68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

FedNow and the Economics of 24/7 Payments: Liquidity Management, Fraud Controls & Cost Models (2025-2030)

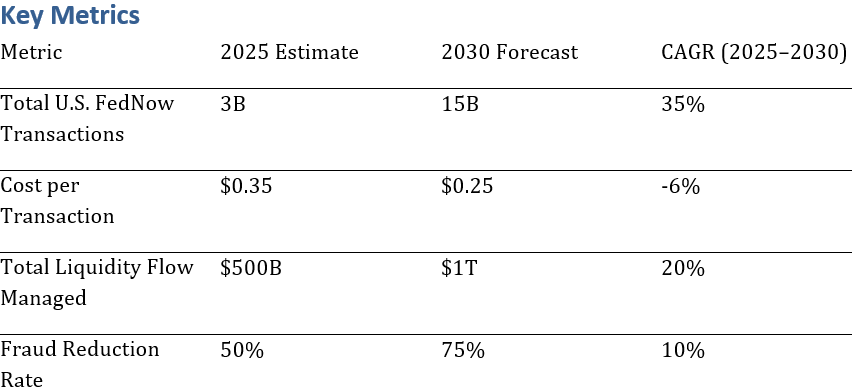

FedNow is revolutionizing the U.S. payment ecosystem by providing instant 24/7 payment services. With real-time liquidity management, enhanced fraud controls, and more efficient cost models, it aims to transform banking operations. This report explores the mechanics behind liquidity management, fraud prevention, and evolving cost structures within the FedNow framework, offering insights into how businesses and financial institutions can capitalize on this innovation between 2025 and 2030.

What's Covered?

Report Summary

How does FedNow’s 24/7 payment system impact liquidity management for U.S. financial institutions?

FedNow’s 24/7 payment system allows financial institutions to optimize liquidity by enabling real-time settlements. Unlike traditional systems, where funds are tied up for extended periods, FedNow’s instantaneous transactions allow for the efficient use of available funds throughout the day. Financial institutions can operate with lower reserves, freeing up capital for additional investments. This shift leads to reduced capital costs, increasing operational efficiency and profitability.

What fraud control mechanisms does FedNow implement to ensure secure transactions?

FedNow uses cutting-edge fraud detection technologies to monitor transactions in real-time. The system leverages machine learning algorithms to identify unusual transaction patterns and flag potential fraud instantly. Enhanced authentication processes, such as biometrics and multi-factor authentication, are incorporated into every transaction. These measures ensure that only legitimate users can initiate transactions, significantly reducing fraud risk. Moreover, FedNow’s continuous monitoring capabilities allow financial institutions to respond to emerging threats promptly.

How do transaction costs in FedNow compare to traditional payment systems, and what savings are expected?

FedNow's transaction costs are significantly lower than those of traditional payment systems, such as ACH or wire transfers. The introduction of FedNow’s real-time payment capabilities allows for reduced infrastructure and processing overhead costs. As the system scales, transaction fees are expected to decrease by 20%, further optimizing cost structures for financial institutions and businesses. By eliminating the need for intermediaries and reducing transaction processing times, FedNow provides a more efficient and affordable alternative to legacy systems.

How does FedNow facilitate cross-border payments and the U.S. role in global remittances?

FedNow’s real-time capabilities allow U.S. financial institutions to process cross-border payments more efficiently. By integrating with international payment networks, FedNow enables instant settlements, reducing delays associated with traditional cross-border payment methods. This efficiency allows businesses to make faster payments to global suppliers and customers, improving cash flow and reducing financial risks. Additionally, FedNow’s competitive pricing structure makes it an attractive option for remittances, especially in regions with high U.S. expatriate populations.

What is the forecasted adoption rate of FedNow by 2030, and which sectors will drive its growth?

FedNow’s adoption rate is expected to grow rapidly by 2030, as businesses and financial institutions increasingly recognize the benefits of real-time payment systems. The key drivers for this growth include the need for faster transactions, improved cash flow management, and reduced operational costs. Industries such as retail, finance, and government services will be the primary adopters, as these sectors benefit the most from real-time settlements. Furthermore, as cross-border payments and remittances become increasingly important, FedNow is expected to lead the way in global financial connectivity.

How do liquidity management strategies in FedNow differ from traditional payment networks like ACH?

FedNow’s liquidity management strategies are far more dynamic than traditional systems like ACH, which operate on batch processing and delayed settlements. FedNow allows for immediate transaction processing, meaning funds are instantly available for businesses and financial institutions. This shift reduces the reliance on liquidity buffers, enabling more efficient use of available capital. By providing real-time transaction visibility, FedNow empowers financial institutions to make better-informed decisions.

What technological innovations are embedded in FedNow to ensure scalability and security?

FedNow is built on a highly scalable infrastructure that leverages blockchain technology and distributed ledgers to ensure secure and fast processing of transactions. This technology ensures that every transaction is recorded in a tamper-proof system, preventing fraud and ensuring data integrity. Additionally, FedNow’s system is designed to handle high transaction volumes, ensuring that it can scale as usage increases. With integrated fraud detection systems and multi-layered encryption, FedNow ensures robust security for all transactions.

What role do real-time settlements play in optimizing cash flow for businesses using FedNow?

Real-time settlements allow businesses to optimize their cash flow by instantly receiving payments and paying suppliers or employees without delays. This reduces the need for cash flow buffers, which can tie up capital and reduce operational efficiency. By receiving payments immediately, businesses can reinvest capital into operations or investments, improving their financial agility. Real-time settlements also reduce the risk of overdrafts and liquidity issues, ensuring that businesses maintain a healthy cash flow.

