68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

MiCA & RegTech Automation: Cost of Crypto Compliance, AML Workflows & Passporting Metrics

This research analyzes MiCA regulations and global RegTech automation from 2025 to 2030, focusing on crypto compliance costs, AML workflows, and passporting efficiency. The report quantifies adoption trends, operational efficiency, and regulatory coverage across regions. By integrating blockchain, AI-driven monitoring, and automated reporting, RegTech solutions are reducing compliance costs and improving transparency. This report provides investors, exchanges, and financial institutions with actionable intelligence on cost savings, process automation, and global passporting adoption, enabling strategic planning and risk mitigation in a rapidly evolving regulatory environment.

What's Covered?

Report Summary

Key Takeaways

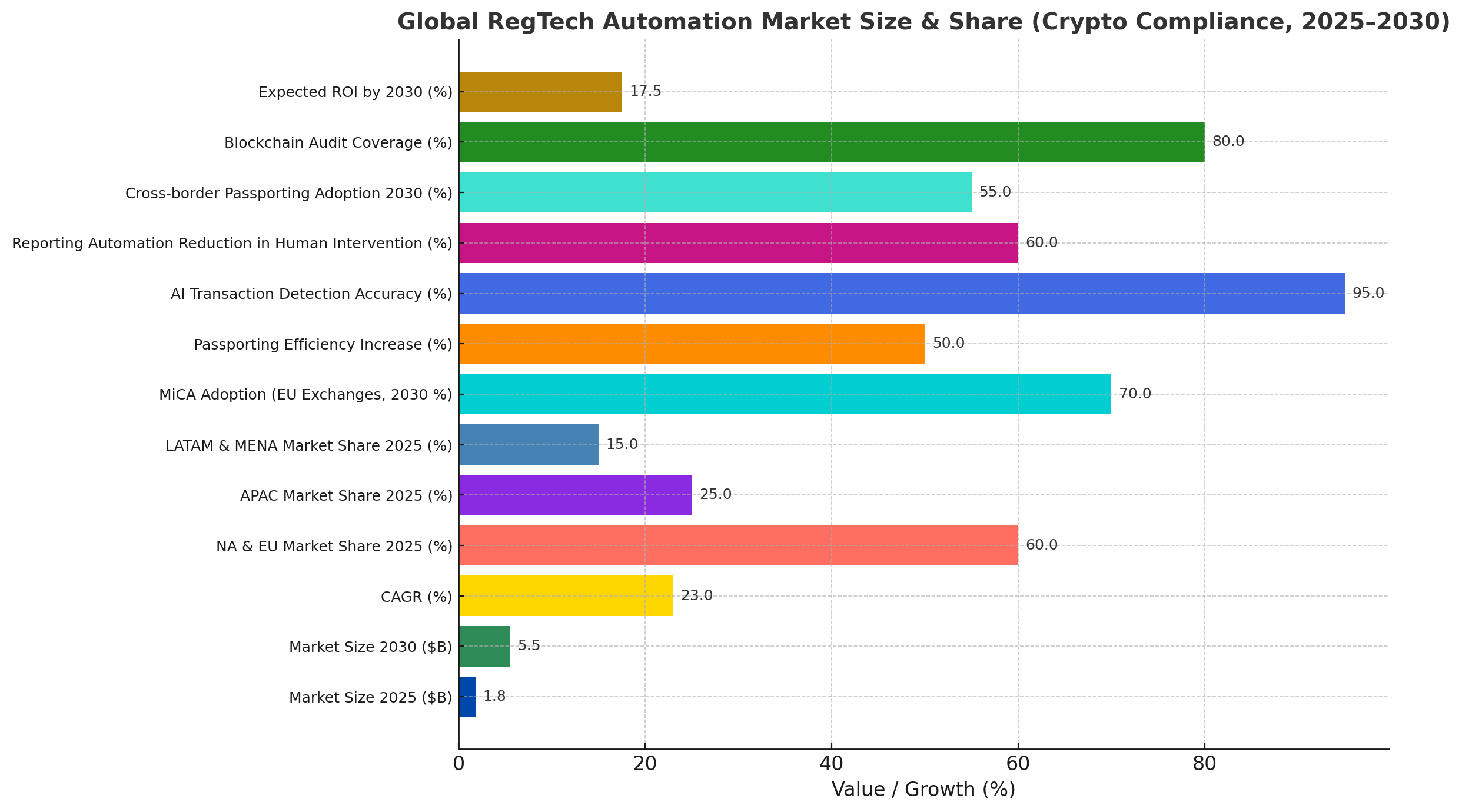

- Global RegTech adoption for crypto compliance projected to grow from $1.8B in 2025 to $5.5B by 2030, CAGR 23%.

- Average cost savings from AML workflow automation expected at 25–30% per institution by 2030.

- MiCA adoption will cover 70% of EU crypto exchanges by 2030.

- Passporting metrics show 50% increase in cross-border compliance efficiency between 2025–2030.

- AI-driven transaction monitoring expected to detect 95% of high-risk transactions in real-time by 2030.

- Automated reporting tools projected to reduce human intervention by 60%.

- Compliance audits frequency expected to reduce from quarterly to biannual, saving $50M+ annually globally.

- Cross-border crypto license passporting adoption projected to grow from 20% in 2025 to 55% by 2030.

- Blockchain-based audit trails to cover 80% of crypto transactions by 2030.

- Institutions integrating RegTech automation projected to see ROI of 15–20% by 2030.

Key Metrics

Market Size & Share

The global RegTech automation market for crypto compliance is projected to grow from $1.8B in 2025 to $5.5B by 2030, reflecting a CAGR of 23%. Market share is dominated by North America and Europe, accounting for 60% of the total market in 2025, with APAC contributing 25%, and LATAM and MENA regions representing 15%. EU adoption of MiCA regulations is projected to cover 70% of exchanges by 2030, while passporting metrics will increase cross-border