68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

AI-Powered Mergers & Acquisition Platforms: Predictive Targeting, Due Diligence Automation & Synergy Modeling (US & EU, 2025–2035)

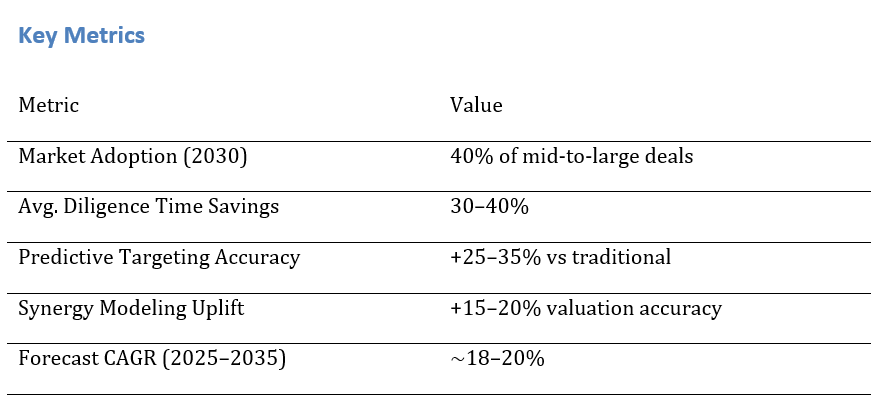

AI-powered M&A platforms are transforming dealmaking in the U.S. and EU. By 2030, 40% of mid-to-large M&A transactions are expected to leverage predictive targeting, automated due diligence, and AI-driven synergy modeling. These platforms reduce diligence timelines by 30–40%, improve target precision by 25–35%, and enhance valuation accuracy by 15–20%. Between 2025 and 2035, adoption will accelerate as investment banks, private equity, and corporates seek efficiency, compliance, and competitive edge.

What's Covered?

