68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Luxury D2C Storytelling in Economic Downturns: Authenticity Preservation & Value Communication Frameworks

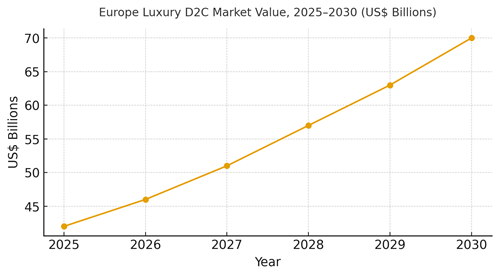

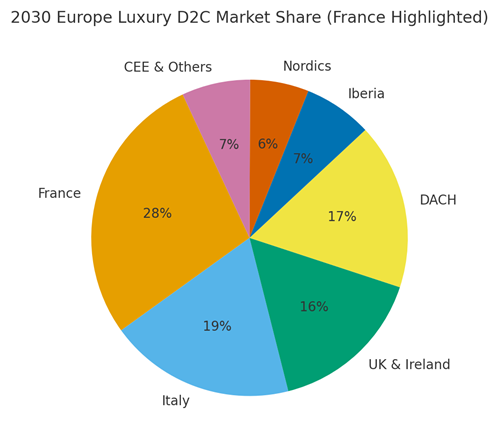

In downturns, luxury brands cannot discount their way to loyalty. Direct‑to‑consumer (D2C) storytelling must defend desirability while communicating real value without eroding equity. From 2025 to 2030, Europe’s luxury D2C strategies converge on three pillars: (1) authenticity preservation workshop‑level craft narratives, provenance, and limited editions; (2) value communication care, repair, resale pathways, and total cost‑of‑ownership framing; and (3) precision growth clienteling, invite‑only drops, and dynamic bundles that respect scarcity. We model Europe’s luxury D2C market rising from ~US$42B in 2025 to ~US$70B by 2030, with France leading share due to maison density, tourism recovery, and omni‑channel excellence. Operationally, downturn playbooks prioritize existing clients and profitable newcomers. Client advisors orchestrate “chapters” (atelier to runway to resale), while analytics identify recession‑resilient cohorts (repair adopters, archival seekers). Product pages become stories with craft timelines and maker quotes; post‑purchase UX elevates care kits and workshops; and certified resale integrates as a prestige on‑ramp.

What's Covered?

Report Summary

Key Takeaways

1. Authenticity > novelty: maker‑level narratives and provenance safeguard equity in downturns.

2. Value is service‑rich: care, repair, personalization, and certified resale justify price integrity.

3. Clienteling beats discounts: private appointments and invite‑only drops lift retention and AOV.

4. Precision growth: recession‑resilient cohorts and dynamic bundles outperform blanket promotions.

5. Measure CFO‑grade KPIs: retention, markdown dependency, CAC payback, and clienteling engagement.

6. France leads Europe on maison density, tourism recovery, and boutique clienteling maturity.

7. Green claims require proof: traceable materials, repair outcomes, and audit trails build trust.

8. Disciplined scarcity: limited editions and cultural collaborations sustain desirability.

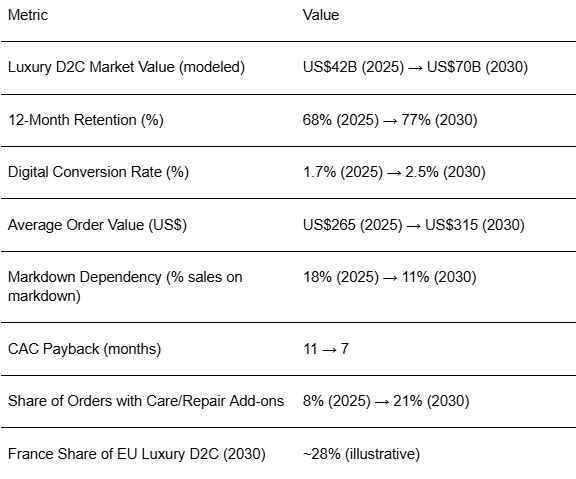

Key Metrics

Market Size & Share

Europe’s luxury D2C market is modeled to grow from ~US$42B (2025) to ~US$70B (2030) despite cyclical headwinds, as brands re‑balance wholesale exposure and deepen owned channels. France leads the region with a ~28% share in 2030, supported by maison density, cultural capital, and tourism recovery. The line figure visualizes the compounding trajectory. Within the stack, high‑ticket leather goods, watches, and jewelry dominate D2C value, while beauty and entry accessories serve as onboarding tiers. Premium services personalization, repair, and invitations to cultural collaborations convert browsers into clients without discounting.