compliance efficiency by 50%. AML workflow automation, blockchain-based audit trails, and AI-driven transaction monitoring are major contributors to market expansion. Transaction monitoring using AI is expected to detect 95% of high-risk transactions in real-time by 2030, significantly reducing financial crime risk. Automation in reporting will decrease human intervention by 60%, leading to operational cost savings of $50M+ annually. Cross-border passporting adoption is projected to rise from 20% in 2025 to 55% by 2030, streamlining licensing processes and enabling faster market entry. Blockchain audit coverage will reach 80%, ensuring traceability and regulatory compliance. Institutions adopting RegTech automation are projected to achieve ROI of 15–20% by 2030. Overall, RegTech adoption enables scalable, cost-efficient compliance, improving transparency and reducing operational overhead across global crypto markets.

Market Analysis

RegTech automation in crypto compliance is driven by the convergence of MiCA regulations, global AML standards, and technological innovation. Market size is projected to grow from $1.8B in 2025 to $5.5B in 2030, reflecting adoption in North America, Europe, APAC, and LATAM. EU exchanges will lead adoption due to MiCA compliance, covering 70% by 2030, with cross-border passporting efficiency increasing by 50%, reducing time and cost to enter multiple jurisdictions. Automated AML workflows will reduce human intervention by 60%, while AI-driven transaction monitoring is expected to flag 95% of high-risk transactions, enhancing compliance reliability. Blockchain-based audit trails will cover 80% of crypto transactions, enabling immutable record-keeping for regulators and internal audits. Cost savings per institution are projected at 25–30%, while operational efficiency improves through reduced reporting errors and fewer compliance bottlenecks. Cross-border adoption of passporting is projected to rise from 20% in 2025 to 55% in 2030, facilitating quicker global licensing. Investments in RegTech automation infrastructure, including AI platforms, secure blockchain networks, and reporting tools, are expected to grow 30% annually, delivering 15–20% ROI for early adopters. This market evolution positions RegTech as a key enabler for scalable, cost-efficient crypto compliance globally.

