68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

AI-Enhanced Cloud Contact Centers: Sentiment Analysis & CX Personalization

UK cloud spend is set to reach £29 billion in 2025, but only 24% of UK enterprises are considered FinOps mature, leading to average annual cloud waste of £1.3–£2.1 million for low-maturity organizations. Those with advanced FinOps practices achieve 23–30% cost savings via usage-based chargebacks and real-time alerting. Tool adoption, led by platforms like Apptio and Cloud Health, has surged 41% year-over-year, though multi-cloud users still face challenges with dashboard silos and poor integration. FinOps is evolving from a back-office task to a strategic, integrated cost control hub.

What's Covered?

Report Summary

Key Takeaways

1. Arabic/English ASR+NLU accuracy is the gating factor for containment & CSAT.

2. Agent assist and next‑best‑action compress AHT and raise FCR.

3. RAG knowledge + CRM context personalizes resolution and upsell offers.

4. Quality automation reduces handle variance and improves compliance.

5. Omnichannel orchestration enables journey continuity across chat/voice/social.

6. Real‑time sentiment guides tone and escalations, lifting CSAT and retention.

7. Data residency, redaction, and consent logs underpin privacy assurance.

8. CFO dashboard: AHT, FCR %, containment %, CSAT, $/contact, attrition %, IRR.

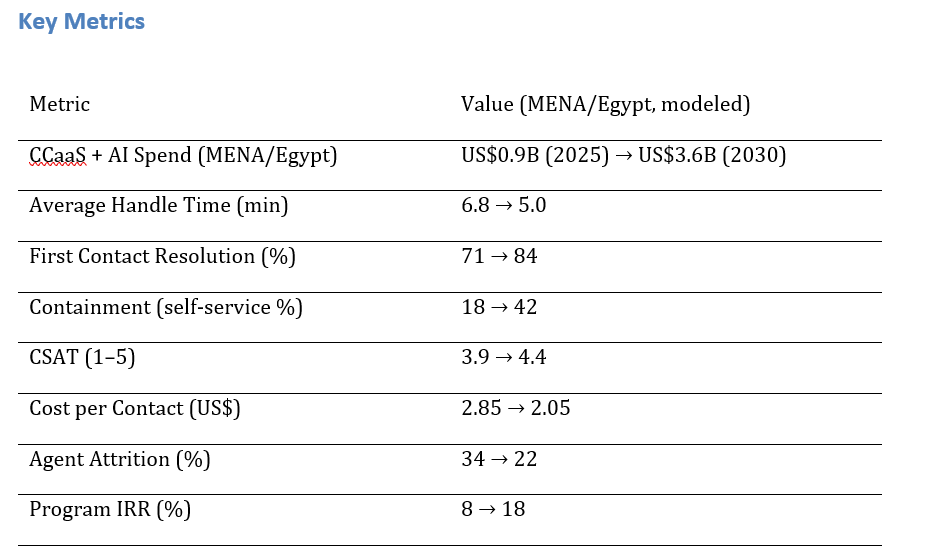

a) Market Size & Share

MENA/Egypt CCaaS+AI spend is modeled to grow from ~US$0.9B in 2025 to ~US$3.6B by 2030 as brands standardize cloud contact operations and deploy real‑time analytics for sentiment, intent, and guidance. The line figure shows the trajectory. Share accrues to providers with dialect‑tuned ASR/NLU, channel breadth (voice/WhatsApp/web/social), and deep CRM/CDP integrations. Execution risks include legacy telephony cutover and skills gaps; mitigations are phased migrations, partner training, and robust monitoring. Share should be tracked via AHT, FCR %, containment %, CSAT, $/contact, attrition %, and IRR.

