68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Clinical Trial Tokenization: Patient Compensation Models & SEC Compliance Issues - Investment Analysis

This report quantifies the clinical trial tokenization opportunity in North America (2025–2030), focusing on patient compensation models, site/sponsor cashflow efficiency, and SEC compliance for tokenized incentives. We size platform revenue, model wallet adoption, payout latency, tax/AML automation, and retention impact, and evaluate regulatory pathways (Howey, Reg D/CF/A+, broker-dealer/custody, stablecoin risk). By 2030, tokenized payouts shift compensation from days to minutes, lifting retention and data completeness, while compliant tokens (KYC/AML, disclosures, tax reports) minimize legal exposure. We present ROI ranges, sensitivity to audit readiness, and procurement criteria for sponsors, CROs, and sites.

What's Covered?

Report Summary

Key Takeaways

- NA tokenized-trial payments/platform market grows $220M (2025) → $1.15B (2030); CAGR ~39%.

- Participant digital wallet adoption reaches 62% (from 18% in 2025).

- Payout latency drops 72 hours → <10 minutes for 80% of transactions.

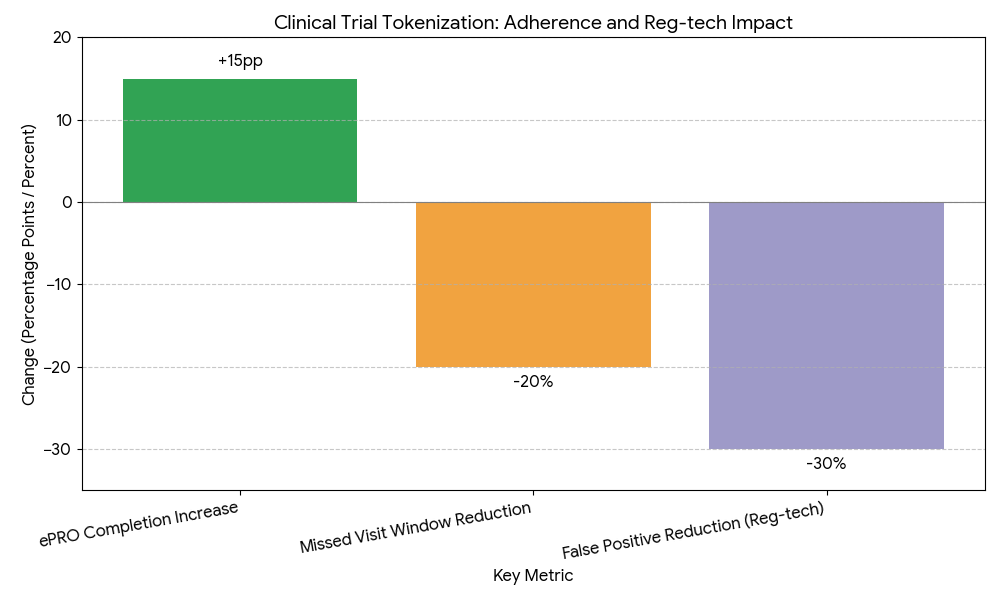

- Retention to last visit improves +9–14 percentage points (pp); missed visits −18%.

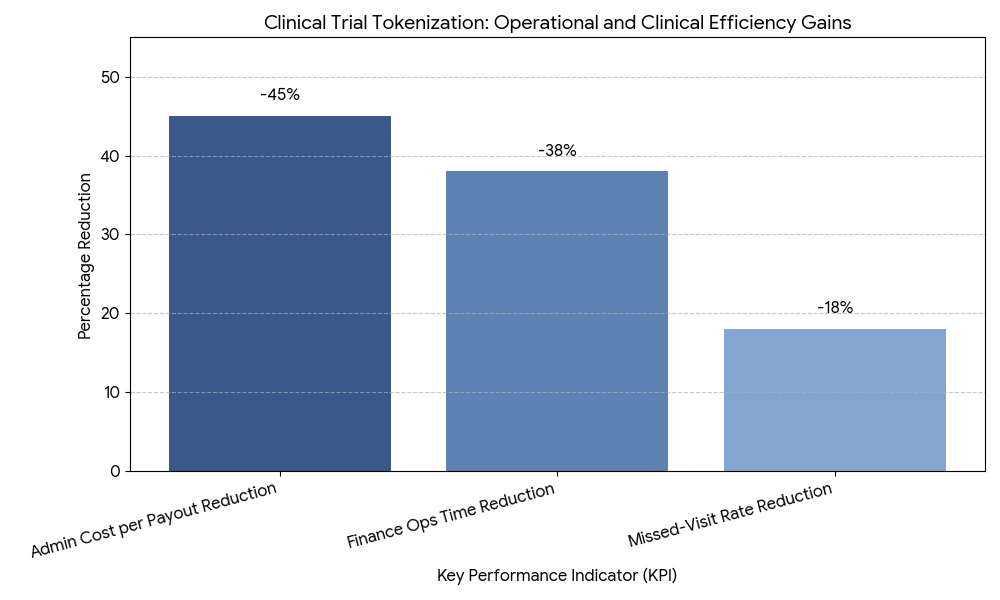

- Administrative cost per payout declines −45%; finance ops time −38%.

