68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Phygital Loyalty Ecosystems: NFT Reward Systems & Metaverse Engagement in Luxury Retail

Luxury loyalty is evolving from points to ownership. Between 2025 and 2030, European maisons fuse physical clienteling with digital collectibles, wallets, and metaverse experiences to create scarce, portable status that unlocks service. We model Europe’s phygital loyalty and NFT engagement spend growing from ~US$3.9B (2025) to ~US$10.3B (2030), with France contributing a leading share driven by maison density, creative studios, and museum‑grade events. The stack spans: (1) tokenized benefits (invites, atelier access, repair credits), (2) portable identity (wallet linkage and zero‑knowledge proofs), and (3) immersive engagement (virtual salons, capsule drops, and authenticated resale benefits). Value is realized through higher retention, more frequent redemptions, deeper engagement minutes, and measurable ROI on digital collectibles when tied to services or resale utility. Operating model: loyalty moves onto a data fabric where on‑chain/off‑chain events feed decisioning. Wallet linkage and identity orchestration make benefits portable across ecommerce, boutiques, partner venues, and metaverse stores.

What's Covered?

Report Summary

Key Takeaways

1. Ownership beats points: tokenized benefits unlock services and preserve equity.

2. Wallet linkage is the gateway custodial paths reduce friction and expand reach.

3. Utility > speculation: collectibles tied to care, repair, invites, or resale have durable ROI.

4. Decisioning needs on‑chain + off‑chain events with privacy‑preserving proofs.

5. Metaverse stores act as engagement hubs; measure minutes and assisted sales.

6. France advantage: cultural venues + maisons deliver prestige‑anchored activations.

7. Governance: IP/licensing, promotions compliance, and anti‑scalping are non‑negotiable.

8. CFO dashboard: linkage %, redeem frequency, retention, engagement minutes, ROI on collectibles.

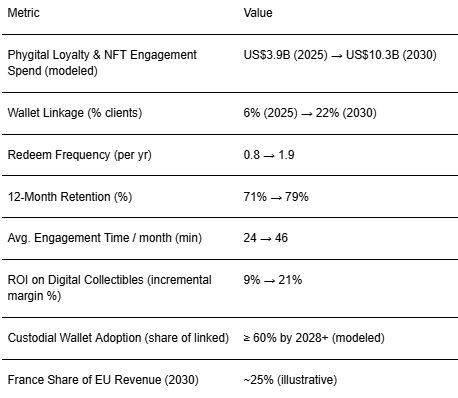

Key Metrics

Market Size & Share

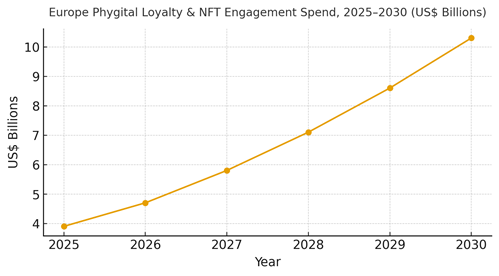

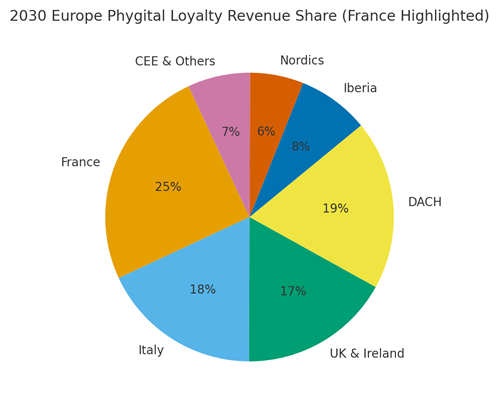

Europe’s phygital loyalty and NFT engagement market is modeled to grow from ~US$3.9B (2025) to ~US$10.3B (2030). Spend clusters around luxury maisons, culture‑adjacent brands, and premium retailers with boutique networks. France’s ~25% share is underpinned by flagship venues, museum partnerships, and creative studios. The line figure charts the compounding growth trajectory.