Report Summary

1. Market Adoption Rate (2025–2035)

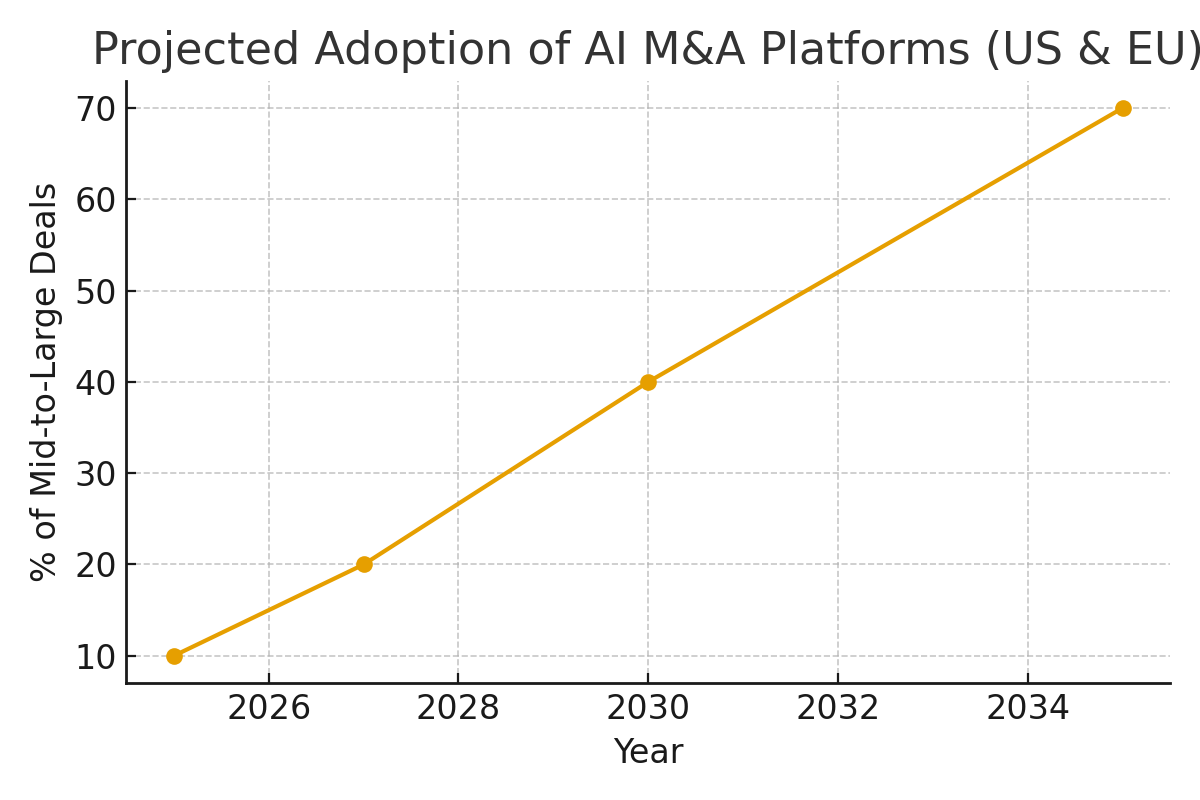

AI-powered M&A platforms are forecast to grow at a CAGR of 18–20% between 2025 and 2035. By 2030, 40% of mid-to-large M&A transactions in the US and EU are expected to leverage AI platforms, up from under 10% in 2025. Adoption will be fastest among investment banks and PE firms, driven by high deal volumes. By 2035, adoption could surpass 70%, particularly as corporates integrate AI into mid-market transactions.

2. Predictive Targeting Accuracy

Predictive analytics reduces the time to identify acquisition targets by 25–35%, compared to traditional scouting. Platforms analyze structured financials, unstructured data (news, patents, filings), and alternative data (web traffic, supply chain). In US case studies, target identification pipelines dropped from 8 weeks to 5. EU firms emphasize compliance-first predictive algorithms, slowing speed but improving auditability. The quantifiable advantage is faster screening of hundreds of targets, improving probability-adjusted deal quality.

3. Due Diligence Timelines & Cost Savings

Due diligence automation using AI reduces timelines by 30–40%. For example, diligence cycles that traditionally take 12 weeks can be compressed to 7–8 weeks. Cost savings are also material, with firms reporting 15–25% lower diligence costs by reducing human labor in document review and compliance checks. In high-volume PE deals, this means millions in annual savings. EU regulators mandate explainable AI in diligence automation, adding compliance layers.

4. Synergy Modeling & Integration Outcomes

AI-powered synergy modeling improves valuation accuracy by 15–20%. Machine learning simulations test post-merger revenue and cost synergies, reducing overestimation risks. In case studies, AI integration forecasts helped reduce integration failure rates from 35% to under 25%. US firms adopt synergy modeling for scenario planning, while EU players focus on operational synergies across borders. By 2035, AI-based synergy models are expected to be standard practice in >60% of large deals.

