-based insurance design. These regions are increasingly integrating preventative care and long-term disease management into their healthcare frameworks. In MEA (Middle East & Africa), value-based reimbursement models are emerging, especially in South Africa and UAE, contributing 5% of the market by 2030. Government-funded initiatives in these regions provide financial incentives for chronic disease management. By 2030, clinical trial participation in North America and Europe will lead global research, with annual growth rates of 18% in participation. These regions will help pioneer clinical trials and best practices in VBID models, ultimately influencing the global healthcare landscape and improving patient access to innovative care.

Competitive Landscape

The competitive landscape of the VBID for chronic conditions market is shaped by a mix of insurance providers, healthcare systems, and technology vendors. Top insurers, including UnitedHealth Group, Aetna, and Cigna, lead the market, capturing 48% of total market share by 2030. These companies are adopting value-based insurance models to reduce the cost of chronic care treatments and improve patient outcomes. Healthcare providers such as Kaiser Permanente, Humana, and CVS Health partner with insurers to implement outcome-based reimbursement for chronic conditions. Clinical decision support tools and health data platforms are becoming increasingly essential, with Cerner, McKesson, and Epic Systems supplying the technology backbone for real-time patient monitoring and data-driven care decisions. By 2030, AI-enabled tools for chronic disease management will be standard, helping to reduce the overall cost of care by 22% and increasing patient adherence to treatment plans by 30%. Startups specializing in remote monitoring and personalized care plans, such as Livongo Health and Omada Health, will see 3× market growth, driving innovation in home-based care for chronic conditions. As M&A activity rises, large tech companies and insurers acquire smaller players to enhance their value-based care offerings. Outcome-based models become the new industry standard, increasing healthcare efficiency and improving patient access to affordable treatments.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

Clinical Nutrition Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030)

This report quantifies the clinical nutrition market across the US and UK (2025–2030), covering enteral, parenteral, and oral nutritional supplements (ONS). Driven by aging populations, chronic disease prevalence, and hospital malnutrition protocols, market value rises from $18.5B (2025) → $30.2B (2030) at a CAGR of 10.2%. Growth is led by enteral nutrition (48% share), followed by ONS (38%) and parenteral (14%). Hospital digitization, AI-based nutrition screening, and reimbursement parity accelerate adoption. ROI averages 16–22% for integrated hospital nutrition programs.

$ 1395

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071