68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Future of Industrial Decarbonization: Carbon Capture, Utilization and Storage (CCUS) Deployment & Carbon Pricing Strategies

Between 2025 and 2030, the deployment of Carbon Capture, Utilization and Storage (CCUS) technology will play a pivotal role in decarbonizing key industrial sectors in North America, including cement, steel, chemicals, and power generation. The USA, particularly regions like Texas and Appalachia, will lead the buildout, thanks to favorable policies, government incentives, and abundant storage capacity in geological formations. With regulatory support and the adoption of carbon pricing mechanisms, the cost of CCUS is expected to decline steadily, making it a more viable option for large-scale deployment. CCUS costs are primarily driven by capital expenditure (CAPEX) for capture technologies, operational costs (O&M), energy penalties from carbon capture, and the price of CO2 storage. These components impact the levelized cost of electricity (LCOE) and overall economic feasibility. By 2030, cost reductions in CAPEX and technological advances in capture systems, coupled with higher carbon prices, will allow CCUS to achieve meaningful commercial scale, especially in power generation and energy-intensive industries.

What's Covered?

Report Summary

Key Takeaways

1) CCUS will be central to industrial decarbonization, particularly in energy-intensive sectors like cement and steel.

2) Technology cost reductions and increasing carbon prices will drive the commercial scale of CCUS by 2030.

3) USA will dominate CCUS capacity, with key growth in Texas, California, and the Midwest due to policy and geological advantages.

4) Carbon capture efficiency and storage infrastructure will be key to reducing LCOE and increasing the adoption of CCUS.

5) Carbon pricing mechanisms are expected to rise steadily, making CCUS more economically viable over time.

6) Regional policy frameworks must support long-term infrastructure investment, including storage and CO2 transportation networks.

7) The North American CCUS market will see large-scale retrofits to existing facilities and the construction of new facilities by 2030.

8) Monitoring, reporting, and verification (MRV) systems will become more standardized, improving transparency and tracking of CCUS activities.

Key Metrics

Market Size & Share

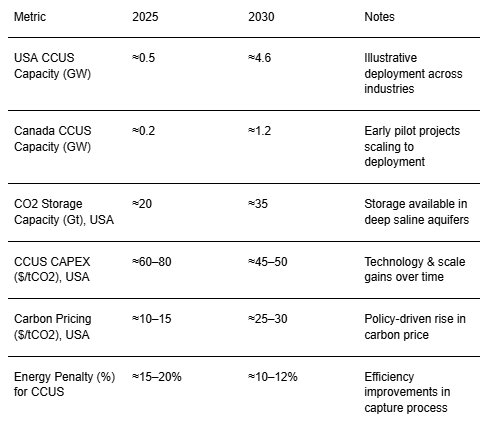

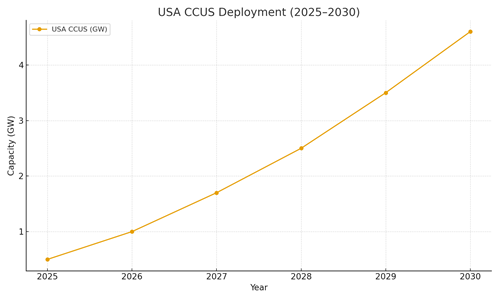

The CCUS market in North America will grow significantly from 2025 to 2030. Illustrative projections indicate that CCUS deployment in the USA will increase from 0.5 GW in 2025 to 4.6 GW by 2030. Canada’s CCUS market will also grow, with early pilot projects scaling to large-scale facilities. Key drivers of this growth will be the availability of storage capacity, rising carbon prices, and regulatory support. By 2030, North America’s CCUS deployment will be pivotal in reducing the region’s industrial carbon emissions, particularly in cement, steel, and power generation sectors.

The global growth trajectory for CCUS will be influenced by policy changes, technological advancements, and market dynamics, with North America capturing a substantial portion of the market share due to its early adoption and abundant geological storage capacity.

