68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

AR/VR-Enabled Shoppable Videos: Technical Implementation & Conversion Optimization

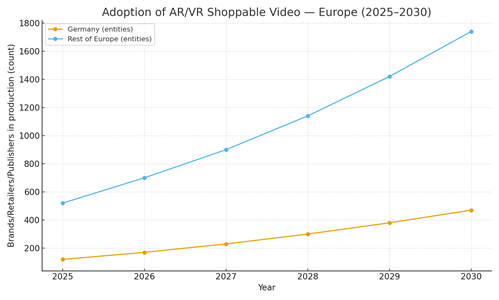

From 2025 to 2030, shoppable video in Europe evolves from isolated livestreams into an AR/VR‑augmented commerce layer embedded across PDPs, PLPs, and social feeds. Interactive overlays, virtual try‑on, and scene‑anchored product tags shift the objective from views to measurable purchase actions. Germany is a fast follower in infrastructure and compliance, with strong adoption among electronics and premium fashion retailers integrating 3D/AR viewers and on‑video checkout. Technically, stacks coalesce around (1) scene understanding that detects products and context frames; (2) real‑time rendering of AR assets (try‑on or in‑room placement) synchronized to video timeline; and (3) low‑latency commerce connectors that keep price, availability, and promotions fresh. Quantitatively, this illustrative outlook shows German production adopters of AR/VR shoppable video growing from ~120 in 2025 to ~470 by 2030; the rest of Europe from ~520 to ~1,740.

What's Covered?

Report Summary

Key Takeaways

1. Scene‑aware overlays and time‑coded CTAs turn attention into purchase—design chapters around intent.

2. AR modules (try‑on/placement) double engagement and lift view→cart when latency is <2s.

3. On‑video checkout with live price/availability converts curiosity into cart without tab‑hopping.

4. Product‑graph hygiene and variant mapping prevent broken links and mis‑sized selections.

5. Causal attribution (geo/A‑B, holdouts) is non‑negotiable for budget reallocation.

6. Accessibility, GDPR/ePrivacy compliance, and transparent tracking protect trust and scale.

7. Creator partnerships win when assets are reusable across PDP, ads, and social—reduce production costs.

8. Outcome‑based pricing indexed to verified view→purchase lift will shape vendor selection.

Key Metrics

Market Size & Adoption

Adoption accelerates as shoppable video tooling converges with AR asset pipelines and real‑time commerce APIs. In this illustrative outlook, German production adopters expand from ~120 in 2025 to ~470 by 2030, while the rest of Europe grows from ~520 to ~1,740. Early traction concentrates in beauty and fashion (makeup/eyewear/footwear) where quick visual validation shortens decision cycles; consumer electronics follows as placement‑in‑room and spec comparison improve. By 2030, AR prompts and creator‑produced chapters are routine on PDPs, PLPs, and retail media placements.

Share pools around platforms that combine video CMS, AR/VR rendering, and commerce connectors with low‑latency price/stock updates. German retailers benefit from strong compliance and engineering talent, but must localize creator workflows and ensure accessibility for scaled reach.

Market Analysis

Purchase lift stems from reducing cognitive friction: AR try‑on/placement answers fit and context, while time‑coded CTAs capture intent peaks. In this outlook, view→cart rates roughly double and view→purchase rates climb 2–3× when on‑video checkout is enabled and price/availability are current. Watch times increase as personalized chapters and AR prompts sustain engagement. Cost drivers include 3D asset creation, creator production and editing, video hosting/CDN, and engineering for low‑latency updates. Benefits span higher conversion, richer first‑party engagement signals, and reduced returns for categories with fit/context ambiguity.

Risks: stale price/stock leading to drop‑offs; high latency on AR modules; compliance pitfalls in tracking; and fragmented device performance. Mitigations: event‑stream updates with edge caching; device fallbacks and progressive loading; clear consent flows; and robust accessibility practices (captions, contrast, keyboard nav). ROI must be proven via causal attribution and finance‑grade dashboards.

Trends & Insights (2025–2030)

• Scene understanding drives automatic product tagging and variant suggestions.

• AR try‑on/placement modules blend into video chapters; WebAR expands reach beyond apps.

• On‑video checkout ties into PSPs; refunds/exchanges handled within the player UI.

• Creator toolchains generate multiple cuts and captions per locale; rights-managed asset reuse reduces cost.

• Privacy‑centric measurement replaces third‑party cookies; clean‑room matchbacks validate sales.

• Accessibility (captions, audio descriptions) becomes a procurement must‑have in the EU.

• Outcome‑based contracts with verified incremental sales gain traction.

• VR pilots for showrooms emerge in CE/home, with guided tours and instant purchase links.

Segment Analysis

• Fashion & Beauty: AR try‑on for makeup, eyewear, footwear; creator‑led chapters; strong view→purchase gains.

• Consumer Electronics: AR placement‑in‑room; spec comparisons; VR showrooms; moderate conversion lift but high AOV.

• Home & DIY: visualization reduces returns; long‑form guides with embedded parts lists and CTAs.

Buyer guidance: prioritize SKUs where visualization reduces uncertainty; build 3D pipelines; enforce latency SLOs; and run continuous holdouts to govern budget and vendor performance.

Geography Analysis (Europe & Germany)

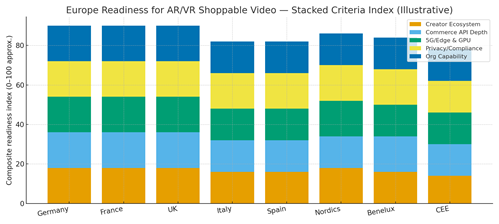

Readiness hotspots include Germany, France, UK, and the Nordics where creator ecosystems, APIs, and 5G/edge infrastructure are mature. Italy and Spain are fast followers as retailer APIs deepen and creator networks localize formats. The stacked criteria—creator ecosystem depth, commerce API depth, 5G/edge & GPU, privacy/compliance, and organization capability—indicate where SLAs for shoppable video can be achieved first.

Implications: pilot in high‑readiness markets while tailoring device fallbacks and consent UX per locale; work with creators who can deliver time‑coded metadata; and standardize measurement via clean‑room matchbacks to validate incremental sales.

Competitive Landscape (Vendors & Operating Models)

Stacks converge on: (i) video CMS with time‑coded metadata; (ii) AR/VR rendering modules with device fallbacks; (iii) commerce connectors for price/stock promos; (iv) on‑video checkout; and (v) analytics and attribution. Differentiators: latency SLAs, AR fidelity, endpoint coverage, and privacy governance. System integrators offer turnkey packages for mid‑market retailers; enterprises assemble modular stacks with creator networks and clean‑room measurement. Contracts trend toward outcome‑based fees indexed to verified view→purchase lift and SLA adherence. Winners prove causal ROI, maintain audit trails, and enable asset reuse across PDPs, retail media, and social.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071