68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Cross-Border E-Commerce Logistics: Customs Optimization & Duty Management in EU-China Trade

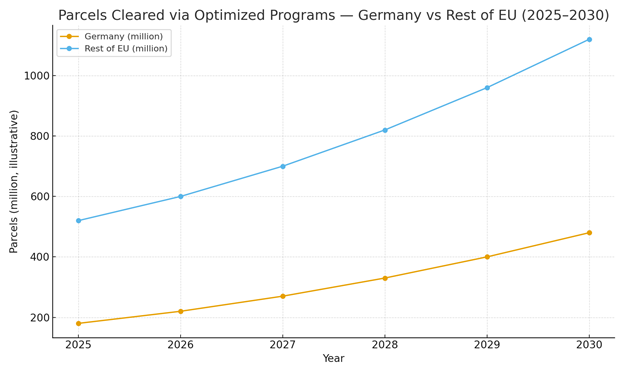

From 2025 to 2030, cross‑border e‑commerce between China and the EU shifts from fragmented DDU flows to predictable DDP programs anchored by IOSS compliance, FTZ/bonded hub pre‑clearance, and highly automated returns. Germany emerges as a control‑tower market: deep air/rail links, CEP density, and strong IT alignment with customs. Merchant platforms and 3PLs converge on three playbooks: (1) DDP via IOSS for low‑value B2C parcels with VAT at point of sale; (2) DDP via EU free‑trade/bonded hubs with postal or CEP injection for mid‑value baskets; and (3) legacy DDU only where product or country constraints require it. Illustratively, parcels cleared through optimized programs scale in Germany from ~180m in 2025 to ~480m by 2030; in the rest of the EU from ~520m to ~1.12bn.

What's Covered?

Report Summary

Key Takeaways

1. DDP with IOSS or FTZ hubs outperforms legacy DDU on speed, predictability, and landed‑cost accuracy.

2. A golden master for HS/VAT/IOSS with audit trails is the backbone of duty management and compliance.

3. FTZ/bonded hubs enable pre‑clearance, value‑added services, and postal/CEP injection at scale.

4. Lane‑level SLAs should index to lead time, first‑time clearance, and landed‑cost variance.

5. Returns must integrate duty drawback and refurbished resale to recover margin.

6. Analytics should flag misclassification/anomalies in HS, origin, and valuation before customs does.

7. Split‑shipment vs consolidation decisions should consider duty thresholds and promise windows.

8. EU DPP and eco‑design signals will tighten data needs; start SKU‑level traceability now.

Key Metrics

Market Size & Share

EU‑China cross‑border parcels continue to grow as platforms and brands formalize duty/VAT at checkout and standardize documentation. In this illustrative outlook, Germany’s parcels cleared via optimized programs rise from ~180m in 2025 to ~480m by 2030; the rest of the EU grows from ~520m to ~1.12bn. Share consolidates in gateway states Germany, Netherlands, Belgium where air/rail links, FTZ/bonded hubs, and postal/CEP injection networks are deepest. Germany’s control‑tower role expands due to CEP density and robust IT exchanges with customs.

By 2030, leaders capture share by bundling IOSS checkout, harmonized HS/VAT masters, and bonded‑hub pre‑clearance with postal/CEP injection. Their moat is predictability: low landed‑cost variance and high first‑time clearance that protect margins and customer promises.

