68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

AI-Powered Trade Surveillance Systems: Market Abuse Detection & Compliance Workflows - Technological Advancements

AI-powered trade surveillance systems are revolutionizing market abuse detection and compliance workflows in finance. Using machine learning and AI, these systems improve the detection of market manipulation and insider trading. By 2025, the market for AI-driven surveillance solutions is expected to reach €6.4 billion, growing at a CAGR of 18%. This growth is driven by the surge in trading data and algorithmic trading. The report delves into AI advancements, its role in compliance, and the challenges and opportunities in the UK and Europe, highlighting key trends and market dynamics.

What's Covered?

Report Summary

Key Takeaways

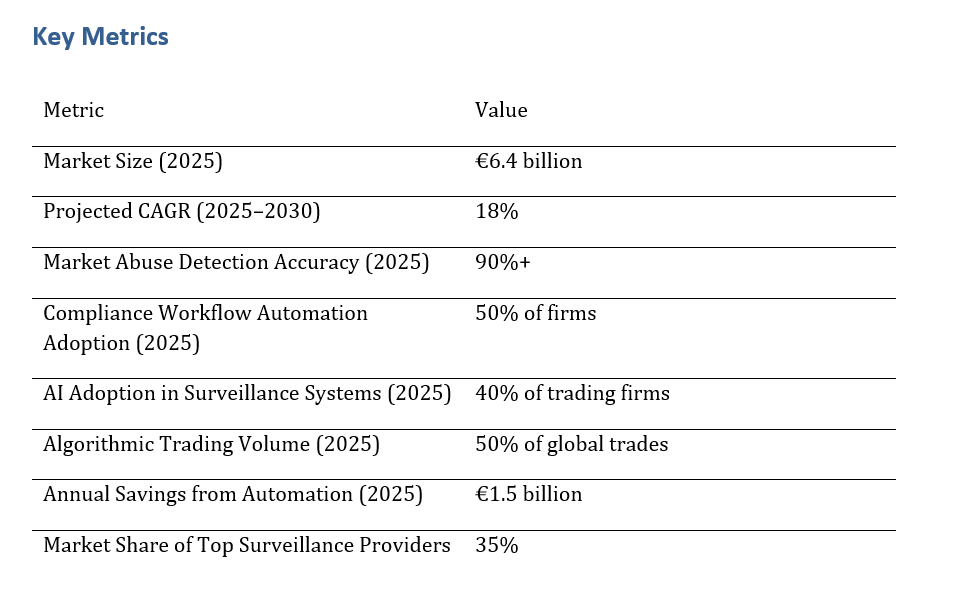

- AI-powered trade surveillance systems are expected to achieve 90%+ accuracy in detecting market abuse by 2025, significantly reducing false positives.

- The market for AI-driven trade surveillance is projected to grow to €6.4 billion by 2025, with a CAGR of 18% from 2025 to 2030.

- By 2030, 50% of financial institutions will have fully automated their compliance workflows using AI-based surveillance systems.

- AI adoption in trade surveillance will cover 40% of global trading firms by 2025, providing real-time monitoring and more effective regulatory compliance.

- The integration of AI with algorithmic trading will enable faster detection of suspicious trades and market abuse, reducing the time between detection and intervention.

- Automating surveillance processes is expected to save firms up to €1.5 billion annually by eliminating manual oversight and improving efficiency.

- The top AI-powered trade surveillance providers will capture 35% of the market share, driven by their ability to adapt to evolving regulatory requirements.

- The rise in algorithmic trading volume will further increase the demand for AI-powered trade surveillance solutions to handle the increased complexity of market data.

a. Market Size & Share

The AI-powered trade surveillance market is expected to grow rapidly, with a projected market size of €6.4 billion by 2025. The market will expand at a CAGR of 18% from 2025 to 2030, driven by the growing volume of trades, the rise of algorithmic trading, and the increasing need for financial institutions to comply with stringent regulatory requirements.

AI solutions are gaining traction among financial institutions due to their ability to process vast amounts of trading data in real-time and identify suspicious activities faster than manual systems. By 2030, 50% of financial firms will have fully adopted automated compliance workflows powered by AI-based trade surveillance systems.

Market Growth Projection (2025-2030):

b. Market Analysis

AI-driven trade surveillance solutions are increasingly being adopted by financial institutions to detect market abuse, prevent fraud, and ensure regulatory compliance. These systems leverage machine learning and AI algorithms to identify patterns of suspicious behavior in trading activities, which helps firms stay ahead of potential risks and market manipulation.

