68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Edible & Biodegradable Packaging Solutions: Cost Challenges & Consumer Perception in Food Retail

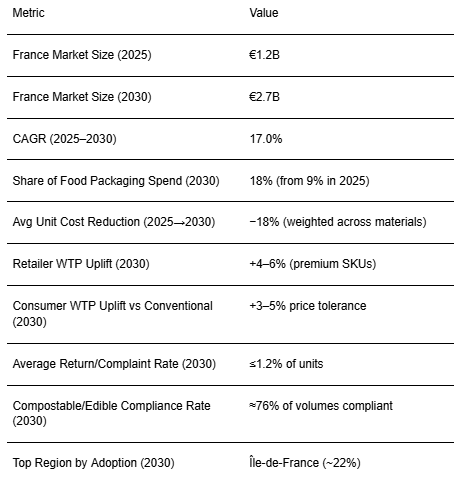

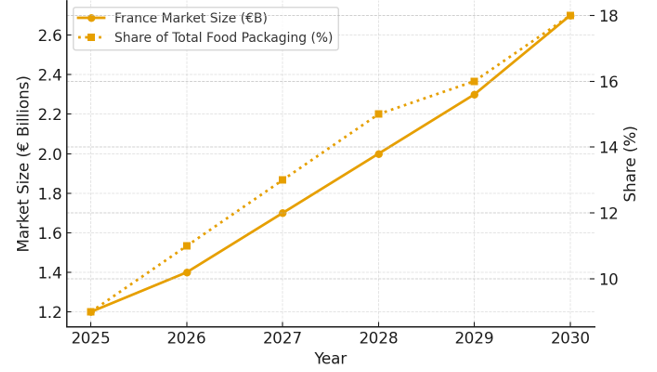

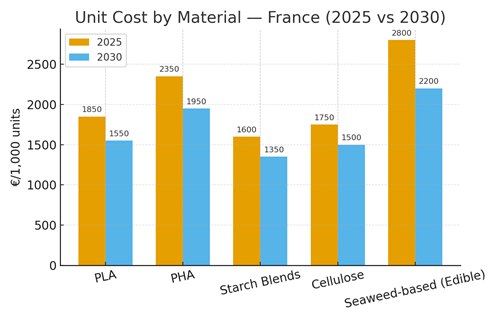

France’s edible and biodegradable packaging market in food retail is moving from pilot to scaled adoption, driven by EPR targets, retailer ESG agendas, and consumers’ sensitivity to food-contact safety and clear end-of-life. We model value expanding from ~€1.2B in 2025 to ~€2.7B by 2030 (~17% CAGR), while share of total packaging spend rises from ~9% to ~18%. Margin depends on (1) cost curves bending through localized compounding, higher line speeds, and lower scrap, and (2) trust systems verified claims (EN 13432, migration tests), taste neutrality, and disposal clarity that unlock willingness to pay. Cost is the immediate constraint: PHA and seaweed-based films carry premiums vs. conventional plastics, but weighted unit costs fall ~18% by 2030 as capacity scales and processes mature.

What's Covered?

Report Summary

Key Takeaways

1. Market scales to ~€2.7B by 2030 (≈17% CAGR) with share near 18% of food-retail packaging.

2. Weighted unit costs fall ~18% by 2030; PHA and seaweed remain premium, starch/cellulose drive volume.

3. Consumers pay +3–5% when claims are verified, taste is neutral, and disposal is clear.

4. Retailers protect margin through premium PL, shrink reduction, and logistics rightsizing.

5. Edible films win in single-serve and counters; compostable trays/lids expand in ready-meals.

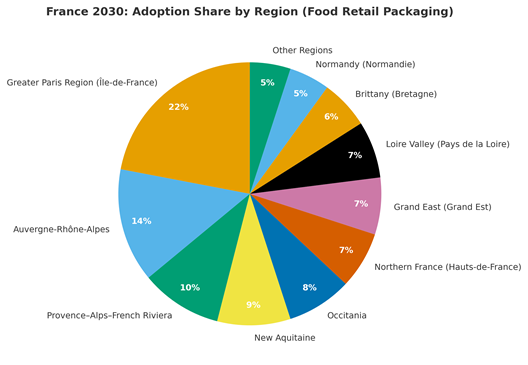

6. Île-de-France leads adoption; Auvergne-Rhône-Alpes and PACA are growth corridors.