Share dynamics within the stack: token issuance and benefit orchestration; wallet/identity; metaverse/virtual stores; and analytics. Leaders gain share by tying tokens to services (care, repair, invitations) and resale authenticity, not just art drops. Execution risks include wallet friction and fragmented data; mitigations are custodial options, progressive disclosure of features, and interoperability standards. Measurement expands beyond issuance to linkage, redemption, and service attachment rates.

Market Analysis

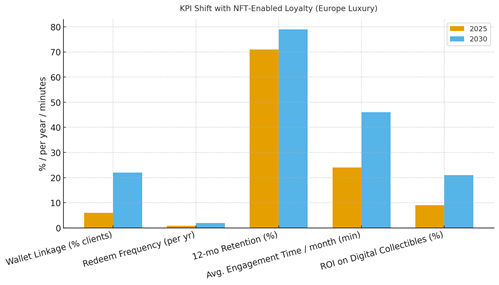

NFT‑enabled loyalty shifts measurable KPIs when utility is clear. We model wallet linkage rising from ~6% to ~22% of luxury clients by 2030; redeem frequency from ~0.8 to ~1.9 per year; 12‑month retention from ~71% to ~79%; average engagement minutes from ~24 to ~46 per month; and ROI on collectibles from ~9% to ~21% incremental margin when benefits trigger service and resale behaviors. Enablers: custodial wallets with smooth KYC where required, ZK proofs for privacy, on‑chain/off‑chain event streams, and metaverse experiences with assisted selling. Barriers: speculation, wallet UX, and IP/licensing complexity.

Financial lens: attribute to incremental margin net of issuance, royalties, and service cost; use geo or cohort holdouts; and tie activations to service attachments (repair, personalization) to prove durable value. The bar chart summarizes the directional shifts.

Trends & Insights

1) Utility‑anchored tokens: benefits tied to appointments, care/repair, and museum access. 2) Privacy‑preserving identity: ZK proofs confirm entitlements without revealing PII. 3) Metaverse as service desk: concierge, try‑ons, and private viewings drive assisted sales. 4) Portable status: badges travel across ecommerce, boutiques, and partner venues. 5) Resale adjacency: authentication rights and provenance bound to tokens. 6) Custodial paths: mainstream adoption with recoverable wallets. 7) Interop standards: avoid lock‑in across wallets, engines, and marketplaces. 8) Safety & accessibility: session limits, moderation, captions, and comfort modes. 9) Licensing discipline: clear rights for art, music, and event content. 10) CFO‑grade attribution: linkage %, redeem frequency, retention, engagement minutes, and incremental margin.

Segment Analysis

Haute Couture & Leather Goods: Tokens as invitations and personalization credits. Watches & Jewelry: Authentication/provenance, boutique appointments. Beauty: Sampling, regimen tokens, and exclusive drops. Footwear & Street Luxury: Limited editions and community events with anti‑scalping controls. Hospitality & Culture Partners: Access tokens for exhibitions and residencies. Across segments, define scarcity rules, custodial wallet flows, and redemption catalogs; track per‑segment linkage %, redemption, retention, and incremental margin.

Geography Analysis

France is modeled at ~25% of Europe’s phygital loyalty revenue by 2030, with DACH (~19%), Italy (~18%), UK & Ireland (~17%), Iberia (~8%), Nordics (~6%), and CEE & Others (~7%). Paris anchors flagship activations; regional boutiques translate digital benefits to service. Localization: French language UX, promotions compliance, accessibility, and strong cultural partnerships. The pie figure reflects France’s leadership in the regional mix.

Execution: centralize token issuance and analytics; allow local teams to curate partner utilities; and measure geography‑specific linkage, redemption, retention, and engagement minutes.

Competitive Landscape

Incumbent maisons leverage boutiques and heritage; challengers specialize in wallet UX, token utility, and metaverse production. Differentiation vectors: (1) custodial wallet reach and recovery, (2) ZK‑backed identity proofs, (3) service‑anchored token catalogs, (4) metaverse engagement quality with assisted selling, and (5) clean event streams to analytics. Procurement guidance: demand open standards, privacy‑preserving identity, licensing/IP clarity, and SLAs for uptime and support. Competitive KPIs: wallet linkage %, redemption frequency, retention uplift, engagement minutes, and ROI on collectibles.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071