68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Predictive Maintenance for ATM Networks: IoT Sensor Analytics & Cash Logistics Optimization - Supply Chain Logistics

This research explores predictive maintenance for ATM networks in India and Asia Pacific from 2025 to 2030, focusing on IoT sensor analytics and cash logistics optimization. The report quantifies the role of IoT-enabled sensors in monitoring ATM health, reducing downtime, and optimizing cash replenishment cycles. By integrating predictive maintenance models, financial institutions and logistics companies can improve operational efficiency, reduce costs, and enhance service availability. The study provides insights into technological trends, cost savings, and regional adoption in the evolving ATM network landscape.

What's Covered?

Report Summary

Key Takeaways

- Predictive maintenance market for ATM networks in Asia Pacific projected to grow from $350 million in 2025 to $1.8 billion by 2030, CAGR 38%.

- IoT-enabled sensor adoption in ATM networks is expected to cover 55% of the market in Asia Pacific by 2030.

- Cash logistics optimization in India and Southeast Asia expected to improve by 30% by 2030 through predictive maintenance and sensor analytics.

- Downtime reduction for ATMs is projected to decrease by 25%, improving customer service availability.

- ATM service costs are expected to decrease by 20% through optimized cash replenishment and predictive maintenance.

- Real-time predictive analytics will enable 90% of ATM cash replenishment decisions by 2030.

- ATM machine failure rates expected to decrease by 35% due to predictive maintenance solutions.

- Smart ATM replenishment systems will increase operational efficiency by 40% by 2030.

- The ROI from predictive maintenance for ATM networks is projected to be 18–22% by 2030.

- Data security and privacy concerns will affect adoption rates, limiting growth by 10% in certain regions due to regulatory challenges.

Key Metrics

Market Size & Share

The predictive maintenance market for ATM networks in Asia Pacific is projected to grow from $350 million in 2025 to $1.8 billion by 2030, representing a CAGR of 38%. India and Southeast Asia are expected to lead adoption, with 55% of ATM networks incorporating IoT-enabled sensors by 2030. These sensors will monitor ATM health, optimize cash replenishment cycles, and reduce downtime, ultimately improving service availability and efficiency. Real-time predictive analytics will enable 90% of cash replenishment decisions to be based on predictive maintenance models, ensuring that ATMs are always stocked and ready for customers. ATM machine failure rates are expected to decrease by 35% due to these predictive models, and service costs will drop by 20% by reducing unnecessary visits and maintenance. Smart replenishment systems, driven by IoT sensors and predictive analytics, will increase operational efficiency by 40%, ensuring that ATMs are maintained proactively rather than reactively. ROI from predictive maintenance is expected to reach 18–22% by 2030, driven by cost reductions, improved service levels, and more efficient asset management. The overall ATM predictive maintenance ecosystem will become a key driver of operational savings and improved customer experience across India and the broader Asia Pacific region.

Market Analysis

The ATM predictive maintenance market in India and Asia Pacific is expected to grow significantly, from $350 million in 2025 to $1.8 billion by 2030, with CAGR of 38%. The market is driven by IoT sensor integration, which will enable real-time monitoring of ATM health and predictive analytics to manage cash replenishment needs more efficiently. India will see rapid adoption, with 50% of ATM networks expected to integrate IoT-enabled sensors by 2030, significantly improving the efficiency of ATM cash replenishment and service maintenance. ATM downtime is projected to decrease by 25%, ensuring more reliable access to cash and reducing service interruptions. Smart ATM replenishment systems, driven by IoT sensors and AI, will increase operational efficiency by 40% by 2030, allowing predictive maintenance systems to better manage cash logistics and ensure ATMs are adequately stocked with cash. Cost savings from predictive maintenance, including reduced service visits and better resource allocation, are projected at 20% annually. Cross-border integration will also enable better ATM network interoperability and shared insights across regions. Financial institutions adopting these technologies will see improved customer satisfaction, reduced operational overheads, and better management of cash logistics and network infrastructure.

