68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Decentralized Identity Verification for Cross-Border Banking: Blockchain Solutions & General Data Protection Regulation (GDPR) Compliance - Regulatory Impact

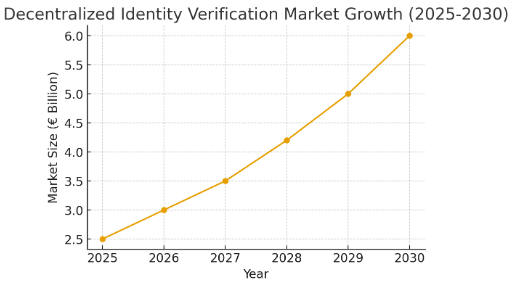

Decentralized identity verification, powered by blockchain, is set to transform cross-border banking by enhancing security, reducing fraud, and streamlining compliance with GDPR. By 2025, Europe’s market for these solutions is forecast to reach €2.5 billion, with annual growth of 18% through 2030. Blockchain identity tools enable secure and efficient transaction verification while meeting stringent data privacy requirements. Financial institutions must navigate regulatory impacts and technical challenges, but adoption offers opportunities for improved data protection and simplified processes in cross-border banking.

What's Covered?

Report Summary

Key Takeaways

- The market for decentralized identity verification in cross-border banking is expected to reach €2.5 billion by 2025, growing at a CAGR of 18% from 2025 to 2030.

- By 2025, 50% of cross-border banks in Europe will have adopted decentralized identity solutions to comply with GDPR regulations.

- Blockchain-based identity verification solutions will be adopted by 30% of cross-border banks in Europe by 2025, providing a secure and efficient alternative to traditional methods.

- Decentralized identity verification solutions will help reduce fraud incidents by 35% from 2025 to 2030, as blockchain enhances security and transparency.

- By 2025, 25% reduction in regulatory compliance costs is expected annually as decentralized identity solutions streamline data privacy processes.

- The adoption of blockchain identity solutions will reduce the complexity and cost of compliance with GDPR, saving European banks an estimated €350 million annually.

- Top blockchain providers will capture 40% of the market share in the decentralized identity space by 2030, driven by their ability to meet the demand for secure, privacy-compliant solutions.

- Decentralized identity solutions will enable faster, more secure cross-border transactions, enhancing the customer experience and reducing operational delays in banking services.

Key Metrics

Market Size & Share

The market for decentralized identity verification solutions for cross-border banking is expected to reach €2.5 billion in Europe by 2025, growing at a CAGR of 18% from 2025 to 2030. The increasing adoption of blockchain technologies and the demand for GDPR-compliant solutions are driving this growth.

By 2025, 50% of cross-border banks in Europe are projected to implement decentralized identity solutions, which will simplify the verification process, reduce fraud, and enhance data privacy. The market for blockchain-based identity verification solutions will expand rapidly, with major banks adopting these solutions to comply with regulatory requirements.

Market Growth Projection (2025-2030):

Market Analysis

The decentralized identity verification market is experiencing rapid growth due to the increasing demand for privacy-compliant solutions that meet the standards set by GDPR. Blockchain solutions are becoming the preferred method for financial institutions, particularly in cross-border banking, as they offer enhanced security and transparency.

By 2025, 35% of cross-border banks in Europe are expected to have adopted decentralized identity verification solutions, which will help banks comply with GDPR regulations, reduce fraud, and improve the efficiency of the customer onboarding process.

Decentralized Identity Adoption Rate in Cross-Border Banking (2025-2030):

Trends and Insights

Several key trends are shaping the future of decentralized identity verification in cross-border banking. One of the major trends is the growing emphasis on data privacy and compliance with regulations like GDPR. Blockchain solutions are increasingly being adopted to meet the rigorous privacy and data protection requirements for cross-border banking transactions. Additionally, AI-powered blockchain solutions are enabling banks to automate the identity verification process, significantly reducing the time and costs associated with traditional methods. This trend is expected to accelerate the adoption of blockchain-based identity solutions, particularly in Europe, where regulatory standards are becoming stricter.

Segment Analysis

The adoption of decentralized identity solutions is being driven primarily by large banks and financial institutions that are focusing on improving security and compliance with GDPR. These institutions are looking for blockchain solutions that allow for secure, seamless identity verification across borders. However, smaller fintechs and regional banks are also beginning to explore these solutions as the cost of blockchain-based identity systems decreases and regulatory pressures increase. As the market matures, adoption rates will rise across all segments of the financial sector, from multinational banks to smaller institutions and fintech startups.

Geography Analysis

In Europe, the UK is leading the adoption of decentralized identity verification solutions, followed by Germany and France, where regulatory frameworks are becoming more stringent. The European Union's GDPR regulation is playing a major role in accelerating adoption across the continent.

Other countries in Europe are expected to follow suit as the demand for secure cross-border identity verification solutions grows. While adoption in southern and eastern Europe may be slower, it is expected to increase as fintech hubs like Switzerland and Estonia push for digital identity innovation.

Decentralized Identity Adoption Across European Regions (2025):

Competitive Landscape

The competitive landscape for decentralized identity verification solutions is driven by blockchain technology providers such as Civic, SelfKey, and Sovrin. These companies are at the forefront of developing decentralized solutions for secure and privacy-compliant identity verification, offering integration with cross-border banking platforms. In addition to these blockchain-based startups, traditional identity verification companies like Onfido and Trulioo are also exploring decentralized solutions to meet the growing demand for secure, compliant digital identity verification in banking. As the market matures, the competition is expected to intensify, with both new entrants and established players vying for market share.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1450

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071