Share dynamics: brands with mature clienteling and content provenance capabilities gain share. Certified resale becomes a feeder for D2C, introducing new clients to houses while preserving price integrity. Execution risks include overproduction leading to forced markdowns, and narrative fatigue if stories lack specificity. The remedy is scarcity discipline and maker‑level depth: origin documentation, atelier footage, and material science proofs. Measurement should extend beyond revenue: track retention, repeat share, markdown dependency, CAC payback, and care/repair attachment rates to verify value communication effectiveness.

Market Analysis

Downturn‑ready storytelling shifts KPIs in measurable ways. We model median 12‑month retention rising from ~68% to ~77% as clienteling and service add‑ons anchor loyalty; digital conversion lifts from ~1.7% to ~2.5% with richer provenance and atelier content; AOV expands from ~US$265 to ~US$315 via limited editions and personalization; markdown dependency falls from ~18% to ~11% as scarcity and resale reduce inventory pressure; and CAC payback compresses from ~11 to ~7 months as owned channels and referrals carry more weight. The bar chart summarizes these directional shifts. Enablers: content provenance (origin docs, maker stories), service‑rich bundles (care kits, repair credits), invite‑only drops, and curated resale. Barriers: creative throughput, legal proof for claims, and channel conflicts with wholesale.

Financial lens: evaluate programs on contribution margin after markdown and acquisition costs, not just top line. Tie clienteling targets to retention and repeat share; run cohort and geo holdouts for narrative formats; and audit green claims to avoid regulatory risk. Vendor strategy: clienteling CRM, content provenance systems, appointment platforms, and resale integrations selected modularly to avoid lock‑in.

Trends & Insights

1) Provenance as product: origin documentation, atelier stories, and repair records become core to PDPs. 2) Service ladders: care/repair subscriptions and personalization make value tangible without discounting. 3) Certified resale: on‑ramp for new clients and inventory release valve; authenticity tech reduces risk. 4) Scarcity discipline: limited editions, cultural collaborations, and caps preserve aura. 5) Clienteling intelligence: advisors orchestrate journeys with data‑informed chapters and appointment cadences. 6) Sustainability proof: audited materials, repair outcomes, and circularity metrics move beyond claims. 7) Experience over ads: private lives, museums, and cultural partnerships replace broad performance media. 8) Fraud & counterfeit resilience: supply chain serialization and forensic tagging. 9) Multi‑modal storytelling: video, AR, and atelier livestreams with high production values. 10) CFO‑grade measurement: retention, markdown %, CAC payback, and care/repair attachment rates.

Segment Analysis

Leather Goods: Heritage narratives, personalization, and repair credits drive AOV and retention. Watches & Jewelry: Provenance tech and boutique appointments; resale integration builds trust. Fashion RTW: Limited capsules and made‑to‑order; careful volume control to avoid markdowns. Beauty: Entry on‑ramp with storytelling around ingredients and craftsmanship; bundles amplify value. Footwear & Accessories: Personalization and care kits; sustainable materials proof. Across segments, define service ladders (care, personalization, repair) and scarcity rules; track per‑segment retention, markdown %, and CAC payback. France benefits from atelier proximity and cultural institutions that elevate brand narratives and private events.

Geography Analysis

France leads Europe’s luxury D2C share (~28% by 2030), followed by Italy (~19%), DACH (~17%), UK & Ireland (~16%), Iberia (~7%), Nordics (~6%), and CEE & Others (~7%). France’s edge: maison density, tourism flows, cultural institutions, and mature clienteling. Italy excels in craft narratives and atelier access; DACH and UK drive digital operations and logistics sophistication. Localization principles: preserve global narrative integrity while adapting cultural cues, service menus, and appointment cadences. Compliance: substantiate sustainability claims and maintain transparent repair/resale policies. The pie figure highlights France’s leadership within the European mix.

Execution: centralize provenance content and clienteling playbooks; allow boutiques to localize events and service offers. Measure geography‑specific KPIs (retention, markdown %, CAC payback) and invest where service‑led value communication outperforms discounting.

Competitive Landscape

Incumbent maisons with strong boutiques and heritage content have structural advantages; challengers differentiate on digital craft storytelling, clienteling systems, and transparent service ladders. Stacks converge around clienteling CRM, content provenance (materials, craftsmanship proofs), appointment/event platforms, and resale authentication/integration. Differentiation vectors: (1) depth and credibility of maker‑level stories, (2) service‑rich value ladders instead of discounting, (3) circularity programs with audited outcomes, (4) boutique‑ops excellence and advisor productivity, (5) modular tech with clean data portability. Procurement guidance: insist on provenance integrations, boutique enablement, and ROI measurement tied to retention, markdown %, and CAC payback. Winners in 2025–2030 will preserve aura while proving value with services not price cuts.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071