68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Smart Refinery Transformation: IIoT Adoption & Crude Flexibility Analysis

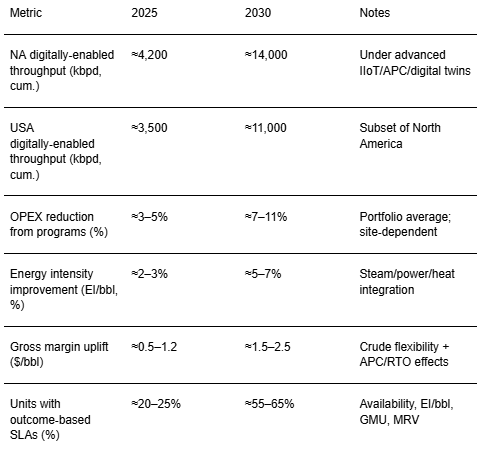

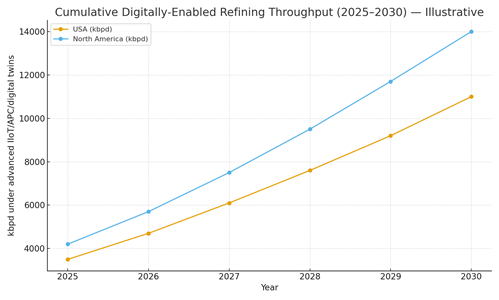

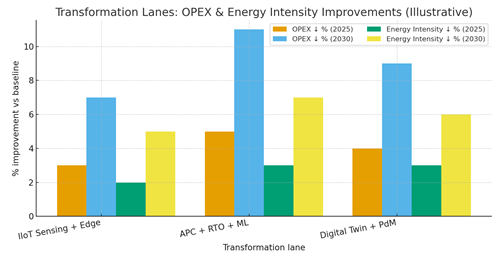

From 2025 to 2030, North American refineries shift from isolated optimization projects to programmatic, portfolio‑wide digital transformations. Three lanes converge to drive performance: (1) IIoT sensing with edge analytics to expose real‑time constraints; (2) advanced process control (APC) combined with real‑time optimization (RTO) and machine learning to maximize margins within safety/environmental envelopes; and (3) plant/asset digital twins to orchestrate reliability, energy intensity, and crude‑flex ops. The result is a step‑change in crude flexibility wider API and sulfur windows, faster slate changes, and higher utilization of discounted opportunity crudes without violating corrosion, fouling, or emissions constraints. Illustratively, cumulative digitally‑enabled throughput under advanced control/twin programs could rise from ~4.2 to ~14.0 mmbpd across North America by 2030 (USA from ~3.5 to ~11.0 mmbpd). Lane contributions stack: IIoT+edge trims blind spots and manual rounds; APC+RTO+ML lifts yields and reduces giveaways; digital twins with predictive maintenance reduce unplanned downtime and avoid energy excursions. OPEX reductions compound from ~3–5% in 2025 toward ~7–11% by 2030; energy intensity (EI/bbl) improves ~2–3% trending to ~5–7% as heat‑integration and steam/power optimization tighten. Gross margin uplift (GMU) of ~$0.5–1.2/bbl evolves toward ~$1.5–2.5/bbl on well‑executed portfolios, driven by crude‑to‑chemistry routing, distillation/reformer severity control, and off‑gas/H₂ network optimization.

What's Covered?

Report Summary

Key Takeaways

1) Crude flexibility is a digital + metallurgy problem: monitor corrosion/fouling and optimize severity in real time.

2) APC+RTO+ML delivers the largest GMU; IIoT and twins amplify by reducing downtime and energy excursions.

3) By 2030, illustrative portfolios reach ~7–11% OPEX and ~5–7% EI/bbl improvements with ~$1.5–2.5/bbl GMU.

4) Hydrogen, off‑gas, and utilities networks are pivotal; bias early work to H₂ balance and reformer/coker controls.

5) Data governance and OT cybersecurity are prerequisites for scale and regulator confidence.

6) Outcome‑based SLAs with MRV (EI/bbl, availability, GMU) increase bankability of digital programs.

7) Gulf Coast leads readiness; Midwest and Alberta/Saskatchewan benefit from crude logistics and heavy‑oil expertise.

8) Standardized analytics stacks and digital twins shorten turnaround and de‑risk slate changes.