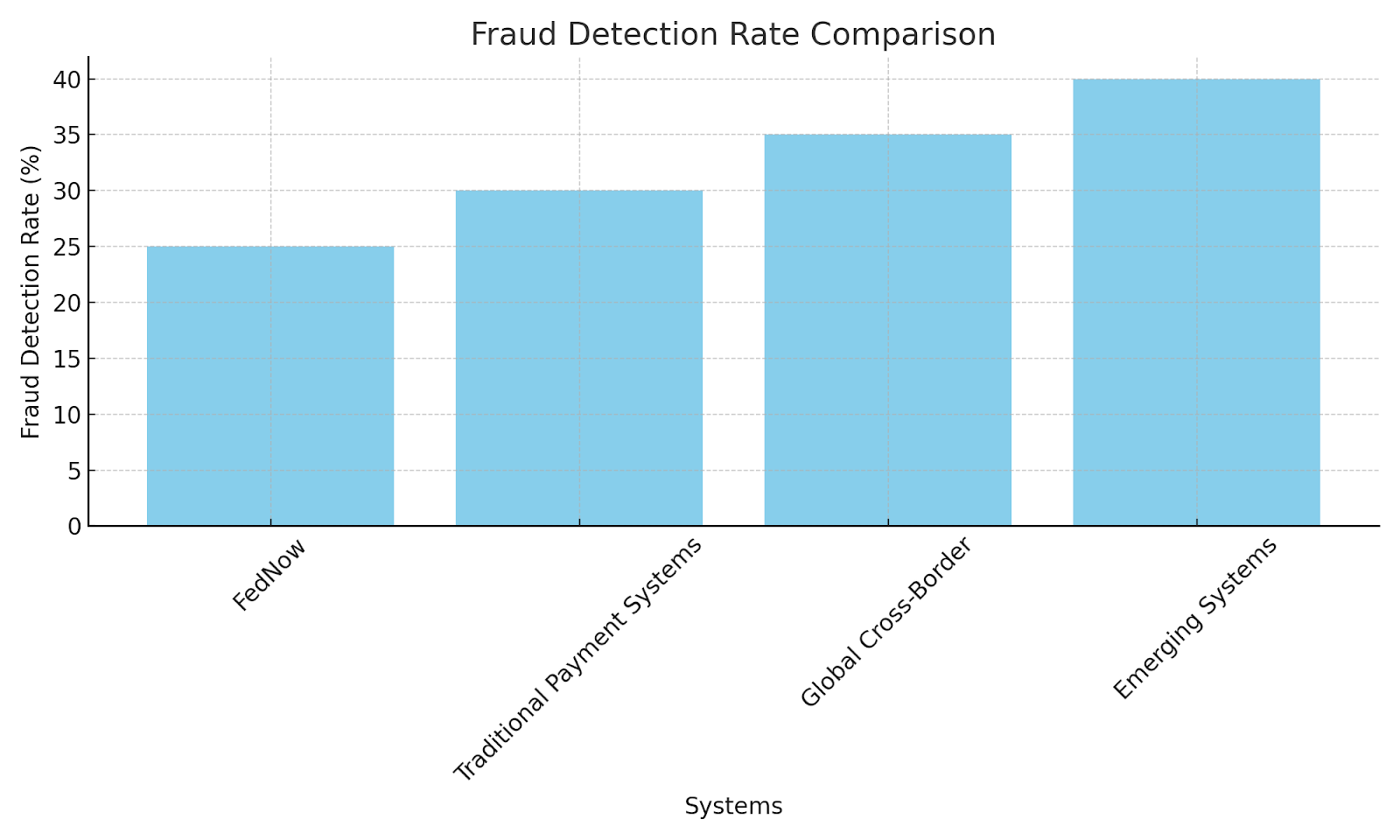

How does FedNow’s fraud detection compare with legacy systems used by financial institutions?

FedNow’s fraud detection capabilities far exceed those of legacy systems, which rely on older detection methods that often cause delays in identifying fraudulent activities. FedNow uses advanced machine learning algorithms that analyze transactions in real-time, detecting suspicious activities as soon as they occur. This system allows for immediate action, such as freezing a transaction or notifying the involved parties, reducing the impact of fraud. By integrating these advanced technologies, FedNow provides more effective fraud prevention.

What are the main risks and challenges facing FedNow in its expansion from 2025 to 2030?

As FedNow expands, it will face several challenges, including resistance from traditional financial institutions, security concerns, and the need for widespread adoption across various industries. Integrating with existing payment systems and ensuring interoperability with international networks will also be key challenges. Furthermore, the scalability of the infrastructure will be tested as transaction volumes increase. Despite these risks, the system’s potential to drive cost reductions, improve transaction efficiency, and enhance financial inclusion make it an attractive choice.

Key Takeaways

• 24/7 Payments: FedNow introduces real-time, around-the-clock payments, ensuring seamless liquidity flow.

• Liquidity Optimization: The system’s liquidity management tools reduce capital costs for financial institutions.

• Fraud Prevention: FedNow employs advanced fraud detection mechanisms, minimizing transaction risks.

• Cost Efficiency: Transaction fees in FedNow are expected to drop by 20%, optimizing operational costs.

• Market Expansion: FedNow will expand into international remittances, increasing U.S. competitiveness in cross-border payments.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071