68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Prime Membership Economics: Customer Retention Strategies & Regional Growth Analysis in Western Europe

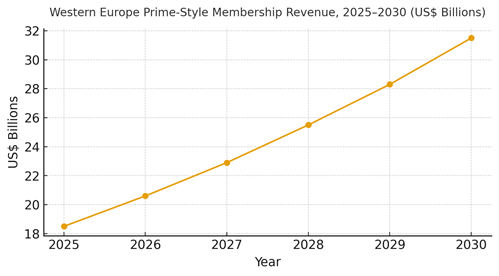

Prime-style memberships in Western Europe are shifting from shipping benefits to cross-vertical value engines that bundle speed, content, payments, and local services. From 2025 to 2030, growth depends on disciplined retention mechanics tiered pricing, localized perks, and attach strategies that lift ARPU without pushing churn. We model Western Europe gross membership revenue rising from ~US$18.5B in 2025 to ~US$31.5B by 2030. Benelux (including Luxembourg) builds outsize profitability through high digital adoption, cross-border convenience, and affluent, multilingual households. Retention playbook: (1) benefits ladder core delivery/returns, then content, grocery/restaurant delivery, and fintech perks; (2) cohort-led pricing (student/senior/family) and monthly trials with soft landings; (3) habit formation weekly missions, streaks, and member-only events; and (4) issue prevention fast refunds, proactive outage credits, and transparent price-change notices. Measurement is CFO-grade: 12-month retention, churn, ARPU, attach rates across content/local services, and CAC payback. Our model suggests retention can rise from ~78% to ~84%, churn fall from ~22% to ~16%, ARPU climb from ~US$108 to ~US$129, attach to video/content expand from ~46% to ~62%, and CAC payback compress from ~11 to ~8 months by 2030 when playbooks are localized and tested.

What's Covered?

Report Summary

Key Takeaways

1. Bundles win when benefits are daily-use and locally relevant not just shipping speed.

2. Tiered pricing + soft landings reduce churn while lifting ARPU through upsell.

3. Attach engines (video, grocery, fintech) drive habit and raise switching costs.

4. Issue-prevention (fast refunds, outage credits) protects trust and retention.

5. Cohort-led tests (student/senior/family) optimize price–value perception.

6. Luxembourg advantage: affluent, multilingual households favor bundle penetration.

7. CFO dashboard: retention, churn, ARPU, attach %, CAC payback, and refund SLAs.

8. Compliance first: explicit consent, renewal reminders, and easy downgrade paths.

Key Metrics

Market Size & Share

Western Europe’s Prime-style membership revenue is modeled to rise from ~US$18.5B (2025) to ~US$31.5B (2030) as bundles shift from shipping-led to daily-utility ecosystems. Germany, France, and the UK lead scale; Benelux (including Luxembourg) contributes outsized profitability per member. The line figure visualizes the growth trajectory through 2030.

Share dynamics across the stack: core logistics benefits, content/streaming, grocery/restaurant delivery, and fintech perks (cashback, insurance). Players that localize benefits and reduce friction in payments and identity will grow share. Luxembourg’s role is strategic as a high-income, multilingual micro-market with cross-border convenience to FR/DE/BE. Execution risks: price hikes without visible value, fragmented identity, and refund friction. Mitigations: clear value comms, unified ID across devices, and proactive credits.

Market Analysis

Retention and attach mechanics move KPIs in tandem. We model 12‑month retention rising from ~78% to ~84%; churn falling from ~22% to ~16%; ARPU increasing from ~US$108 to ~US$129; attach to video/content expanding from ~46% to ~62%; and CAC payback compressing from ~11 to ~8 months by 2030. Enablers: pricing science with soft landings, habit engines (weekly missions, member events), fast refunds/outage credits, and localized benefits (grocery/mobility/streaming). Barriers: over-bundling complexity and consent/renewal friction.

Financial lens: attribute to incremental margin after content/licensing and logistics; use cohort/geo holdouts for new benefits; and model lifetime value by segment. The bar chart summarizes directional KPI shifts under disciplined membership economics.

Trends & Insights

1) Bundles with daily utility: grocery, mobility, and payments outrank episodic perks. 2) Habit architectures: streaks, missions, and localized events cement usage. 3) Family plans: shared benefits reduce household churn in small markets like Luxembourg. 4) Identity & payments: SEPA, open banking, and device identity reduce friction. 5) Refund/credit automation: preemptive make-goods protect NPS. 6) Price harmonization windows: avoid cross-border whiplash across DE/FR/BE/LU. 7) Consent-forward renewal UX: reminders and easy downgrades build trust. 8) Streaming/content localization: subtitling and language tracks for multilingual regions. 9) Member-only retail/media: loyalty-linked discounts and ad-free experiences. 10) CFO-grade attribution: retention, churn, ARPU, attach %, and CAC payback by cohort.

Segment Analysis

Urban Professionals: High attach to grocery/mobility; price elasticity moderate. Families: Family plans, kids content, and grocery benefits reduce churn. Students/Youths: Discounted tiers; streaming-led attach. Seniors: Pharmacy/health delivery and easy UX. Cross-border Workers (Luxembourg): Value from delivery across FR/DE/BE and multilingual content. Across segments, define price–value thresholds, attach playbooks, and refund SLAs; track retention, ARPU, attach %, and CAC payback per segment.

Geography Analysis

By 2030, membership revenue share is modeled as Germany (~24%), France (~21%), UK & Ireland (~18%), Italy (~12%), Spain & Portugal (~10%), Benelux (including Luxembourg) (~7%), Nordics (~5%), and Others (~3%). Luxembourg’s influence is amplified through Benelux high ARPU and low service radius costs. Localization: multilingual support (FR/DE/EN), cross-border delivery rules, and price harmonization windows. The pie figure reflects the regional mix.

Execution: centralize identity/payments and content licensing; allow local teams to tailor grocery/mobility partners. Measure geography-specific retention, ARPU, attach %, and CAC payback; rebalance benefits where attach stalls.

Competitive Landscape

Incumbent platforms scale via logistics, content catalogs, and billing reach; challengers specialize in regional bundles or vertical depth (grocery, mobility, fintech). Differentiation vectors: (1) retention ops (refund SLAs, outage credits), (2) attach engines with localized partners, (3) identity/payments friction, (4) price science and soft landings, and (5) consent-forward renewal UX. Procurement guidance: demand open APIs, transparent SLA reporting, data rights, and holdout-friendly experimentation. Competitive KPIs: retention, churn, ARPU, attach %, CAC payback, refund latency, and NPS.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071