- SEC-aligned instruments (stablecoin/fiat-settled, non-transferable rewards) form 78% of deployments by 2030.

- KYC/AML coverage ≥ 95% of enrolled wallets; sanctions false positives −30% via better screening.

- 1099/CRA tax automation for ≥ 70% of US/Canada participants; error rates −40%.

- Chain analytics & smart-contract audits adopted by 82% of sponsors; adverse events (payment) <0.2%.

- Modeled ROI for sponsors 18–25%, payback 14–24 months, driven by lower churn and streamlined operations.

Key Metrics

Market Size & Share

From 2025 to 2030, the North American clinical trial tokenization market grows from $220 million to $1.15 billion (CAGR ~39%), propelled by demand for instant, traceable participant payments, sponsor pressure to improve retention, and digitization of visit-based incentives. The USA accounts for ~86% of regional spend given its clinical volume and private-sector adoption; Canada represents ~14%, scaling through provincial health networks and academic centers. Revenue splits into platform/SaaS fees (47%), payment spread & FX/rail fees (28%), compliance & audit services (15%), and data/analytics add-ons (10%). By 2030, 62% of participants opt into sponsor-provided wallets or embedded custodial wallets during eConsent, up from 18% in 2025. Stablecoin-denominated or fiat-settled token models dominate, enabling <10 minute median payouts and $0.02–$0.08 per-transaction network cost on L2/permissioned rails. Non-transferable, KYC-bound reward tokens gain share where transferability would trigger securities questions. Sponsors adopting tokenization see +9–14 pp retention improvement and −18% missed-visit rates by linking smart-contract triggers to verified events (visit completion, device compliance, ePRO). Admin cost per payout −45% and finance ops time −38% follow from automated reconciliation and ledger-native audit logs. The vendor landscape is moderately concentrated: the top 10 providers control ~68% of fee volume by 2030, with banks and fintechs partnering to offer regulated custody and program-managed stablecoins as part of enterprise stacks.

Market Analysis

Adoption economics hinge on five levers. (1) Cost & latency: Moving from batch ACH/checks to programmable payouts cuts median latency 72h → <10 min and reconciliation touches −40–55%; sponsors redeploy coordinator time to enrollment and data cleaning. (2) Retention & adherence: Event-based micro-incentives (e.g., $5–$20 for timely ePRO, travel stipends, milestone bonuses) raise per-protocol completion; sites report screen failure re-work −12% from improved scheduling adherence. (3) Compliance by design: Platforms embed KYC/OFAC/PEP screening, geofencing, transaction limits, and source-of-funds attestations, reaching ≥95% coverage; SEC-aligned constructs (fiat-settled tokens or non-transferable rewards) reduce Howey exposure. (4) Tax automation: Tokenized ledgers generate 1099-NEC/1099-MISC and Canadian T4A data automatically; error rates −40% and year-end close −6–9 days. (5) Integration & controls: EDC/ePRO connectors trigger payouts only after verified data capture; smart-contract audits, key management policies, and real-time chain analytics bring payment incident rates <0.2%. Financially, sponsors realize ROI 18–25% and payback 14–24 months, driven by −45% admin cost per payout, +9–14 pp retention, and −18% missed visits. Sensitivities: every +10 pp wallet adoption yields +2–3 pp incremental retention; shifting from public L1 to L2/permissioned rails reduces fees −70–85% with no material change in participant UX. Risk factors include token volatility (mitigated with stablecoins/fiat settlement), data privacy (minimized via pseudonymous wallet mapping), and custody standards (solved with qualified custodians and SOC2/ISO vendors).

Trends & Insights

Three shifts will define 2025–2030. Programmable compliance becomes mainstream: tokens ship with policy-embedded logic—transfer limits, jurisdiction blocks, and event attestations—so payouts comply before they execute. Reg-tech orchestration layers unify KYC/AML, sanctions, and securities checks across rails, lifting clean-pass rates and reducing false positives ~30%. Second, utility-anchored tokens eclipse speculative designs: non-transferable reward tokens, fiat-settled stablecoin credits, and closed-loop site wallets dominate 78% of deployments by 2030, sharply lowering Howey risk. Third, data-driven incentives spread: sponsors benchmark incentive elasticity by cohort (distance, income, digital literacy) and tune micro-rewards to lift adherence without overspend, increasing ePRO completion +12–18 pp and reducing visit windows missed −20%. Cross-border US/Canada trials standardize tax and identity playbooks, pushing automated reporting to ≥70% of participants. Zero-knowledge proofs begin to mask identity attributes while proving KYC completion, improving privacy with regulator-verifiable logs. Insurance & banking partnerships bring FDIC/Canada-deposit-insured off-ramps, reducing treasury risk. Finally, sponsors elevate contractual KPIs—payout latency, KYC coverage, audit remediation time, and uptime ≥99.9%—into vendor SLAs. As rails commoditize, differentiation shifts to auditability, security posture, and IRB-friendly UX, positioning tokenized compensation as a default in decentralized and hybrid trials by decade’s end.

