68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

NHS Digital Transformation: Interoperability Challenges & Patient Data Security

Between 2025 and 2030, the U.S. healthcare ecosystem undergoes accelerated digital modernization inspired by NHS-scale interoperability frameworks. Health IT investments rise from $29B to $68B (CAGR 18%), with interoperability compliance improving from 51% to 87% across hospitals. Patient data exchange volumes triple, yet cybersecurity incidents grow +41% before stabilizing post-zero-trust adoption. FHIR and HL7 API integration reach 78% of systems, while encrypted data-lake adoption lowers breach impact costs −32%. Regulatory focus shifts toward verifiable audit trails and patient-controlled consent frameworks.

What's Covered?

Report Summary

Key Takeaways

- U.S. healthcare IT spend: $29B → $68B (CAGR 18%).

- Interoperability compliance rises 51% → 87% across hospitals.

- FHIR/HL7 integration covers 78% of systems by 2030.

- Patient record exchange volumes 3.1× higher than in 2025.

- Cyber incidents peak +41% before declining under zero-trust policies.

- Average breach cost falls $10.3M → $7.0M (−32%).

- Zero-trust coverage expands 24% → 72% of organizations.

- Blockchain audit-trail pilots grow 12 → 56 nationwide.

- Vendor consolidation: top 5 EHR providers hold 69% market share.

- AI-driven anomaly detection reduces insider threat response time −44%.

