68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Generative AI in Merchandising: Personalized Storytelling, Dynamic Content, and Micro-Influencer Campaigns (USA & EU, 2025–2030)

Retailers and consumer brands in the USA and EU are reframing merchandising around Generative AI (GenAI). Three capability stacks are scaling fastest: (1) personalized storytelling (AI-authored product narratives and shoppable content), (2) dynamic content/creative (DCO for ads, dynamic product ads, on‑site modules, email, and CTV), and (3) micro‑influencer campaigns orchestrated with AI for creator matching, briefing, and asset remixing. Anchored by robust AI‑in‑retail growth forecasts and broad enterprise AI adoption, we model AI‑in‑merchandising sub‑segment spend in USA+EU rising from ~US$7.0B in 2025 to ~US$20.5B by 2030. Adoption is propelled by first‑party data mandates, creative production cost deflation, and measurable uplifts in engagement and conversion tempered by governance needs under the EU AI Act and brand‑safety controls. Operationally, GenAI compresses content cycles from weeks to days, enabling seasonal, local, and persona‑level variants at scale while keeping visual and voice consistency within brand guardrails. Personalized stories improve product discovery and AOV in categories with complex attributes (beauty, electronics, home). Dynamic content engines re‑rank products and render creatives on‑the‑fly across ad, email, and owned surfaces.

What's Covered?

Report Summary

Key Takeaways

1. GenAI shifts merchandising from static catalogs to adaptive narratives and creatives.

2. Dynamic content becomes default; DCO/DPA lift ROAS and onsite conversion when tied to clean first‑party data.

3. Micro‑influencers drive higher engagement and trust; GenAI improves creator matching and brief quality.

4. Creative velocity is a KPI: cost per asset and variant test speed predict performance gains.

5. Guardrails (brand rules, QA, synthetic media disclosure) are mandatory under EU AI Act expectations.

6. Winners run disciplined experiments and prove incrementality, not just content volume.

7. Retail, beauty, CPG, and consumer electronics see the fastest ROI from attribute‑rich storytelling.

8. CFO‑credible dashboards unify media, creator costs, and contribution margin after returns.

Key Metrics

Market Size & Share

Global AI in retail is projected to expand rapidly through 2030. Against this backdrop, we model an AI‑in‑merchandising sub‑segment for USA+EU rising from ~US$7.0B (2025) to ~US$20.5B by 2030. This model triangulates: (1) published AI‑in‑retail market baselines and CAGRs, (2) enterprise AI adoption in marketing/merchandising functions, and (3) cost deflation in creative production observed in case studies. Growth drivers include first‑party data mandates, cookieless targeting shifts, and the proliferation of dynamic content across paid and owned channels. Micro‑influencer programs expand as brands seek trusted voices and measurable engagement at lower CPMs. Risks include governance under the EU AI Act, model bias, and uneven performance from pilots lacking data plumbing or experimentation discipline.

Share dynamics: fashion and beauty lead in narrative‑rich merchandising, followed by consumer electronics (attribute depth) and home categories. Retailers with strong CDP/PIM foundations outgrow peers by rendering real‑time product narratives and shoppable modules that reflect local context, inventory, and price. Unit economics improve as content cycle times compress and variant testing scales. The line chart illustrates the compounding sub‑segment growth in USA+EU through 2030.

Execution guidance: attribute mapping and content schemas should be standardized across PIM and CMS; human‑in‑the‑loop QA must precede full rollout; and legal teams should review disclosure language for synthetic media. Measurement should prioritize incremental revenue per 1,000 rendered variants, not just output volume.

Market Analysis

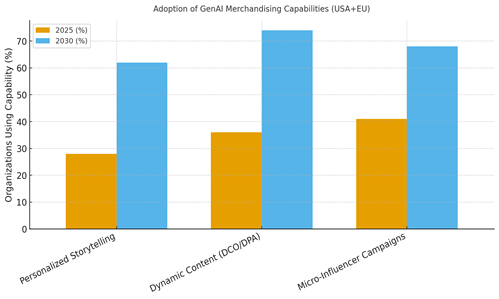

Capability adoption will be uneven but material by 2030. We project personalized storytelling adoption among mid/large brands/retailers increasing from ~28% (2025) to ~62% (2030), dynamic content/DCO from ~36% to ~74%, and micro‑influencer campaigns from ~41% to ~68%. Drivers: cost deflation, better tooling, and measurable ROAS/engagement gains particularly when linked to first‑party data. Personalized storytelling lifts discovery and AOV in attribute‑rich categories (beauty, consumer electronics); DCO optimizes creative fit across placements; micro‑influencers deliver higher engagement than macro‑led campaigns and create reusable UGC for commerce surfaces. Barriers include data silos, weak experimentation, and creative QA debt. Organizationally, leaders are building cross‑functional merch‑media teams with creative ops and data engineering embedded.