Key Metrics

Market Size & Share

Digitally‑enabled throughput grows as refineries standardize IIoT, APC/RTO, and digital twins across crude/vacuum, conversion, and utilities. In this illustrative outlook, North America’s cumulative digitally‑enabled crude throughput rises from ~4.2 mmbpd (2025) to ~14.0 mmbpd (2030), while the USA scales from ~3.5 to ~11.0 mmbpd. Share concentrates on systems integrators that bundle sensing, controls, and reliability with MRV allowing CFO‑credible benefit realization. Gulf Coast complexes accrue early share, with Midwest heavy‑oil systems and Canadian hubs following as hydrogen and logistics constraints are optimized.

Market Analysis

Transformation lanes deliver complementary value. IIoT + edge analytics reduce blind spots and manual variance; APC + RTO + ML maximizes yields and reduces giveaways; digital twins coordinate maintenance and energy/system constraints. In this view, OPEX reductions scale from ~3–5% (2025) to ~7–11% (2030), while energy intensity improves from ~2–3% to ~5–7%. GMU rises toward ~$1.5–2.5/bbl as crude flexibility widens and unit severity is dynamically optimized. Sensitivities: hydrogen price/availability, fouling/corrosion rates, coker and reformer bottlenecks, and utility limits. Mitigations include corrosion/erosion monitoring, exchanger cleaning analytics, and hydrogen network optimization.

Trends & Insights (2025–2030)

• Unified data fabrics: historians + MES + cloud lakehouses with contextual models enable cross‑unit optimization.

• Real‑time crude‑assay inference: spectroscopic + soft sensors predict yields/corrosion for rapid slate changes.

• Hydrogen network optimization: integration with reformers, PSA, and off‑gas routing reduces EI/bbl.

• Reliability by design: twin‑driven PdM, exchanger cleaning strategies, and furnace health monitoring.

• Cybersecurity at OT edge: segmented networks, zero‑trust gateways, certificate‑based auth.

• Outcome‑based SLAs: GMU, EI/bbl, availability; MRV dashboards for auditors and financiers.

• Turnaround digitization: schedule risk analytics, spare strategy, and digital handover cut critical path.

• Workforce enablement: operator decision support and mobility reduce variance and incidents.

Segment Analysis

• Complex Gulf Coast refineries: early winners broad crude windows, H₂ network leverage, vendor ecosystems.

• Heavy‑oil Midwest/Canadian hubs: focus on desalter, visbreaker/coker, and corrosion; logistics widen crude access.

• Coastal West/East: environmental constraints require energy and emissions MRV; digital twins de‑risk.

• Mid‑size inland refineries: modular analytics stacks with targeted APC on crude/vacuum and reformer.

Buyer guidance: baseline EI/bbl and GMU; prioritize H₂/off‑gas networks; enforce cyber/data governance; and contract outcome‑based SLAs with independent MRV.

Geography Analysis (USA & North America)

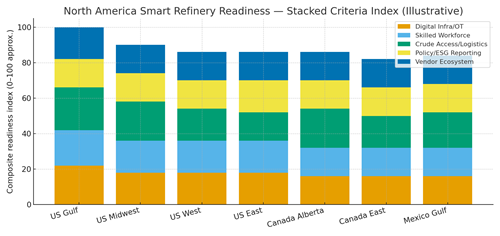

Readiness concentrates along the U.S. Gulf due to digital infrastructure, workforce depth, crude logistics, and vendor ecosystems. The Midwest follows with strong crude logistics, conversion capacity, and pragmatic policy environments. Alberta and Saskatchewan advance via heavy‑oil integration and hydrogen networks; the U.S. East and West coasts progress where policy/reporting frameworks align with modernization programs. The stacked criteria digital infrastructure/OT, skilled workforce, crude access/logistics, policy/ESG reporting, and vendor ecosystem show where balanced capabilities support rapid scaling.

Implications: stage multi‑site programs in Gulf/Midwest hubs, export standardized stacks to Canada and Mexico, and align KPI baselines to enable vendor competition and finance.

Competitive Landscape (Ecosystem & Delivery Models)

Competitors span sensors/IIoT platforms, APC/RTO vendors, digital‑twin/O&M suites, EPCs, and crude logistics/assay providers. Differentiators: proven GMU per unit, EI/bbl reduction, cyber posture, integration with H₂/off‑gas networks, and MRV for outcomes. Leaders offer standardized stacks sensing → control → twin under outcome‑based SLAs with availability, EI/bbl, and GMU guarantees. Delivery models evolve from pilots to programmatic portfolios, sharing engineering, templates, and spares across sites to compress schedules and risk.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071