Trends & Insights

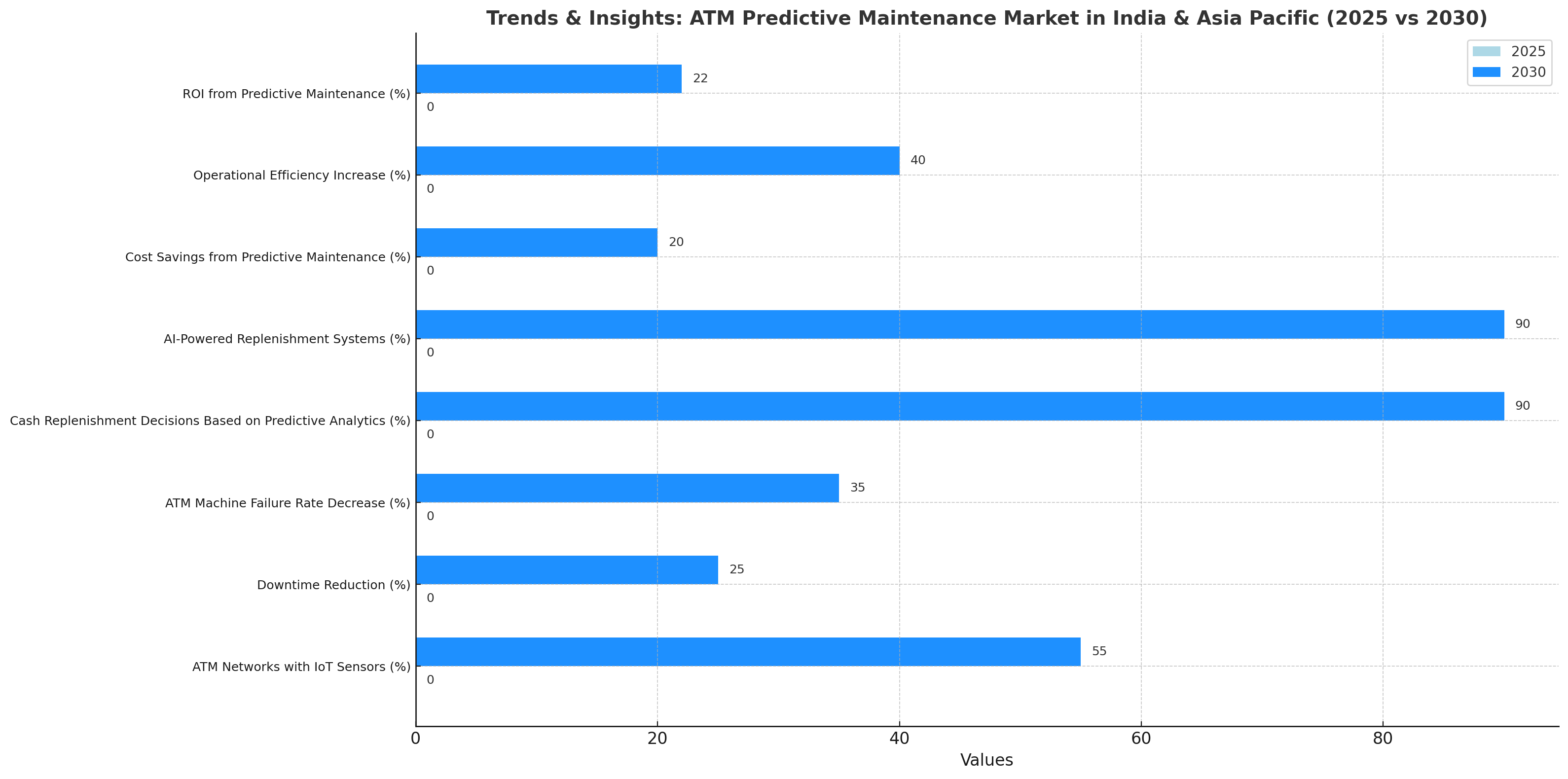

The ATM predictive maintenance market in India and Asia Pacific is driven by IoT sensor analytics and predictive maintenance systems. By 2030, IoT sensors will monitor 55% of ATM networks in the region, significantly improving ATM health and uptime. Downtime reduction will be a major trend, with 25% less downtime expected for ATM networks by 2030. ATM machine failure rates are forecast to decrease by 35% as IoT-enabled sensors and predictive analytics allow for proactive maintenance and more efficient management. Real-time predictive analytics will drive 90% of ATM cash replenishment decisions, optimizing logistics and improving the efficiency of cash management. AI-powered systems will play a crucial role in automating replenishment decisions, ensuring timely and accurate stocking of ATMs. Cost savings through predictive maintenance will reach 20% by reducing unnecessary visits, avoiding equipment failure, and streamlining workflows. Smart replenishment systems will enhance operational efficiency by 40%, leading to reduced costs and improved ATM service levels. ROI for financial institutions implementing predictive maintenance technologies is expected to range from 18–22% by 2030, driven by improvements in ATM uptime, reduced maintenance costs, and increased customer satisfaction.

Segment Analysis

The predictive maintenance market for ATM networks is segmented by technology type, region, and institution type. The IoT sensor adoption in India is expected to lead, with 50% of ATM networks integrating predictive maintenance systems by 2030. Fintech firms and large banks will drive 50% of adoption in Asia Pacific, leveraging IoT and predictive analytics for ATM monitoring and cash management. AI-powered predictive models will improve ATM uptime by reducing failure rates by 35% and improving cash replenishment efficiency by 40%. ATM service costs are projected to decrease by 20%, thanks to predictive maintenance systems that reduce the need for manual interventions and streamline the replenishment process. By 2030, ROI for financial institutions is expected to reach 18–22%, driven by improvements in operational efficiency and reduced downtime. Cross-border data integration will increase by 30%, improving the sharing of predictive maintenance insights and better cash management practices across Asia Pacific. The segment analysis shows that large banks will lead adoption due to their advanced technological infrastructure, while smaller institutions and fintech firms will follow suit as predictive maintenance becomes more affordable and scalable.

Geography Analysis