7. QR traceability + shelf-edge education compress trial-to-repeat cycles.

8. SKU-level LCA + contribution-margin guardrails beat generic ‘green’ positioning.

Key Metrics

Market Size & Share

France’s edible & biodegradable packaging market is modeled to expand from ~€1.2B in 2025 to ~€2.7B by 2030 (≈17% CAGR), with spend share rising from ~9% to ~18%. Growth is supported by policy/EPR pressure, retailer ESG scorecards, and consumer preferences when performance equals or surpasses conventional options. Local compounding reduces resin transport costs, improves supply assurance, and enables faster iterations on master-batch recipes for seal strength and clarity. As lines standardize on compostable specs, scrap rates fall and speeds increase, bending per-1,000-unit costs. Demand pull intensifies where sustainable packaging correlates with freshness and hygiene (produce, bakery, counters). Private label is the beachhead: retailers control specs and pricing, enabling faster A/B testing of materials and messaging. National brands deploy on hero SKUs to justify price premium via verified claims and better shelf presentation. Risks include resin price volatility, home vs. industrial composting confusion, and taste transfer in edible films; mitigations: index-linked contracts, on-pack icons, and rigorous migration tests. By 2030, mainstream use resembles a portfolio: cellulose and starch blends for volume, PLA as mid-tier, PHA and seaweed for premium and mission-critical use-cases. EU peers provide lessons on consumer education and waste-stream alignment, accelerating France’s adoption curve.

Market Analysis

Unit cost trajectories suggest narrowing deltas vs. conventional plastics by 2030. PLA drops ~16% as local supply grows and process parameters improve. PHA falls ~17% thanks to fermentation efficiency and capacity scale, retaining a premium due to superior biodegradation. Starch blends become cost-effective workhorses where machinability on legacy lines is critical, falling ~16%. Cellulose benefits from coating and barrier innovations, improving sealability and clarity while cutting costs ~14%. Seaweed-based edible films remain premium but deliver differentiated value: open-counter hygiene, portion control, and consumer theater. Retail economics depend on contribution margin: shrink reductions and logistics rightsizing frequently offset part of the packaging premium. Tools that matter: MMM for promo/price fence calibration, SKU-level LCAs for credible claims, and changeover kits to limit downtime. Supplier frameworks should enforce quality gates (seal strength, migration, taste neutrality) and dual-source risk. By 2030, cost and performance converge enough for broad private-label adoption, with premium narratives sustaining selective price steps.

Trends & Insights

Compliance-first engineering emerges: materials are shortlisted only after end-of-life pathways and migration tests pass. Shelf-edge storytelling becomes standardized icons for compostability type, QR for batch-level data reducing hesitation and WISMO-style queries post-purchase. Edible films gain traction in single-serve and counters where hygiene and portion control are prized. Data loops harden: defects and complaint types are codified, enabling rapid supplier feedback and cost recovery. Operationally, click-and-collect and lockers reduce damages compared to long-route delivery, making compostables more viable for e-grocery. Retailers pilot deposit/return concepts for compostable containers in urban areas. Consumer expectations sharpen around taste/odor neutrality and disposal clarity; where both are met, WTP uplifts persist without heavy promotions. Net: lower variance in payback, steadier repeat rates, and visible EBITDA conversion from sustainable packaging initiatives.

Segment Analysis

Produce and bakery shoulder early volumes; ready-meal/deli trays follow with verified barrier performance. Dry grocery switches selected SKUs to compostable inner bags and cellulose windows, leaning on premium positioning. Private label expands breadth thanks to controlled specs and faster iteration cycles; national brands prioritize halo SKUs for narrative impact. Shopper segments: eco-active urban cohorts lead, families adopt via bakery/ready-meals, and price-sensitive shoppers convert when benefits are tangible freshness, reseal ability, or convenience. Store formats with high fresh share and counters see faster turnover of edible films. B2B corners (salad bars, bakery stations) inside retail act as reliable anchors for volume. Operational segmentation: regions with strong waste-stream clarity and municipal support show higher disposal compliance and fewer complaints.

Geography Analysis

By 2030, adoption is led by the Greater Paris Region (Île-de-France) at approximately 22%, driven by dense premium retail networks, early-adopter demographics, and pilot-friendly sustainability ecosystems. Auvergne-Rhône-Alpes (~14%) and the Provence–Alps–French Riviera (~10%) follow closely, leveraging their strong agri-food and specialty retail bases. New Aquitaine (~9%) and Occitania (~8%) benefit from active food clusters and tourism-oriented innovations. Northern France and the Grand East (~7% each) scale through cross-border learnings and efficient logistics corridors. The Loire Valley (~7%), Brittany (~6%), and Normandy (~5%) expand through seafood, dairy, and bakery categories, while other regions collectively represent about 5% of the market.

For successful scaling, retailers should combine regional demand analytics, consumer willingness-to-pay (WTP) heatmaps, and supplier proximity data to optimize rollout sequencing. Collaboration with municipalities and waste management authorities remains crucial to standardize disposal guidelines, enhance public education on compostability, and strengthen consumer trust in sustainability claims.

Competitive Landscape

France’s field includes biopolymer producers, converters, and retailer innovation programs. Winners excel at (1) verified claims and transparent datasheets; (2) index-linked, dual-sourced contracts; (3) rapid line trials with feedback loops to product and ops. Converters with flexible tooling, quick changeovers, and low scrap rates capture share. Retailers differentiate via premium private-label ranges and audited LCA deltas. Edible-film specialists build niches in counters and single-serve, while cellulose/starch specialists dominate volume. M&A favors capability acquisitions—coatings, barriers, composting logistics—over pure capacity. Durable advantages stem from operating playbooks and trust systems more than from any single material innovation.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071