68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Methane Emissions Monitoring Technology: Satellite vs Ground Sensor Networks

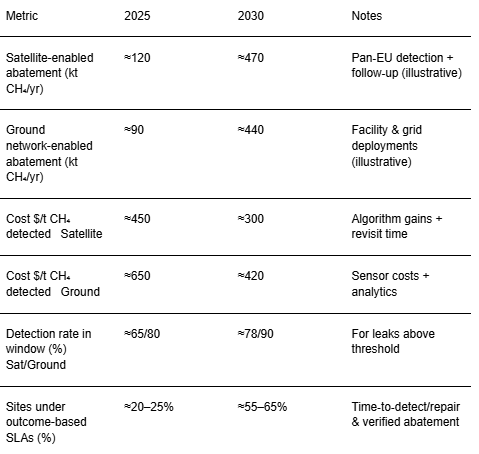

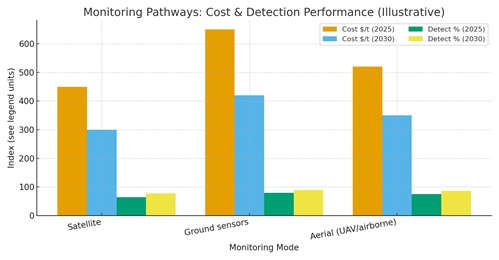

Between 2025 and 2030, Europe’s methane strategy pivots from episodic surveys to persistent monitoring that couples satellite detection with dense ground sensor networks. Germany’s industrial footprint and data‑governance maturity make it a natural testbed: satellites locate and quantify large episodic plumes quickly, while ground networks deliver continuous detection for smaller leaks and operational anomalies. The winning architecture is hybrid: space‑based wide‑area discovery, aerial confirmation where needed, and plant‑level ground sensors for rapid repair and verification. Quantitatively, illustrative trajectories show satellite‑enabled abatement rising from ~120 kt CH₄/yr in 2025 to ~470 kt by 2030 as revisit times shorten and quantification accuracy improves; ground networks rise from ~90 to ~440 kt CH₄/yr as deployments expand across refineries, gas grids, LNG terminals, and biogas clusters. Cost curves improve with sensor commoditization, edge analytics, and standardized data pipelines: satellite detection costs trend toward ~$300/t CH₄ detected by 2030, while ground networks fall toward ~$420/t. Detection performance climbs into the 78–90% range (campaign‑window basis) as thresholds drop and analytics fuse meteorology and facility telemetry.

What's Covered?

Report Summary

Key Takeaways

1) Hybrid monitoring (satellite + ground) maximizes speed‑to‑find and speed‑to‑fix.

2) Cost curves fall with sensor commoditization and analytics; verification becomes standard.

3) Germany, NL, and France lead on policy/MRV; Nordics lead on open data/vendor depth.

4) Outcome‑based SLAs align vendors to time‑to‑detect, time‑to‑repair, and abatement KPIs.

5) Data fusion (met, SCADA, maintenance logs) lifts detection rates and reduces false positives.

6) Portable ground nodes enable rapid hotspot sweeps and post‑repair verification.

7) Biogas and distribution grids join O&G as major abatement opportunities by 2030.

8) Interoperable data schemas and independent MRV unlock finance and ESG credibility.

Key Metrics

Market Size & Share

Europe’s methane monitoring market professionalizes through 2030 as regulations and buyer sophistication converge on verified outcomes. In this illustrative outlook, satellite‑enabled abatement climbs from ~120 to ~470 kt CH₄/yr and ground‑network abatement rises from ~90 to ~440 kt, driven by denser deployments on gas grids, refineries, LNG terminals, and biogas clusters. Market share concentrates around integrators that combine tasking/analytics for satellites with scalable ground sensor rollouts, and that can deliver closed‑loop workflows (alert → confirm → fix → verify) across multiple countries.

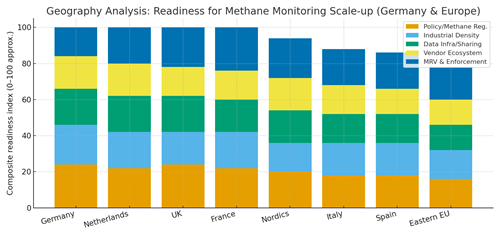

Germany, the Netherlands, and France will anchor demand, reflecting policy readiness, industrial density, and strong grid operators. The UK and Nordics expand on vendor ecosystems and data‑sharing practices, while Southern and Eastern Europe scale with EU methane regulation implementation and modernization funds. As buyers shift from pilots to programs, portfolios coalesce around standardized hardware (low‑power, long‑range comms), edge analytics, and cloud pipelines with open schemas that facilitate multi‑vendor competition.