Market Analysis

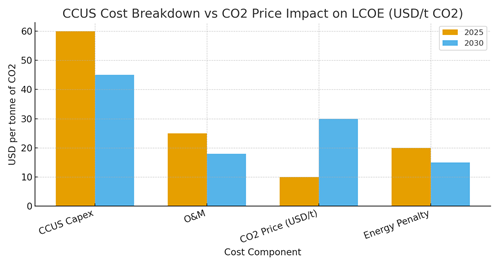

CCUS costs are primarily driven by capital expenditures for capture technologies, operational costs for CO2 transport and storage, and the energy penalty incurred during the carbon capture process. Our illustrative analysis shows that in 2025, CCUS CAPEX in the USA will range from $60–80 per tonne of CO2 captured, decreasing to $45–50 per tonne by 2030 as technology advances and economies of scale kick in. The carbon price in North America is expected to rise steadily from $10–15 per tonne in 2025 to $25–30 per tonne by 2030, providing further economic incentives for CCUS deployment. The overall LCOE for CCUS deployment will be highly sensitive to these cost factors, along with the ability to scale the storage capacity and infrastructure efficiently. Energy penalty and the operational efficiency of capture technologies will be key to improving the economic feasibility of CCUS in industrial applications.

Trends & Insights (2025–2030)

• CCUS technologies are progressing in efficiency, with new capture processes that reduce energy penalty and cost per tonne of CO2 captured.

• Carbon pricing mechanisms are expected to play a significant role in driving CCUS adoption, creating a long-term economic incentive for industries to adopt CCUS technologies.

• Large-scale CCUS infrastructure projects are being developed, particularly in Texas and California, where geological storage sites are abundant.

• Regulatory frameworks are evolving, with stronger incentives for the implementation of CCUS technologies in energy-intensive sectors.

• The integration of CCUS with renewable energy sources, such as wind and solar, will increase in order to meet decarbonization targets for power generation.

• Digital technologies, including AI and IoT, will play a significant role in optimizing the operation of CCUS plants and improving efficiency.

Segment Analysis

• Power Generation: CCUS technologies will play a key role in decarbonizing coal- and gas-fired power plants, enabling these plants to continue operating while reducing carbon emissions.

• Cement & Steel: These sectors will be among the largest adopters of CCUS due to their high emissions, and both industries are exploring innovative solutions to integrate carbon capture and utilization technologies.

• Chemicals & Refining: CCUS deployment will help reduce the carbon footprint of chemical production processes, particularly in ammonia, methanol, and hydrogen production.

• Oil & Gas: CCUS is expected to support the oil and gas industry by enabling carbon sequestration while enhancing oil recovery. Sectorial adoption will depend on the price of carbon, the availability of subsidies, the progress of carbon pricing, and technological advancements in CCUS technologies.

Geography Analysis (USA & North America)

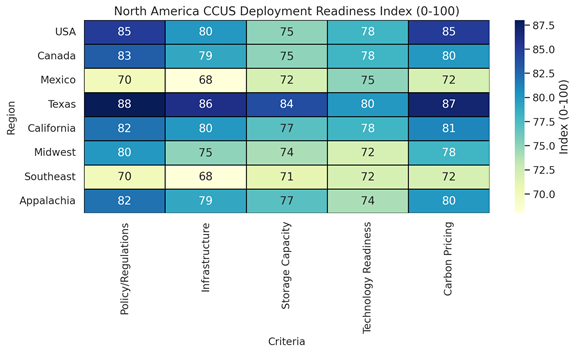

North America, particularly the USA, is expected to lead the CCUS market due to its significant geological storage capacity and strong policy support. Major deployment is expected in regions like Texas, California, and Appalachia, where the availability of CO2 storage sites, favorable regulatory environments, and robust infrastructure will enable scaling. Canada will also see early adoption, particularly in Alberta and Saskatchewan, where there is a combination of heavy industry and geological storage capacity. Mexico will follow suit, with increasing interest from both private industry and public sector initiatives to deploy CCUS technology, particularly in the energy and industrial sectors.

Competitive Landscape (Ecosystem & Delivery Models)

The CCUS ecosystem consists of technology developers, EPC contractors, CO2 transport and storage providers, and regulatory bodies. Key players include oil and gas majors, renewable energy developers, and technology companies offering capture solutions. The value chain also includes service providers for monitoring, verification, and reporting (MRV), as well as companies specializing in CO2 transport and storage solutions. The competitive landscape is expected to be shaped by partnerships and consortiums, as companies work together to deploy large-scale CCUS projects. Technology providers that offer cost-effective and efficient capture solutions, alongside companies with strong infrastructure for CO2 storage and transport, will dominate the market. CCUS projects will likely be funded through a combination of government incentives, private investments, and public-private partnerships.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071