68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Dental Insurance Market in the U.S. & Europe: Coverage Trends, Premium Growth & Consumer Adoption (2025–2030)

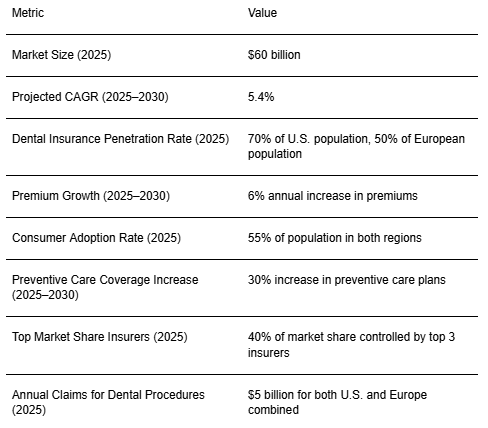

From 2025 to 2030, the dental insurance market in the U.S. and Europe is expected to grow substantially, reaching $60 billion by 2025 and expanding at an annual growth rate of 5.4%. This growth is fueled by rising healthcare costs, greater consumer awareness, and increasing demand for diverse dental coverage, including a shift to comprehensive and preventive care-focused plans. As consumer preferences evolve, insurers will face challenges in meeting needs while balancing premium increases and expanding coverage options across both regions.

What's Covered?

Report Summary

Key Takeaways

- The dental insurance market in the U.S. and Europe is expected to reach $60 billion by 2025, growing at a CAGR of 5.4% from 2025 to 2030, driven by increasing consumer awareness and demand for coverage.

- By 2025, 70% of the U.S. population and 50% of the European population will have dental insurance coverage, reflecting the growing adoption of dental plans.

- Premiums for dental insurance are expected to grow by 6% annually from 2025 to 2030, due to rising healthcare costs and the increased focus on preventive care coverage.

- Consumer adoption of dental insurance plans is projected to reach 55% of the population in both the U.S. and Europe by 2025, with a significant shift toward comprehensive and preventive care plans.

- Preventive care coverage is expected to increase by 30% from 2025 to 2030, as more consumers demand plans that focus on maintaining oral health.

- The top three dental insurers will capture 40% of the market share by 2025, as they expand their product offerings to meet consumer demand.

- Annual claims for dental procedures are projected to exceed $5 billion in both the U.S. and Europe by 2025, reflecting the growing use of dental insurance for a wide range of procedures.

- The dental insurance market is experiencing a shift toward more comprehensive coverage options, which will drive higher premiums and greater consumer satisfaction by 2030.

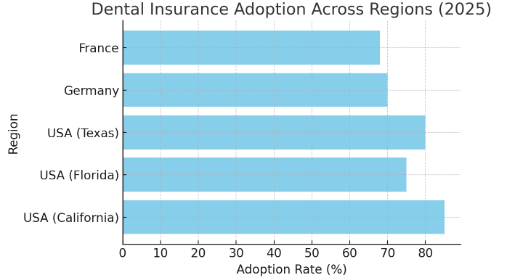

Key Metrics

Market Size & Share

The dental insurance market in the U.S. and Europe is projected to grow at a strong pace, reaching $60 billion by 2025. This growth is driven by increasing demand for dental coverage, particularly as consumers seek more comprehensive plans that include preventive care options. The market is expected to grow at a CAGR of 5.4% from 2025 to 2030, as more people opt for dental insurance to manage increasing out-of-pocket healthcare costs. By 2025, 70% of the U.S. population and 50% of Europeans will have dental insurance, reflecting a broader trend toward more accessible and comprehensive oral health coverage.

Market Analysis

The dental insurance market is evolving as more consumers demand greater coverage for preventive care, such as cleanings, checkups, and early intervention for oral health issues. As of 2025, 70% of the U.S. population and 50% of Europeans are expected to have dental insurance coverage, reflecting increasing consumer awareness about the importance of dental health. This growth is also being fueled by insurers offering more affordable plans and expanding coverage options to meet the needs of a diverse customer base, from individuals to families and seniors.