Market Analysis

Relative economics favor hybrid programs. Satellites excel in wide‑area discovery and quantification of large persistent leaks; costs fall as revisit frequency increases, tasking becomes more efficient, and algorithms improve. Ground sensors provide persistence and fast response on smaller leaks; costs fall with sensor commoditization, mesh networking, and analytics that reduce false positives. Aerial surveys (UAV/airborne) complement both by delivering flexible, high‑resolution confirmation with short lead times.

Illustratively, $/t CH₄ detected trends from ~$450 to ~$300 for satellites and ~$650 to ~$420 for ground networks by 2030; detection rates climb to ~78% and ~90% respectively for leaks above contracted thresholds within campaign windows. Program economics are sensitive to detection thresholds, asset density, weather, and repair crew availability. Mitigations include tiered thresholds (large‑leak triage), dynamic tasking tied to weather windows, and pre‑booked repair capacity. Data‑governance investments standard schemas, APIs, audit trails lower switching costs and improve vendor accountability under outcome‑based SLAs.

Trends & Insights (2025–2030)

• Hybridization becomes default: satellites for discovery, aerial for confirmation, ground for persistence.

• Outcome‑based SLAs: time‑to‑detect, time‑to‑repair, and verified abatement replace hardware counts.

• Edge + cloud analytics: meteorology, plume models, and SCADA integration boost detection and triage.

• Open data models: interoperable schemas/APIs reduce lock‑in and ease regulator reporting.

• Cybersecurity by design: encrypted comms and zero‑trust access for sensor fleets and cloud platforms.

• Biogas & distribution grids: monitoring expands beyond upstream to municipal and agricultural sources.

• Workforce readiness: certified repair crews and mobile response units become critical bottlenecks.

• Financing: verified abatement data supports ESG claims and, potentially, performance‑linked finance.

Segment Analysis

• Upstream & Midstream O&G: satellite discovery + aerial confirmation + fixed ground networks at compressor stations; strong abatement yields.

• Gas Utilities/Distribution: dense ground sensors on pipelines/valves; priority on time‑to‑detect and repair SLAs.

• LNG Terminals & Storage: fence‑line sensors, met integration, and high‑frequency aerial checks during operations and maintenance.

• Biogas & Waste: periodic satellite/aerial sweeps; portable ground nodes for hotspots and verification after fixes.

Buyer guidance: define detection thresholds by asset class; contract for outcomes (detection/repair/abatement) with LDs/bonuses; mandate interoperable data pipelines; and run joint playbooks with repair contractors to ensure measured abatement translates into sustained reductions.

Geography Analysis (Germany & Europe)

Germany leads on policy alignment, industrial density, and MRV maturity; the Netherlands combines progressive regulation with strong data‑sharing practices; the UK brings vendor diversity and open data norms; France balances policy rigor with enforcement capacity. Nordics leverage digital public services and vendor ecosystems. Italy and Spain scale programs as gas grid modernization and biogas growth accelerate; Eastern EU members ramp with EU methane policy implementation and modernization support. The stacked criteria (policy/regulation, industrial density, data infrastructure, vendor ecosystem, MRV/enforcement) highlight complementary strengths and the need for tailored roll‑out sequences in each country.

Implications: prioritize hybrid pilots in high‑readiness markets (DE/NL/FR/UK) to establish playbooks; leverage Nordic data practices for interoperability; and structure cross‑border SLAs with common KPIs to enable regional vendor competition and benchmarking.

Competitive Landscape (Ecosystem & Delivery Models)

Competition spans satellite operators/analytics firms, aerial service providers, ground‑sensor OEMs, integrators, and MRV auditors. Differentiators: detection sensitivity vs false positives, latency/time‑to‑insight, interoperability, cybersecurity posture, and the ability to deliver outcome‑based SLAs with verified abatement. Integrators that bundle satellite tasking, aerial confirmation, ground deployments, and independent MRV through a single data model gain share. Delivery models shift from capex‑heavy pilots to managed service contracts indexed to outcomes. Buyers increasingly require independent MRV and open APIs; vendors respond with shared data lakes, role‑based access, and audit trails. Leaders pair engineering with strong governance data protection, safety, and transparent reporting turning detection into durable abatement.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071