b) Market Analysis

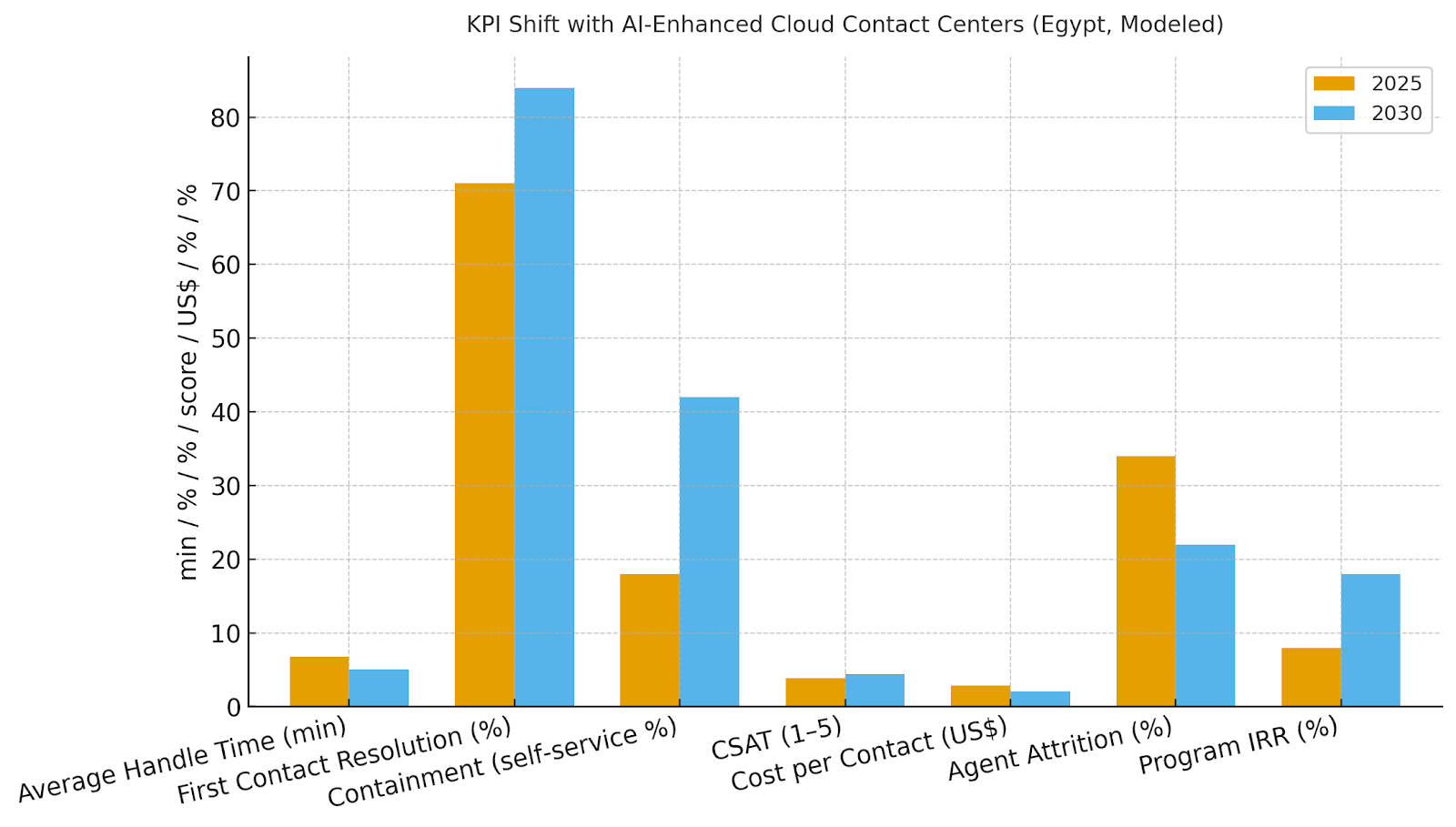

AI unlocks measurable improvements: in our model AHT improves ~26%, FCR rises ~13 points, containment more than doubles to ~42%, CSAT lifts by ~0.5, cost per contact falls ~28%, and attrition drops ~12 points—driving IRR from ~8% to ~18%. Enablers: accurate ASR/NLU in Egyptian Arabic and English, RAG knowledge bases kept current, and agent assist woven into workflows. Barriers: model accuracy for dialectal speech, data governance for recordings, and legacy CRM customizations.

Financial lens: value arises from lower handle time and higher containment (fewer agent minutes), increased conversion from personalized offers, and reduced attrition hiring costs. The bar chart summarizes KPI movement under disciplined programs.

c) Trends & Insights

1) Dual‑language (Arabic/English) models become table‑stakes for Egypt. 2) Real‑time guidance fuses sentiment, policy, and next‑best‑action. 3) Omnichannel journeys rely on intent‑based routing and unified histories. 4) Quality automation (auto‑scorecards, redaction) scales compliance. 5) Personalization shifts from static scripts to dynamic offers informed by CDP segments. 6) CX agents become ‘knowledge strategists’ with coaching insights. 7) Trust centers expose consent, data lineage, and retention. 8) Carbon‑aware cloud routing and right‑sizing optimize spend and ESG footprints. 9) Agent‑assist copilots require guardrails to prevent hallucinated guidance. 10) Measurement standardizes on AHT, FCR, containment, CSAT, $/contact, and churn/retention.

d) Segment Analysis

Banking/Financial Services: high compliance; focus on authentication, dispute resolution, and personalized offers. Telecom: large inbound volumes; priority on outage, billing, and upsell journeys. Travel & Hospitality: multilingual support; disruption handling and proactive outreach. Retail/E‑commerce: order status, returns, and live promotions; WhatsApp and social channels dominate. Public Services: accessibility and cost‑to‑serve; knowledge‑led deflection. Across segments, define SLAs, redaction policies, and coaching regimes; track AHT, FCR, containment, CSAT, $/contact, attrition, and IRR per queue.