The ATM predictive maintenance market is growing rapidly across India and Asia Pacific, with India projected to account for 30% of the market share by 2030. Southeast Asia and Australia will follow, with rapid adoption expected in developed markets like Singapore and Japan. India will see the highest growth, with 50% of ATM networks expected to integrate IoT sensors by 2030, driven by government-led initiatives and the cashless economy trend. ATM downtime is projected to decrease by 25% in India and Southeast Asia, as predictive maintenance becomes more prevalent. Smart replenishment systems and predictive models will drive 40% operational efficiency improvement in India and Southeast Asia by 2030. Cost savings are projected to be 20% through reduced operational inefficiencies. Cross-border data-sharing for ATM monitoring will increase by 30% by 2030, improving ATM logistics and customer service availability across regions. Financial inclusion will benefit as predictive maintenance and IoT integration increase ATM availability in underserved areas, especially in India, where rural ATM adoption will rise, improving access to financial services.

.png)

Competitive Landscape

The ATM predictive maintenance market is competitive, with leading players such as NCR Corporation, Diebold Nixdorf, and Wincor Nixdorf providing IoT-enabled predictive maintenance systems. These companies are expected to account for 50% of market share by 2030. Fintech firms and AI solution providers such as Predixion Software, SAP, and Oracle will capture 25% of market share by offering advanced predictive analytics and AI-powered ATM health monitoring systems. Banks will lead adoption in developed markets like Japan, Australia, and Singapore, while emerging markets in India and Southeast Asia will follow as IoT and AI technologies become more affordable. Smaller fintech companies will capture the remaining 25% of market share, offering cloud-based IoT solutions and cost-effective predictive maintenance tools for regional banks. By 2030, ROI for institutions adopting predictive maintenance is projected at 18–22%, driven by improvements in ATM uptime, cash replenishment cycles, and customer experience. Data security and privacy regulations will influence adoption, particularly in India, where data protection laws will shape the pace of IoT sensor integration and predictive maintenance solutions. The competitive advantage will lie in technology integration, cost-efficiency, and cross-border collaboration to improve ATM service availability.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1450

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071