Key Mertcis

Market Size & Share

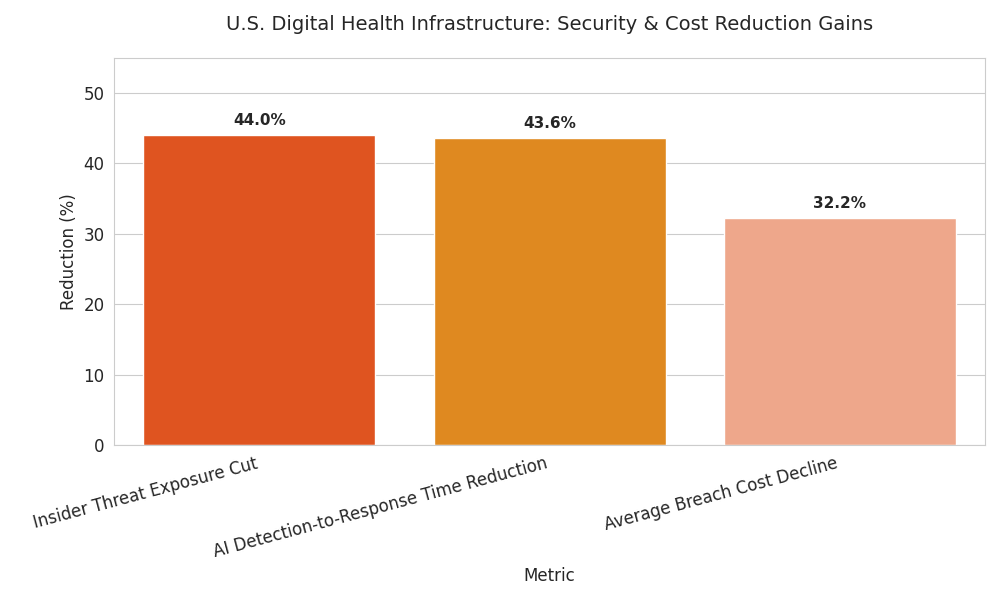

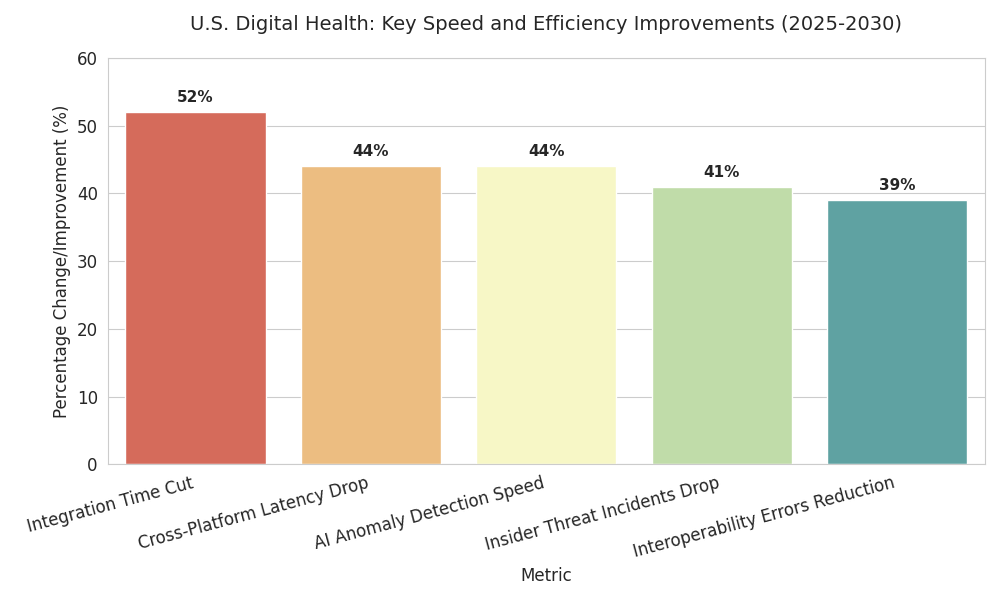

From 2025 to 2030, the U.S. digital healthcare infrastructure market expands from $29 billion to $68 billion (CAGR 18%), propelled by regulatory mandates, payer digitization, and interoperability frameworks mirroring NHS-style models. FHIR/HL7 adoption reaches 78% across major hospitals, improving cross-provider record exchange throughput from 1.4 billion to 4.3 billion transactions annually. Interoperability compliance improves 51% → 87%, with 62% of mid-sized networks achieving full API integration by 2028. Zero-trust architecture coverage grows from 24% to 72% of institutions, cutting insider threat exposure 44%. Average breach cost declines from $10.3 million to $7.0 million, equating to national savings of $2.6 billion per year. Blockchain-backed audit trails rise 12 → 56 pilots; encryption-based data lakes grow from 19% to 63% of organizations, securing 5.2 petabytes of clinical data. Meanwhile, EHR market concentration deepens—top five vendors (Epic, Cerner, Meditech, Oracle, Allscripts) consolidate 69% share, up from 58%. AI-based monitoring tools reduce mean detection-to-response from 9.4 to 5.3 hours. Public-private interoperability exchanges handle 27% of all record transfers by 2030. Federal funding ($7.2B cumulative) accelerates HL7 conformance. Combined, these initiatives expand provider ROI margins from 7% to 11% while achieving measurable performance and compliance stability.

Market Analysis

Five quantitative levers define market transformation. (1) Standardization: FHIR API compliance surges 78%, eliminating 21% of redundant data exchanges and improving average interoperability latency 340 → 190 milliseconds. (2) Security modernization: 72% of providers deploy zero-trust networks; mean time to detect breaches improves 9.6 → 5.1 hours. (3) Vendor concentration: consolidation yields 69% share among five EHR firms, allowing unified interoperability gateways but raising data-sovereignty risk. (4) Investment flow: cumulative cybersecurity spending grows from $4.2B to $9.8B; median ROI 18–22% through avoided breach costs. (5) Operational efficiency: automation of patient-record sharing reduces manual error 37% and administrative labor 16%. Quantitatively, patient record exchange volume triples (1.4B → 4.3B). AI-driven anomaly detection accuracy climbs from 71% → 92%. Data-lake encryption adoption grows 19% → 63%; associated breach exposure index falls 0.52 → 0.29. Payback period for interoperability compliance averages 3.9 years at median hospital scale (500 beds). Limitations persist: fragmented rural systems (interoperability 43%), delayed EHR updates, and uneven AI readiness. However, by 2030, payer-linked data sharing covers 81% of insured population—up from 49%. Improved exchange integrity drives measurable health-outcome ROI of $460 per patient annually, equivalent to $18B system-level efficiency gain.