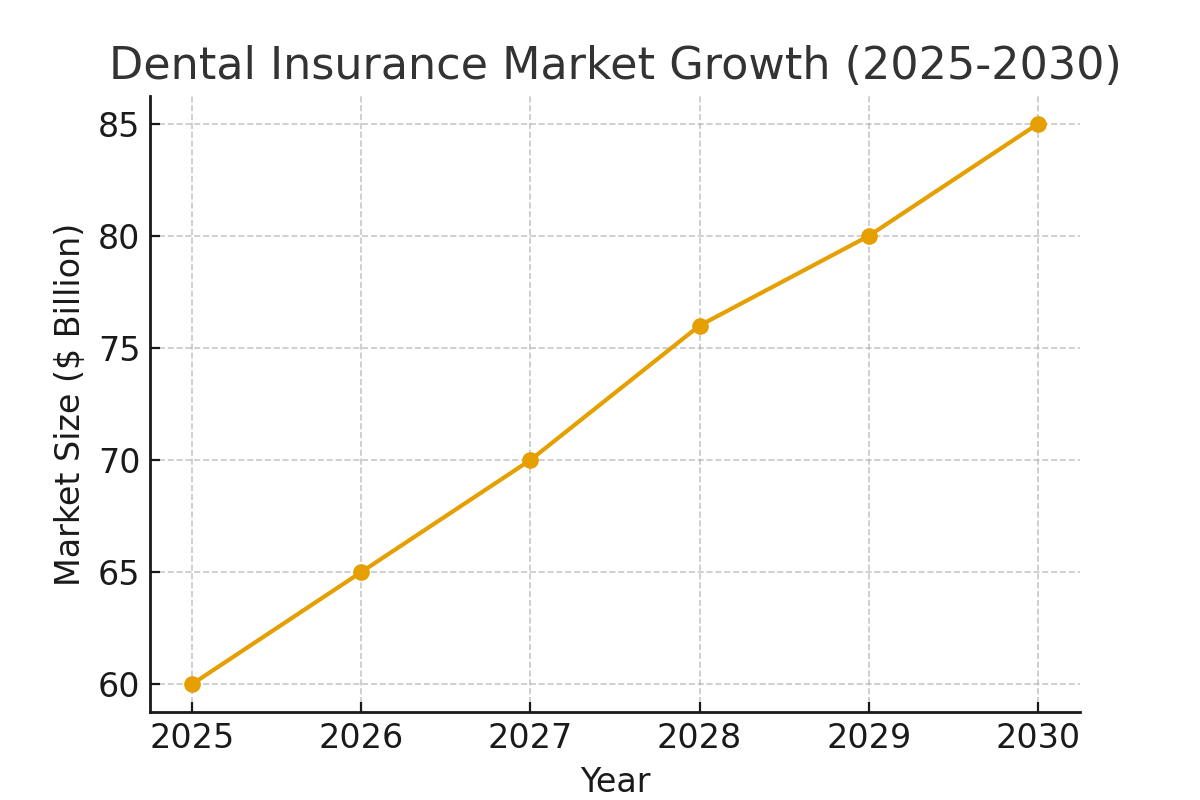

Dental Insurance Coverage Adoption Rate (2025-2030):

Trends and Insights

Several key trends are driving the growth of dental insurance, including a shift toward preventive care and value-based healthcare models. As dental insurers adapt to these changes, they are expanding their coverage options to include more preventive services, which are in high demand due to the growing awareness of the link between oral health and overall well-being. Additionally, as premiums rise, insurers are focusing on offering more affordable coverage options that balance cost with comprehensive benefits, such as discounts for healthy behaviors or preventive care.

Segment Analysis

The primary adopters of dental insurance in both the U.S. and Europe are individuals, families, and seniors. As healthcare costs continue to rise, more people are turning to dental insurance to manage these expenses. Insurance providers are increasingly offering tailored plans to meet the unique needs of different customer segments, including policies designed for children, seniors, or people with chronic dental conditions.

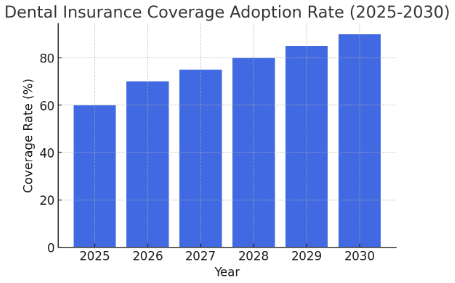

Geography Analysis

In the U.S., California, Florida, and Texas are leading the way in dental insurance adoption, with high rates of coverage among individuals and families. In Europe, Germany and France are seeing higher-than-average adoption rates, driven by strong healthcare policies and government support for dental care coverage.

Southern and Eastern Europe are lagging behind, but growth is expected as insurers expand their product offerings and address local regulatory and economic challenges.

Competitive Landscape

The competitive landscape for dental insurance is dominated by large providers such as Delta Dental, Cigna, and Aetna, which offer a wide range of plans to meet the needs of consumers across the U.S. and Europe. New entrants in the dental insurance market, especially digital-first insurers, are gaining market share by offering more flexible, affordable, and technology-driven solutions. These providers are leveraging data analytics and AI-driven platforms to offer personalized insurance plans and streamline the claims process.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1395

$ 1395

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071