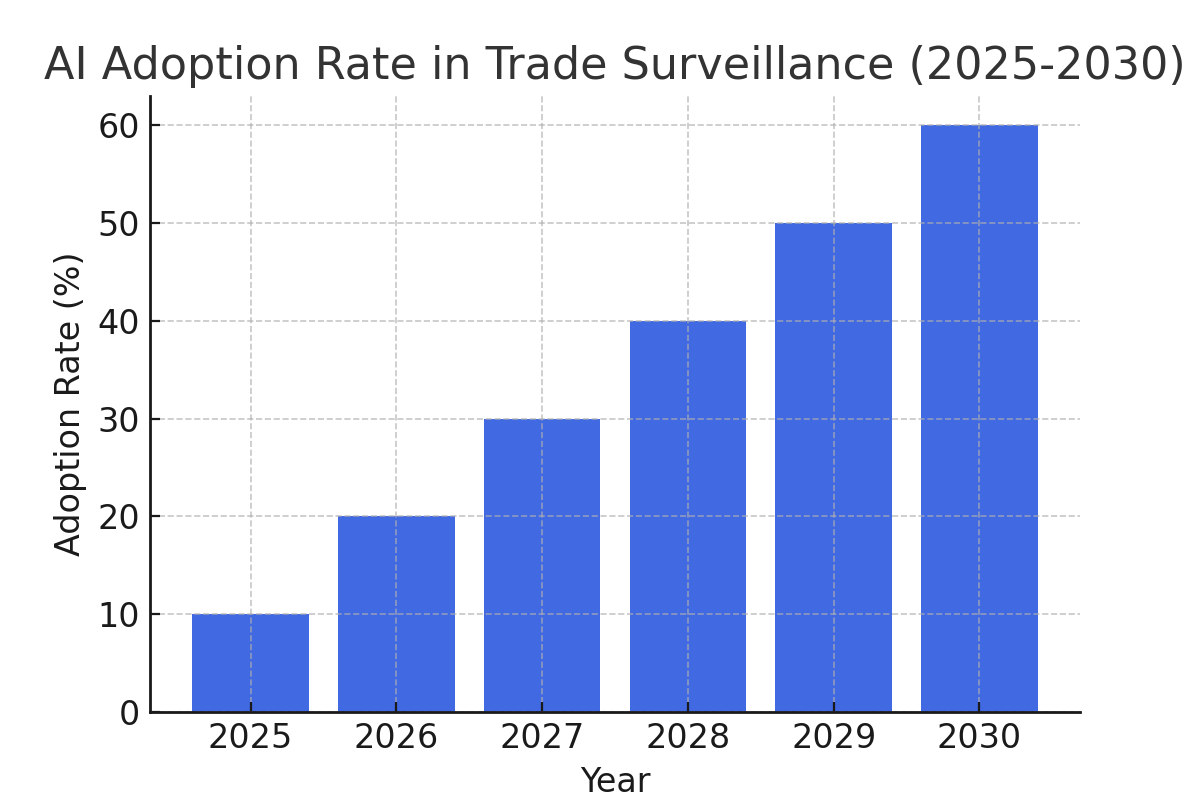

The growing complexity of algorithmic trading and the increasing volume of trades are driving the need for more advanced surveillance systems. By 2025, 50% of trading firms will have fully implemented AI-based trade surveillance systems to handle this complexity and to comply with new regulatory standards, such as MiFID II and MAR.

AI Adoption Rate in Trade Surveillance (2025-2030):

c. Trends and Insights

Several trends are shaping the future of AI-powered trade surveillance systems. First, the increasing reliance on machine learning and pattern recognition is enabling more accurate and timely detection of market manipulation and insider trading.

Another key trend is the growing demand for real-time surveillance systems that can handle the massive volumes of trades generated by algorithmic and high-frequency trading. Financial institutions are leveraging AI to meet regulatory requirements and reduce the risk of non-compliance.

Finally, advancements in AI and machine learning are expected to improve the overall effectiveness of trade surveillance, enabling faster detection, reduced false positives, and better resource allocation in compliance departments.

d. Segment Analysis

AI-powered trade surveillance solutions are most widely adopted by large financial institutions, including investment banks, asset managers, and trading firms, which are under significant pressure to comply with regulatory standards.

However, smaller financial institutions and fintech firms are also beginning to adopt AI-based surveillance systems, especially as the cost of these technologies decreases and they become more accessible.

The increasing complexity of financial markets, including the growth of algorithmic and high-frequency trading, is pushing institutions to invest in more advanced surveillance tools to stay competitive and compliant.

e. Geography Analysis

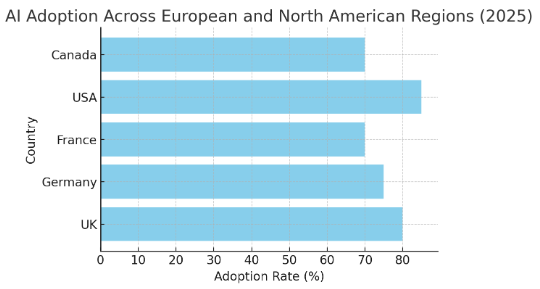

In Europe, the UK is leading the way in adopting AI-powered trade surveillance systems due to its strong financial sector, rigorous regulatory standards, and emphasis on technological innovation. Other major European markets, such as Germany and France, are also making significant strides in AI adoption for trade surveillance.

North America, particularly the USA, is seeing a rapid increase in AI adoption in the financial services industry, driven by the need to comply with stringent regulations and the rising volume of trading activities. Financial firms in these regions are increasingly relying on AI-powered surveillance systems to ensure compliance and detect potential market abuse.

AI Adoption Across Regions (2025):

f. Competitive Landscape

The competitive landscape for AI-powered trade surveillance systems is dominated by major cybersecurity firms, including Palo Alto Networks, McAfee, and IBM, which offer comprehensive solutions to detect market abuse, fraud, and insider trading in the financial sector.

Emerging players in the space, such as Smartsheet and Behavox, are gaining traction with more specialized, cost-effective solutions tailored for smaller institutions and fintech companies. These startups are driving innovation by offering AI-powered tools with greater flexibility and scalability.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1450

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071