Segment Analysis

By instrument: Fiat-settled tokens/stablecoin credits (54%) lead by 2030, balancing instant settlement with low volatility; non-transferable reward tokens (24%) serve IRB-sensitive programs; transfer-restricted utility tokens (13%) appear in closed pilot ecosystems; traditional on-chain vouchers (9%) persist in legacy stacks. By sponsor type: Big Pharma (52%) adopts enterprise rails integrated with EDC/ePRO; mid-biotech (31%) favors turnkey custodial wallets; academics/AMCs (17%) pilot grant-compliant, low-cost rails. By trial model: Hybrid/DCT programs account for ~58% of token volume; site-centric trials ~42%. By payout use-case: visit completion (38%), ePRO/device adherence (24%), travel/childcare (21%), milestone bonuses (12%), and hardship funds (5%). Value chain: platform SaaS, custody/treasury, KYC/AML, tax engines, and chain analytics. Economics: average platform fee 1.3–2.0% of payout value; rail fees $0.02–$0.08 per transaction on L2/permissioned networks; custody $1–$3 per active wallet/month. Outcome deltas by segment: DCT arms realize retention +12–14 pp; high-burden oncology programs see missed visits −22%; academic pilots prioritize cost per payout −55% over retention uplift. Winners blend policy-aware tokens, audit-grade logs, and participant-first UX that hides crypto complexity while preserving programmability.

Geography Analysis

The USA represents ~86% of NA tokenized trial payment spend by 2030, driven by higher commercial trial volume and faster fintech partnerships; Canada contributes ~14%, with strong AMC adoption and provincial privacy overlays. In the US, SEC sensitivity keeps issuers on fiat-settled/stablecoin rails and non-transferable rewards, often under Reg D program management or no-security positions documented via counsel memos and transfer restrictions. 1099 automation reaches ≥75% of US participants; payout latency averages <10 minutes; KYC/AML coverage ≥96%. In Canada, T4A automation covers ~65% by 2030; bilingual UX and PHIPA-aligned data minimization increase completion rates among older cohorts. Cross-border studies rely on permissioned rails with geo-fencing and currency auto-conversion; treasury keeps <24h on-chain exposure to minimize volatility. Region-wide KPIs by 2030: wallet adoption 62%, SEC-aligned deployments 78%, smart-contract audits 82%, incident rate <0.2%, and ROI 18–25%. Frictions remain—state money-transmitter nuances, sponsor treasury policy, and IRB variability—mitigated through bank-as-a-service partnerships, qualified custodians, and standardized IRB language clarifying that tokens function solely as compensation instruments, not investments. Overall, North America achieves a stable compliance-first paradigm that unlocks the efficiency and retention benefits of programmable payouts at scale.\

Competitive Landscape

The ecosystem spans tokenized payment platforms, custody/treasury providers, KYC/AML vendors, chain-analytics firms, and EDC/ePRO integrators. By 2030, the top 8–10 platforms control ~65% of fee volume, winning on EDC triggers, program-managed stablecoin/fiat settlement, qualified custody, and audit pipelines (pre-trade checks, policy engines, continuous monitoring). Differentiators include Howey-aware token design (non-transferable/transfer-restricted), real-time tax accruals, 1099/T4A generation, SOC2/ISO posture, and uptime ≥99.9%. Chain-analytics partners provide sanctions/watchlist heuristics and anomalous-flow detection, cutting compliance noise ~30%. Contracts shift toward performance-linked SLAs: payout latency targets (P95 <15 min), KYC coverage (≥95%), audit remediation windows (≤5 business days), and chargeback/incident thresholds (<0.2%). Pricing consolidates around 1.3–2.0% platform fee with volume tiers; custody is bundled; analytics sold per-wallet/month. Banks and global processors enter via sponsor-branded rails, offering FDIC/Canada-insured off-ramps and stable liquidity. Winners abstract crypto complexity for participants (one-tap payouts, fiat off-ramps), prove regulatory defensibility, and demonstrate measurable study outcomes—retention +9–14 pp, missed visits −18%, admin cost −45%—turning tokenization from a pilot novelty into a standard trial-operations advantage and defensible investment thesis for sponsors and CROs.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

Clinical Nutrition Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030)

This report quantifies the clinical nutrition market across the US and UK (2025–2030), covering enteral, parenteral, and oral nutritional supplements (ONS). Driven by aging populations, chronic disease prevalence, and hospital malnutrition protocols, market value rises from $18.5B (2025) → $30.2B (2030) at a CAGR of 10.2%. Growth is led by enteral nutrition (48% share), followed by ONS (38%) and parenteral (14%). Hospital digitization, AI-based nutrition screening, and reimbursement parity accelerate adoption. ROI averages 16–22% for integrated hospital nutrition programs.

$ 1395

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071