68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Offshore Oil & Gas Decommissioning: Robotics & Circular Economy Applications

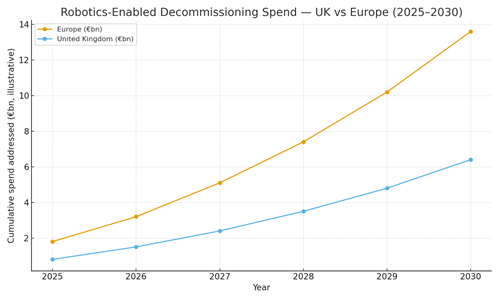

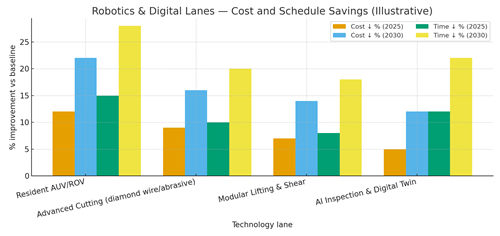

From 2025 to 2030, offshore decommissioning in the UK and Europe shifts from episodic heavy‑lift campaigns to programmatic, robotics‑first execution that emphasizes safety, cost discipline, and circular value. Resident autonomous underwater vehicles (AUVs) and work‑class ROVs extend inspection windows and reduce vessel days; advanced cutting systems and modular shears enable subsea segmentation; and AI‑assisted digital twins compress engineering and permitting cycles. In parallel, a circular economy lens scrap steel recycling, metals recovery from subsea hardware, and component refurbishment begins to unlock new revenue and ESG credit, especially when paired with auditable measurement, reporting, and verification (MRV). Illustratively, robotics‑enabled campaigns could address cumulative spending of ~€1.8 bn in 2025 rising to ~€13.6 bn by 2030 across Europe, with the UK growing from ~€0.8 bn to ~€6.4 bn over the same period. By 2030, cost reductions of ~12–22% and schedule reductions of ~15–28% versus baseline are achievable across key lanes such as resident AUV/ROV, advanced cutting, modular lifting, and AI inspection. Risk is rebalanced from single‑shot heavy lift toward continuous subsea programs that de‑risk weather windows and vessel dependence.

What's Covered?

Report Summary

Key Takeaways

1) Robotics shifts decommissioning from heavy‑lift peaks to continuous subsea programs with fewer vessel days.

2) By 2030, robotic lanes deliver ~18–22% cost and ~20–28% schedule reduction (illustrative).

3) Digital twins and AI inspection compress engineering and permit workflows; safer, faster decisions.

4) Circular value: 92–95% metals recovery achievable with audited MRV and certified yards.

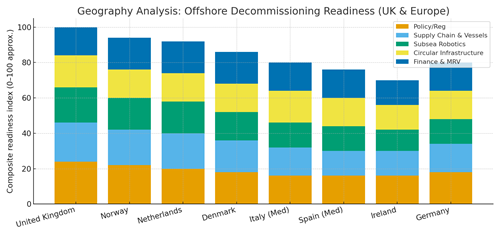

5) UK/Norway lead on policy and supply chain; NL/DK scale yards and subsea infrastructure.

6) Outcome‑based contracts align vendors to KPIs (cost, time, recycling rate, HSE).

7) Standardized work packs & modular tooling reduce weather exposure and mobilization costs.

8) Integrated waste logistics and certified recycling underpin ESG credibility and revenue.

Key Metrics

Market Size & Share

Decommissioning in the UK and Europe enters a programmatic phase through 2030, with robotics elevating execution efficiency and safety. In this illustrative view, cumulative European spend addressed by robotics‑enabled campaigns rises from ~€1.8 bn in 2025 to ~€13.6 bn by 2030; the UK grows from ~€0.8 bn to ~€6.4 bn as North Sea portfolios mature. Share consolidates around operators and service consortia that can standardize work packs, re‑use tooling, and sequence assets to minimize mobilizations. The mix shifts: fewer single‑shot heavy lifts and more continuous subsea programs (inspection, cutting, segmentation, lifts) that smooth demand for vessels and yards.

Circular economy value frames procurement. Yards with certified environmental management systems and proven scrap logistics capture larger shares; smelters and processors that guarantee traceable recovery for steel, copper, and specialty alloys gain preferred status. By 2030, outcome‑based contracts that link payment to verified recycling rates, vessel‑day reductions, and safety performance become common. The UK and Norway lead by volume and complexity; the Netherlands and Denmark expand as infrastructure and workforce deepen; Mediterranean players increase share as projects ramp and circular infrastructure scales.