Financial lens: treat GenAI as a performance channel. Track cost per approved asset, variant test velocity, DCO win rate, and incremental margin after media/creator costs. Tie rewards and budgets to proven lift, not content volume. Vendor strategy: standardize briefs and templates; keep a modular stack (creative generation, templating, approval workflow, DCO, influencer matching) to avoid lock‑in. The bar chart depicts the step‑function in adoption across the three core capabilities by 2030.

Trends & Insights

1) Creative velocity as strategy: Organizations compress cycle times by >50%, enabling seasonal and persona‑level variants that would be cost‑prohibitive manually. 2) Agentic creative ops: AI agents assist with brief generation, asset QA, and compliance checks raising throughput without sacrificing brand guardrails. 3) First‑party data flywheel: Merch storytelling and DCO improve as CDP signals enrich; content variants become a vehicle to learn preferences. 4) Micro‑influencer trust premium: Smaller creators sustain higher engagement; AI improves matching, briefs, and content remixing for retail assets. 5) Retail media networks (RMNs): Dynamic merchandising assets flow into onsite and offsite inventory, blending trade marketing and performance media. 6) Compliance by design: EU AI Act timelines push disclosure, provenance, and risk classification; brands adopt audit trails and watermarking. 7) Outcome‑based funding: CFOs reallocate budget from static production to experiments with proven incrementality. 8) Category nuance: beauty/fashion favor narratives and UGC; CE and home benefit from spec‑rich copy and comparison modules; grocery uses DCO for price/availability swings.

Segment Analysis

Retail & Fashion: Highest narrative intensity; combine look books with shoppable stories and size/fit guidance; pair with micro‑influencers for social proof. Beauty & Personal Care: Routine‑based storytelling, before/after assets, and ingredient explainers; high ROI from creator UGC remixed into retail placements. Consumer Electronics: Attribute‑heavy copy, spec comparisons, and FAQ‑style stories; DCO adapts to price/availability; influencers skew to niche experts. CPG & Grocery: Weekly dynamic modules reflecting price, promos, and availability; recipe stories and bundle suggestions. Home & DIY: Project‑based stories and visual planners; micro‑influencers demonstrate use‑cases. Cross‑segment KPIs: variant test velocity, incremental revenue per 1k renders, DCO win rate, micro‑influencer CAC vs ROAS, and return‑rate impact from better fit/expectation management. Risks include content drift, QA gaps, and over‑reliance on synthetic visuals without disclosure. Mitigations: enforce brand rule libraries, human‑in‑the‑loop signoff, and automated checks for claims, IP, and bias.

Geography Analysis

By 2030, we estimate USA will represent ~58% of AI‑in‑merchandising spend vs EU at ~42%, reflecting ad/retail media scale, vendor ecosystems, and merchandising intensity. USA advantages include RMN maturity and higher test velocity; EU advantages include strong omnichannel retailers and tightening compliance that may improve consumer trust. Country nuance: in the EU, disclosure and provenance under the AI Act shape creative workflows; in the USA, platform policy and state privacy laws drive data contracts. Operationally, harmonize templates and prompts globally but maintain regional brief variants (language, regulatory copy, cultural cues). For cross‑border brands, centralize the content factory while granting local teams budget for micro‑influencer selection and creative tweaks. The pie chart reflects this split and underscores the need for localized creator networks and compliance processes.

Competitive Landscape

Vendor landscape spans: creative generation (text/image/video), templating and brand rules, creative ops/workflow, DCO/DPA engines, and influencer tools. Enterprise stacks integrate CDP/PIM/CMS with experimentation and RMN delivery. Incumbents with DCO and retail media integrations hold an edge; challengers innovate on agentic workflows and creator marketplaces. Differentiation vectors: (1) throughput and QA automation, (2) first‑party data fusion, (3) compliance tooling (provenance, watermarking, audit logs), (4) integration breadth. Case signals show material cost savings and cycle‑time compression; however, many organizations stall at pilot stage without data readiness or clear governance. Competitive KPIs: approved‑asset throughput, cost per asset, DCO win rate, creator content re‑use rate across channels, and incremental margin after media/creator costs. Strategic moves: standardize brief and prompt libraries; adopt modular procurement to avoid lock‑in; run quarterly creative system audits; and establish disclosure policies aligned to regional rules.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071