e) Geography Analysis

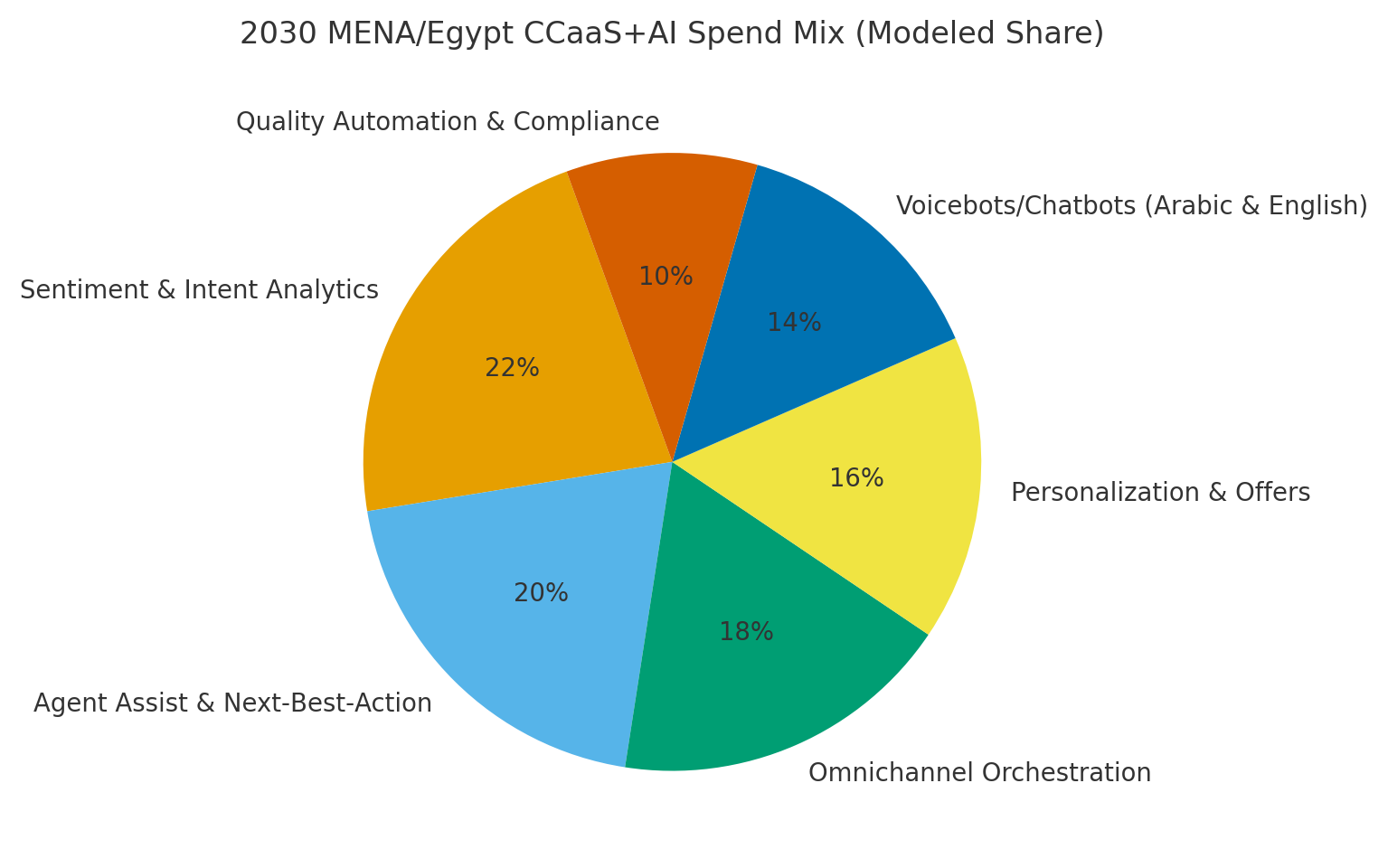

By 2030, we model MENA/Egypt CCaaS+AI spend/use‑case mix as Sentiment & Intent (~22%), Agent Assist & NBA (~20%), Omnichannel Orchestration (~18%), Personalization & Offers (~16%), Voicebots/Chatbots (~14%), Quality Automation & Compliance (~10%). Cairo leads early with enterprise deployments; secondary cities adopt WhatsApp‑centric journeys via cloud‑first rollouts. The pie figure reflects the modeled mix.

Execution: prioritize dialect‑tuned ASR/NLU, data residency, and CRM/CDP integrations; publish KPI dashboards and iterate quarterly with A/B tests.

f) Competitive Landscape

Competition spans global CCaaS suites, regional integrators, and niche AI vendors. Differentiation vectors: (1) Arabic/English ASR/NLU accuracy and latency, (2) deep CRM/CDP connectors and real‑time APIs, (3) guidance quality and controllability, (4) compliance tooling (redaction, consent, audit), and (5) time‑to‑value via templates and playbooks. Procurement guidance: require open APIs, evidence of dialect tuning, redaction/PII tooling, and KPI‑linked case studies. Competitive KPIs: AHT, FCR %, containment %, CSAT, $/contact, attrition %, and IRR uplift.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071