Market Analysis

Robotics and modular tooling deliver compounding cost and schedule advantages. Resident AUV/ROV systems cut transit and standby, yielding ~12–22% cost and ~15–28% time savings by 2030 in this outlook. Advanced cutting (diamond wire, abrasive water jet) addresses multi‑material casings and coatings; modular lifting/shears avoid ultra‑heavy vessels for many tasks; AI‑driven inspection accelerates anomaly detection and reduces repeat site visits. Economics hinge on vessel day rates, weather downtime, tooling utilization, and yard throughput.

Risk management prioritizes subsea asset integrity, cutting reliability, and waste logistics. Digital twins integrate metocean, structural models, and work orders to stress‑test plans and compress permitting. Outcome‑based contracts reallocate risk through KPIs: vessel days, cut success rates, recovered tonnage, and HSE metrics with liquidated damages/bonuses. Circular economy economics improve as scrap markets deepen and certification (chain‑of‑custody) unlocks premium outlets. Programs that unify robotics, logistics, and circular processing deliver predictable schedules and bankable ESG outcomes.

Trends & Insights (2025–2030)

• Resident subsea robotics (AUV/ROV) extend weather windows, cut vessel days, and increase data density.

• Modular cutting/lifting toolkits reduce dependence on ultra‑heavy lift; more segmentation subsea, smaller lifts topside.

• Digital twins orchestrate engineering, permitting, and execution; AI boosts inspection speed and accuracy.

• Circular infrastructure certified yards, smelters, alloy sorting raises recovery rates to ~92–95% by 2030.

• Outcome‑based contracts with MRV tie payments to verified recycling, HSE, and schedule KPIs.

• Integrated waste logistics avoid quay congestion; multi‑site campaigns share tooling/spares.

• Subsea data security and fleet management mature with standard APIs and role‑based access.

• Workforce reskilling shifts from heavy‑lift to robotics technicians, data analysts, and circular operations.

Segment Analysis

• Fixed platforms & jackets (North Sea): staged cutting and modular lifts with resident robotics; high steel recovery and well P&A interfaces.

• Subsea tie‑backs & SURF: AUV mapping, ROV intervention, spool/cable recovery; careful handling to maximize alloy and polymer recycling.

• Floating assets (FPSO/buoys): hybrid approaches tow‑to‑yard vs offshore dismantling; emphasis on hull integrity and hazardous materials controls.

• Mediterranean assets: increasing activity with focus on circular pathways and yard capacity expansion.

Buyer guidance: portfolio sequencing to reduce mobilizations; choose tooling by geometry/coatings/depth; contract outcome KPIs (recycling %, vessel days, HSE); integrate MRV and certified logistics from seabed to smelter; and plan contingency for weather and critical equipment failures.

Geography Analysis (UK & Europe)

The UK and Norway anchor European decommissioning readiness with mature regulation, extensive supply chains, and experienced fleets. The Netherlands and Denmark strengthen through subsea infrastructure and yard investments, while Italy and Spain expand Mediterranean capacity and circular processing. Ireland and Germany pursue select projects tied to national portfolios. The stacked criteria policy/regulation, supply chain & vessels, subsea robotics, circular infrastructure, finance & MRV highlight complementary strengths and a logical sequencing: scale in UK/Norway, expand in NL/DK, and ramp circular infrastructure in Mediterranean markets.

Implications: launch multi‑year robotics‑first campaigns in high‑readiness basins; secure certified yards and smelters; standardize MRV and chain‑of‑custody; and harmonize KPIs across vendors to enable competition and benchmarking.

Competitive Landscape (Ecosystem & Delivery Models)

Competition spans ROV/AUV OEMs, cutting and lifting tool providers, vessel operators, digital twin/MRV platforms, and circular processors. Differentiators: tool reliability and utilization, resident robotics architectures, vessel efficiency, and verified circular outcomes. Leaders offer integrated programs engineering + robotics + logistics + circular processing under outcome‑based contracts with bankable KPIs. Digital platforms that unify inspection data, permits, and MRV streamline audits and financing. Delivery models shift from lump‑sum heavy‑lift to managed services and performance‑linked contracts: guaranteed cut success rates, vessel‑day caps, recycled tonnage, and HSE targets. As portfolios scale, standardized work packs and shared spares/tooling pools cut costs and compress timelines. Vendors that combine subsea excellence with circular capability and robust MRV will win share in Europe’s decommissioning wave through 2030.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071