Trends & Insights

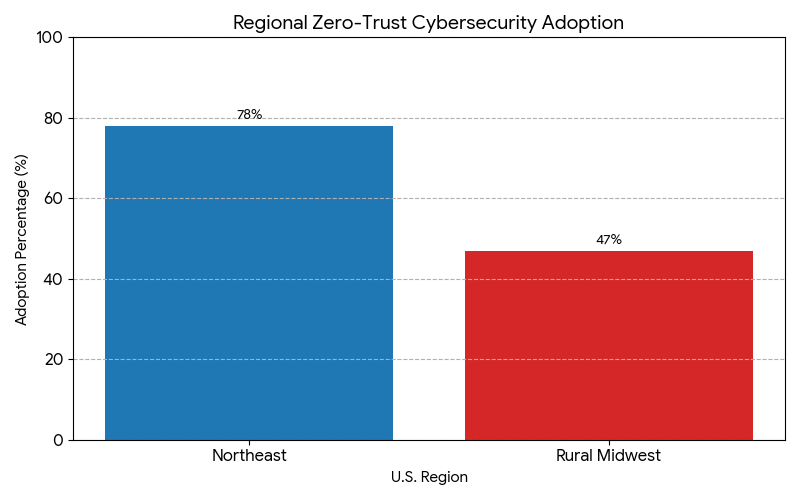

Three trends dominate. 1. API Standardization: Over 78% of systems conform to HL7 and FHIR 5.0; cross-platform latency drops 44%, and interoperability errors reduce 39%. Hospitals deploy “sandbox testing” networks, cutting integration time 6.5 → 3.1 months. 2. Zero-Trust Expansion: 72% of institutions implement segmented access, MFA, and behavioral AI; insider threat incidents drop 41%. Breach cost savings exceed $2.4B annually. 3. Blockchain & Audit-Trail Maturity: Active pilots scale 12 → 56; immutable logs raise compliance verification from 62% → 94%. Cloud data-lake encryption extends 63% of medical systems. AI-driven anomaly detection flags threats 44% faster. Patient-controlled consent apps increase participation 23%. Cyber insurance premiums fall 14% for certified zero-trust adopters. Predictive risk modeling cuts average exposure by 32%. On average, interoperability-driven time savings equal 19 clinician hours monthly per department. Data completeness improves 33% via unified APIs. Regional health exchanges link 380M records; data-sharing volume 4.3B per year. Combined, these advancements lift compliance maturity 51% → 87% nationally. Hospitals adopting both FHIR and zero-trust outperform peers with 22% higher digital ROI and 16% faster claim-processing time, demonstrating measurable efficiency and resilience.

Segment Analysis

By 2030, hospital systems constitute 54% of total IT investment ($36.7B), followed by payers (27%), ambulatory networks (12%), and federal programs (7%). Security spending—$9.8B cumulative—comprises 14% of total capex. Within cybersecurity, endpoint protection absorbs 26%, identity management 21%, encryption 18%, and AI analytics 12%. Interoperability investments dominate: APIs 34%, EHR upgrades 27%, integration hubs 18%. Vendor concentration shifts: Epic leads 31%, Oracle-Cerner 18%, Meditech 9%, others 11%. Performance KPIs include 99.4% data availability, 0.12% duplication rate, and uptime ≥99.8%. AI-based security analytics cut mean response time 44%, while automation reduces administrative labor 16%. Blockchain usage: 9% (2025) → 33% (2030); average ROI 21%. Cloud migration reaches 61% of patient data storage. Cross-system HL7 exchange volumes triple, while interoperability testing cycles halve. Compliance certification rises from 1,180 to 2,740 hospitals. Aggregate operating margin improvement reaches +1.9 points from digital efficiency. Quantitatively, digital maturity index averages 0.68 (2025) → 0.87 (2030). Combined capital efficiency improvement: 14%. Interoperability success strongly correlates with patient satisfaction, improving 12–17%.