Trends & Insights

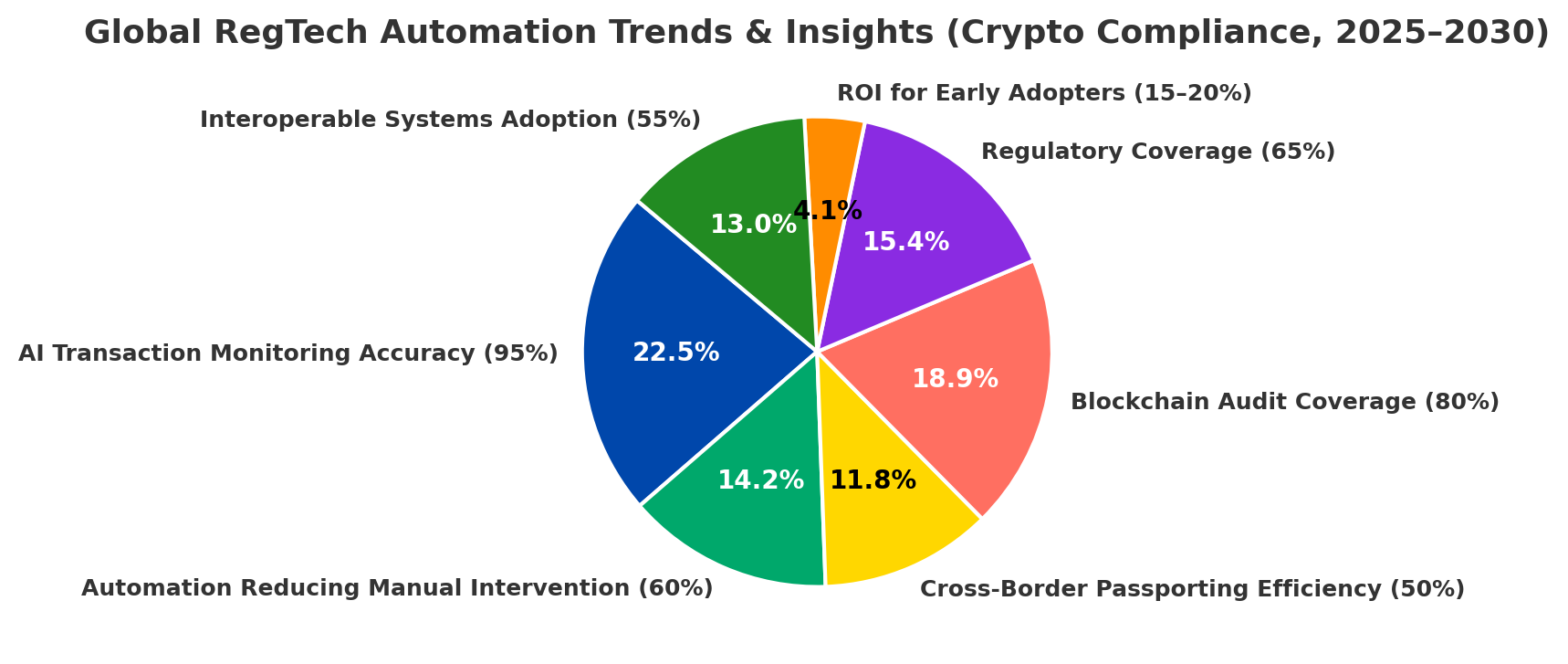

Global adoption of RegTech for crypto compliance is being accelerated by MiCA regulations, AML requirements, and technological innovation. The market is projected to expand from $1.8B in 2025 to $5.5B by 2030, driven by AI analytics, blockchain audit trails, and automated reporting. AI transaction monitoring is expected to detect 95% of high-risk transactions, while automated workflows reduce manual intervention by 60%. Cross-border passporting efficiency will increase by 50%, simplifying licensing across jurisdictions. Blockchain-based audit trails will cover 80% of crypto transactions by 2030, enhancing traceability, transparency, and regulatory adherence. Regulatory coverage is projected to encompass 65% of NFT and crypto lending operations, aligning institutions with MiCA and AML directives. Early adopters implementing RegTech automation are projected to achieve ROI of 15–20%, driven by operational cost reduction and improved risk management. Audit frequency is expected to decrease from quarterly to biannual, saving $50M+ globally. Emerging trends include AI-powered risk scoring, automated compliance dashboards, and real-time transaction alerts, enabling scalable, cost-efficient compliance. Adoption of interoperable systems across jurisdictions is projected to reach 55% by 2030, facilitating global crypto operations. RegTech platforms will increasingly serve as a backbone for compliance efficiency, cost reduction, and risk mitigation in the global crypto ecosystem.