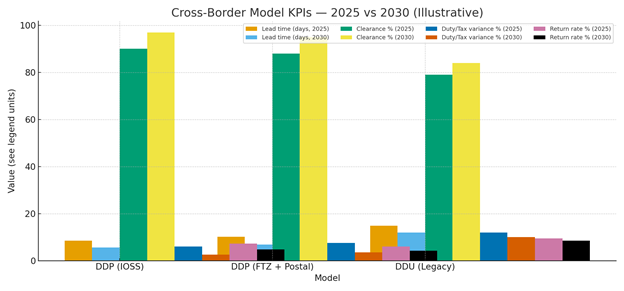

Market Analysis

Performance is a function of data quality, hub design, and carrier mix. In this outlook, DDP via IOSS and DDP via FTZ outperform DDU across lead time, first‑time clearance, landed‑cost variance, and return rates. Lead time drops 2–4 days as pre‑clearance and direct injections reduce dwell; first‑time clearance climbs 5–8 pp with better HS/VAT masters and data validation; landed‑cost variance halves with accurate duties/VAT at checkout; and returns recovery improves with auto‑drawback and refurb channels. Cost stack: linehaul, clearance/handling, injection, delivery, and returns. Value stack: reduced penalties, higher conversion from transparent landed cost, lower refund rates, and improved repeat purchase.

Risks: misclassification penalties, data mismatches (seller vs IOSS), seasonality congestion, and FTZ bottlenecks. Mitigations: rule engines with audit trails, pre‑alert validation, capacity reservations, and fallback lanes. Finance teams will require monthly dashboards keyed to lead time, clearance %, landed‑cost variance, and return rate by lane.

Trends & Insights (2025–2030)

• IOSS normalization: VAT at checkout becomes standard for low‑value consignments, reducing post‑arrival billing and holds.

• Bonded/FTZ pre‑clearance: enables kitting, relabeling, and quality checks before postal/CEP injection to the final country.

• Predictive compliance: anomaly detection flags HS/origin/valuation risks; digital twins test lane performance.

• Returns monetization: auto‑drawback, refurbishment, and local resale capture value on reverse flows.

• DPP/eco‑fees: product passports and eco‑fees increase data granularity and affect landed cost by 2030.

• Rail‑air hybrids: time‑definite rail from China to EU blends with air for peak smoothing.

• SLA transparency: lane‑level KPI contracts with shared dashboards become procurement norms.

• Sustainability: carrier selection and injection points account for CO₂e alongside duty/VAT economics.

Segment Analysis (Categories & Duty Profiles)

• Fashion/Apparel: high returns; benefits from IOSS + FTZ relabeling; focus on HS accuracy and size data to cut returns.

• Consumer Electronics (low‑value accessories): strong fit for IOSS DDP; ensure battery declarations and safety docs.

• Beauty/Wellness: regulatory nuances (ingredients); pre‑clearance and compliant labeling reduce holds.

• Home/Lifestyle: bulky parcels suit FTZ consolidation + CEP injection; duty optimization via accurate HS/valuation.

Buyer guidance: align model (IOSS vs FTZ) to basket value and regulatory nuance; maintain a governed HS/VAT master; and instrument returns for auto‑drawback and refurbishment.

Geography Analysis (Europe & Germany)

Readiness hotspots include Germany, Netherlands, and Belgium—combining air/rail capacity, bonded hubs, and postal/CEP injections. Poland and Czechia scale as near‑shore processing and railheads expand; France, Spain, and Italy provide large consumer bases with maturing injection networks. The stacked criteria—air/rail links, customs IT/pre‑clearance, FTZ/bonded hubs, postal/CEP injection, and returns processing—indicate where production SLAs can be met first for EU‑China programs led out of Germany.

Implications: design a hub‑and‑spoke anchored in DE/NL/BE; reserve capacity at peak; standardize data exchanges with customs; and stand up returns nodes with auto‑drawback and refurb resale.

Competitive Landscape (Platforms & Operating Models)

Stacks converge on: (i) checkout tax engines with IOSS integration; (ii) HS/VAT master data and rule engines; (iii) FTZ/bonded hub operations with kitting and relabeling; (iv) postal/CEP injection orchestration; and (v) reverse logistics with duty drawback and refurb resale. Differentiators: landed‑cost accuracy, first‑time clearance %, returns recovery, and SLA transparency. Integrators bundle control towers with hubs; merchants retain governance over HS/VAT master data and SLA dashboards.

Contracts trend toward outcome pricing indexed to lead time, clearance %, landed‑cost variance, and returns recovery—underpinned by auditable data flows and compliance controls.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071