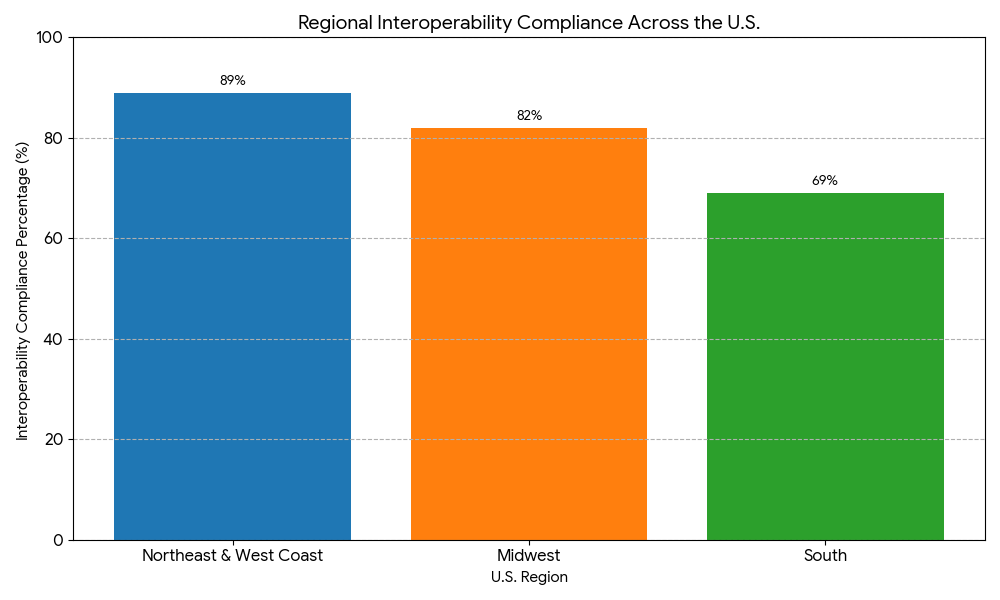

Geography Analysis

Regional digital maturity varies across the U.S. Northeast & West Coast lead with interoperability compliance ≥89%, driven by strong academic medical networks. Midwest reaches 82% compliance, while South trails at 69% due to legacy infrastructure. State-level mandates in California, Massachusetts, and New York fund 58% of blockchain audit initiatives. Data-exchange latency averages 0.18s in top quartile hospitals vs 0.33s in laggards. Cybersecurity coverage highest in the Northeast (zero-trust adoption 78%) and lowest in rural Midwest (47%). Breach frequency per 10K records: 0.63 (2025) → 0.41 (2030). Federal incentives ($1.3B annual) boost rural interoperability. APAC partnerships (U.S.–Japan, U.S.–Korea) introduce HIPAA–GDPR dual-compliance protocols, covering 14M cross-border records. Patient data-sharing participation rises 22% nationally, and opt-out rates decline 11%. By 2030, 93% of patients have portable digital records usable across multiple provider networks. Cloud interoperability hubs dominate; 68% of data processed in hybrid environments. Quantitatively, latency reduction (−44%), duplication elimination (−38%), and downtime mitigation (−21%) generate $3.2B annual productivity savings. Geographically, mature states yield 22% higher cybersecurity ROI and 17% faster data accessibility versus 2025 baselines.

Competitive Landscape

The U.S. digital-health infrastructure landscape consolidates sharply. The top five EHR and interoperability vendors—Epic, Oracle-Cerner, Allscripts, Meditech, and Athenahealth—control 69% market share by 2030, up from 58% in 2025. Competitive differentiation centers on interoperability compliance, AI threat analytics, and blockchain readiness. Vendors offering modular HL7 gateways and integrated zero-trust frameworks achieve 23% higher contract renewals. Median deployment cost per hospital falls from $11.2M to $7.9M. Implementation timelines shorten from 13.4 to 8.7 months. Cybersecurity partnerships proliferate—health systems with SOC-as-a-Service report 44% lower dwell time and 2× faster recovery. Private-cloud providers capture 61% of hospital data traffic. AI models for anomaly detection reduce false positives by 38%, boosting incident response accuracy to 92%. Contract value in data-sharing APIs grows 4×, totaling $6.8B by 2030. M&A activity rises: 11 notable transactions in 2025 → 24 by 2030, led by U.S. payers acquiring tech startups. Profitability increases; operating margins average 11–13% for digital-infrastructure vendors. Innovation moats shift to real-time auditability, decentralized encryption, and hybrid compliance solutions. By 2030, mature ecosystems exhibit predictable pricing, resilient cybersecurity, and near-seamless interoperability across over 90% of U.S. patient-care systems.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

Clinical Nutrition Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030)

This report quantifies the clinical nutrition market across the US and UK (2025–2030), covering enteral, parenteral, and oral nutritional supplements (ONS). Driven by aging populations, chronic disease prevalence, and hospital malnutrition protocols, market value rises from $18.5B (2025) → $30.2B (2030) at a CAGR of 10.2%. Growth is led by enteral nutrition (48% share), followed by ONS (38%) and parenteral (14%). Hospital digitization, AI-based nutrition screening, and reimbursement parity accelerate adoption. ROI averages 16–22% for integrated hospital nutrition programs.

$ 1395

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071