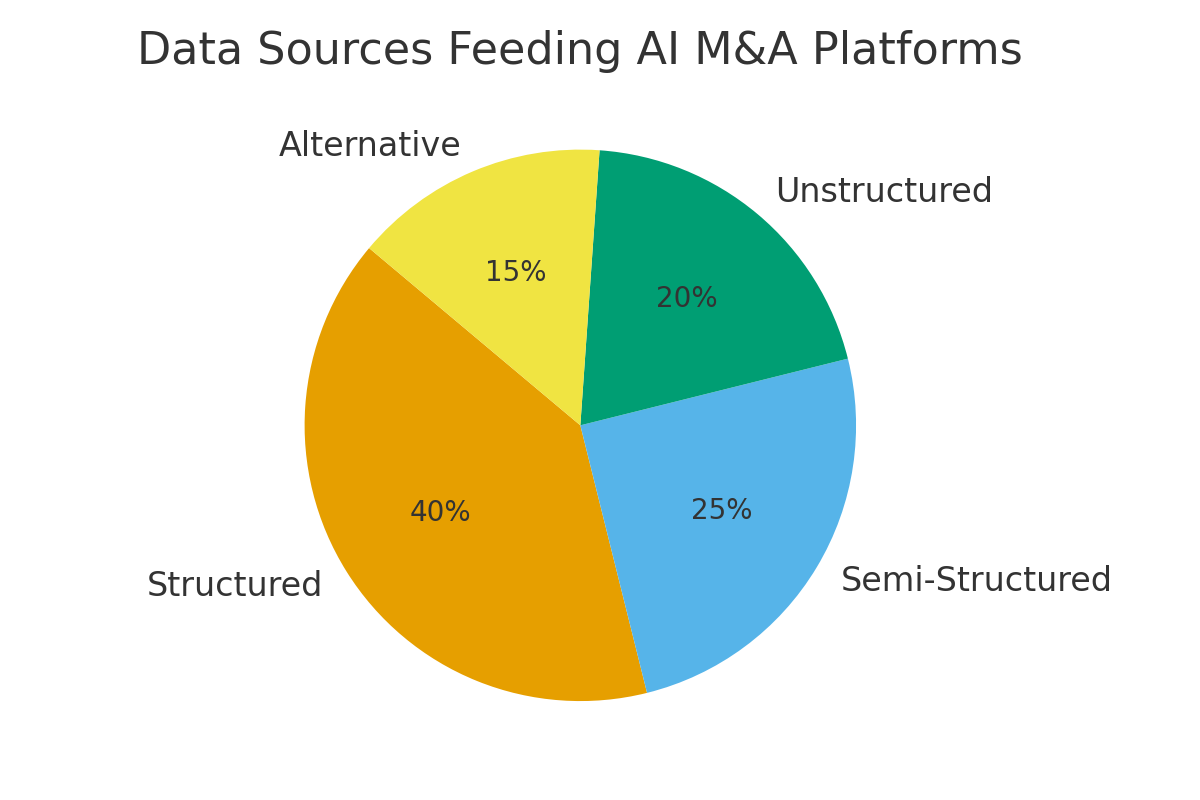

5. Data Sources & Quality Challenges

AI platforms rely on structured data (financials, filings), semi-structured (supply chain, customer databases), and unstructured (news, patents, web). Alternative datasets ESG metrics, employee sentiment are increasingly used. The challenge lies in harmonizing fragmented datasets, ensuring GDPR compliance in the EU, and mitigating noise in alternative data. Poor data quality can reduce accuracy by 20–25%. Firms investing in robust ETL processes achieve higher predictive reliability.

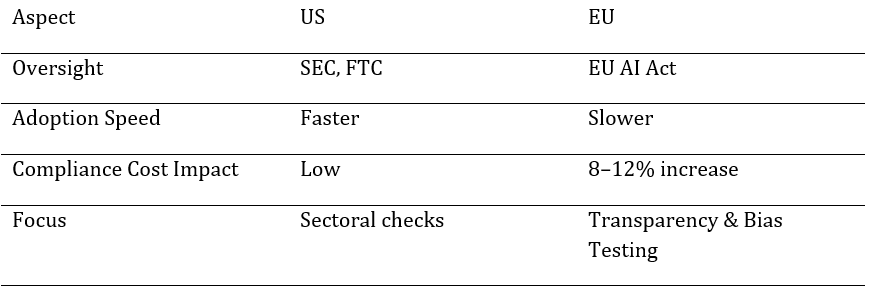

6. Regulatory Frameworks (US vs EU)

The EU’s AI Act classifies M&A AI applications as 'high-risk,' mandating transparency, bias testing, and explainability. Compliance costs are projected to add 8–12% to platform operating costs by 2030. The US lacks a centralized AI law but relies on sectoral oversight by SEC and FTC. This creates a regulatory gap: faster adoption in the US but higher compliance credibility in the EU. Firms operating cross-border must align with the stricter EU standards.

7. Risks: Bias, Compliance & Over-Reliance

AI models risk embedding bias from historical deal data, potentially excluding innovative targets or overvaluing conventional ones. Over-reliance on AI outputs without human oversight could misprice synergies or miss compliance red flags. Compliance exposure is heightened in EU deals where explainability is mandatory. Quantitatively, firms estimate that reliance on unverified AI models could increase regulatory breach risk by 15–20%. Leading vendors now emphasize 'human-in-the-loop' oversight to mitigate risks.

8. Competitive Landscape

The AI M&A platform market is fragmented but consolidating. US-based startups focus on predictive analytics speed, while EU vendors prioritize compliance-first platforms. Large SaaS providers (Salesforce, Microsoft, Refinitiv) are embedding M&A analytics modules. Investment banks are developing proprietary platforms, and PE firms are co-investing in vendors. Market share is expected to consolidate to the top 5 vendors holding ~60% by 2030.

9. Investment Banks vs PE Deployment

Investment banks use AI for sector scanning, target scouting, and predictive deal origination. PE firms emphasize due diligence automation and portfolio synergy modeling. In PE case studies, diligence timelines were reduced from 12 weeks to 7, cutting costs by 20%. Banks gained deal origination efficiency, screening ~30% more targets annually. By 2030, 50% of PE firms in the US/EU are expected to deploy AI platforms, compared to 35% of investment banks.

10. Future Outlook: AI-Human Collaboration

By 2035, AI adoption in US/EU M&A is expected to exceed 70%, but human oversight will remain central. AI will dominate target identification, diligence review, and synergy modeling, while humans lead negotiations, cultural assessments, and regulatory navigation. Quantitatively, firms using AI-human collaboration models report 25% higher success rates in achieving projected synergies versus AI-only or human-only approaches. The long-term outlook is collaborative, not substitutive.

Key Takeaways

• By 2030, 40% of mid-to-large US/EU M&A deals will use AI platforms.

• Predictive targeting improves identification accuracy by 25–35%.

• Due diligence automation cuts timelines by 30–40%.

• Synergy modeling enhances valuation accuracy by 15–20%.

• EU’s AI Act mandates transparency and bias testing; US oversight remains sectoral.

• Market CAGR (2025–2035) projected at 18–20%.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1450

$ 1450

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071