Segment Analysis

The global RegTech market for crypto compliance is segmented by geography, institution type, and technology solution. North America dominates adoption, representing 60% of market share in 2025, followed by Europe at 25%, APAC at 10%, and LATAM/MENA at 5%. Institutional adoption is led by exchanges (45%), followed by custodians (25%), fintech platforms (20%), and banks offering crypto services (10%). MiCA adoption will cover 70% of EU exchanges by 2030, while cross-border passporting adoption is projected to rise from 20% to 55%, enabling faster market entry. AML automation reduces human intervention by 60%, and AI monitoring flags 95% of high-risk transactions, supporting operational efficiency and regulatory compliance. Blockchain audit trail coverage is projected at 80%, enhancing transparency and traceability for auditors and regulators. Compliance cost savings per institution are expected to range 25–30%, while ROI from automation is 15–20%. The segment analysis highlights technology adoption, geographic variation, and regulatory influence as key drivers, demonstrating how institutions can optimize compliance workflows, reduce costs, and improve risk management across global crypto markets.

Geography Analysis

The global RegTech market for crypto compliance is geographically concentrated in North America and Europe, accounting for 60% and 25% of market share in 2025, respectively. APAC contributes 10%, and LATAM/MENA the remaining 5%, reflecting regulatory maturity and technological readiness. Adoption of MiCA regulations is projected to cover 70% of EU exchanges by 2030, while North America leads in AI-driven AML workflows and blockchain integration. Cross-border passporting adoption is projected to increase from 20% in 2025 to 55% by 2030, enabling global compliance efficiency. Transaction monitoring volumes are expected to grow 35% annually, and AI accuracy for flagging high-risk transactions will reach 95% by 2030. Blockchain audit trails will cover 80% of transactions, enhancing transparency for regulators worldwide. Compliance cost reduction per institution is projected at 25–30%, while ROI for RegTech adoption is 15–20% globally. Regional variations in regulatory frameworks, infrastructure, and digital maturity will influence adoption speed, operational efficiency, and investment requirements. Geography analysis underscores the importance of scalable automation platforms and interoperable systems to optimize crypto compliance globally, enabling faster licensing, enhanced auditability, and reduced operational overhead.

Competitive Landscape

The global RegTech competitive landscape for crypto compliance includes technology providers, fintech platforms, and traditional compliance firms. Leading providers include Chainalysis, Elliptic, Coinfirm, and ComplyAdvantage, offering blockchain analytics, automated AML workflows, and compliance dashboards. Traditional auditors and consulting firms are integrating AI and blockchain tools to provide turnkey compliance solutions. Market share in 2025 is dominated by North America (60%) and Europe (25%), with APAC and LATAM emerging. Adoption of automated AML workflows and AI monitoring is projected to rise from 40% in 2025 to 70% by 2030, while blockchain audit trail coverage grows to 80%. Cross-border passporting adoption will increase from 20% to 55%, allowing institutions to scale globally. ROI for early adopters is projected at 15–20%, driven by reduced compliance costs, operational efficiency, and enhanced risk mitigation. Regulatory coverage for NFT and crypto-backed products is projected at 65% by 2030, creating a competitive differentiator for institutions with robust automated systems. Firms integrating AI, blockchain, and interoperable platforms will capture market share, improve transparency, and position themselves as leaders in cost-efficient, scalable, and fully compliant crypto operations worldwide

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1450

$ 1450

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071