68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Microgrid Deployment Strategies for Industrial Parks: Islanding Capabilities & Cybersecurity Protocols

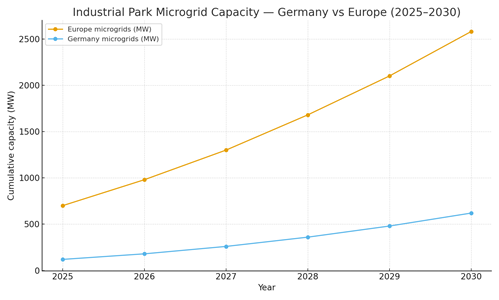

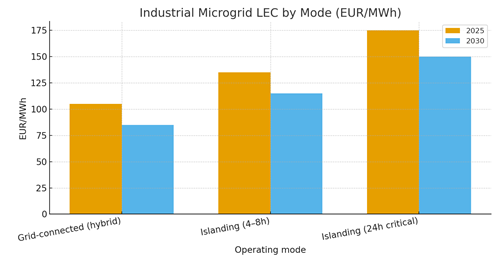

From 2025 to 2030, industrial parks across Europe adopt microgrids to secure power quality, hedge price volatility, and meet decarbonization commitments. Germany leads with brownfield retrofits that integrate PV, wind, battery energy storage systems (BESS), and combined heat and power (CHP) under advanced controllers capable of seamless islanding. The business case rests on three levers: (1) time‑of‑use and imbalance avoidance via optimization and demand response; (2) resilience premiums from islanding during grid outages; and (3) Scope 2 reductions and corporate power purchase agreement (PPA) alignment. Islanding spans four design tiers ride‑through (seconds‑minutes), short‑duration (4–8h), day‑scale (24h) for critical loads, and multi‑day with on‑site generation. Quantitatively, illustrative cumulative capacity for Europe grows from ~0.7 GW in 2025 to ~2.6 GW by 2030, with Germany rising from ~120 MW to ~620 MW as industrial clusters and port zones standardize architectures. Levelized energy cost (LEC) improves across modes: grid‑connected hybrid operations trend from ~€105/MWh in 2025 to ~€85/MWh by 2030 through controls and procurement; short‑duration islanding falls from ~€135 to ~€115/MWh as BESS prices decline and efficiencies improve; 24‑hour critical islanding declines from ~€175 to ~€150/MWh via hybridizing with CHP and demand flexibility.

What's Covered?

Report Summary

Key Takeaways

1) Hybrid microgrids cut LEC and volatility; islanding adds quantifiable resilience value.

2) Germany and Benelux lead on policy, interconnect, and vendor depth; Nordics excel in controls.

3) BESS cost declines and controls drive ~€15–20/MWh LEC improvement by 2030 (illustrative).

4) Cybersecurity is now a design‑basis: zero‑trust, segmentation, secure gateways, and patching.

5) Digital twins and anomaly detection reduce outage risk during transitions to island mode.

6) Outcome‑based SLAs (availability, failover time, cyber KPIs) improve financeability.

7) Energy‑as‑a‑Service and ESCO models unlock multi‑site portfolios and standardization.

8) Grid services (FCR/FRR/peak‑shaving) stack revenues with on‑site load optimization.

Key Metrics

Market Size & Share

Industrial park microgrids scale steadily through 2030 as policies and tariffs reward flexibility and resilience. In this illustrative outlook, cumulative European capacity climbs from ~0.7 GW to ~2.6 GW, while Germany grows from ~120 MW to ~620 MW. Share accrues to integrators that productize architectures PV/wind + BESS + CHP under a common EMS with standardized switchgear, communications, and protection settings enabling multi‑site roll‑outs. Port‑adjacent zones and chemical parks adopt early due to outage costs, power‑quality needs, and space for DERs.

Market concentration increases around players that bundle design, interconnect studies, and O&M with performance guarantees. As parks mature, portfolios co‑optimize LEC and resilience by stacking revenues (FCR/FRR, peak‑shaving, behind‑the‑meter arbitrage) without compromising islanding readiness. Germany, the Netherlands and France become anchor markets; the Nordics scale with advanced controls and low‑carbon grids; Southern/Eastern Europe follow as financing and tariff reforms progress.

Market Analysis

LEC trajectories improve across operating modes as BESS costs decline, controls reduce losses, and hybrid CHP configurations provide firming for 24‑hour critical islanding. Grid‑connected operations approach ~€85/MWh by 2030, while short‑duration islanding trends toward ~€115/MWh, and 24‑hour critical islanding toward ~€150/MWh in this illustrative view. Economics are sensitive to tariff structures, outage frequency, DER capex, and site resource quality. Sensitivity analysis shows that a 10‑pt reduction in round‑trip losses or optimized dispatch windows can trim LEC by ~€6–10/MWh. Risk profile: interconnect delays, inverter‑protection coordination, and EMS complexity can erode schedules; cybersecurity gaps expose operational risk during islanding. Mitigations include early grid studies, hardware‑in‑the‑loop testing, standardized relay settings, and cyber controls (zero‑trust, MFA, cert‑based auth, tight allow‑lists). Bankability improves with outcome‑based SLAs availability, failover time, cyber hygiene and with energy‑as‑a‑service structures that align vendor incentives.

Trends & Insights (2025–2030)

• Standardized architectures: modular switchgear, EMS templates, and protection libraries speed delivery.

• Controls maturity: grid‑forming inverters and black‑start sequences enable smooth islanding and resynchronization.

• Cyber by design: zero‑trust networks, IEC‑62443 zoning, secure gateways, and automated patch/credential management.

• Digital twins: HIL testing and anomaly detection reduce commissioning risk and downtime.

• Market revenues: stacking FCR/FRR with on‑site optimization; careful guardrails to preserve islanding.

• Finance models: ESCO/EaaS contracts with outcome KPIs; portfolio aggregation lowers WACC.

• Safety & compliance: arc‑flash studies, protection coordination, and grid‑code conformance embedded early.

• Workforce: OT cybersecurity and protection engineers become critical path resources.

Segment Analysis

• Chemicals & Pharma Parks: high power quality and process‑critical loads; early adopters of grid‑forming controls and 24‑hour islanding.

• Automotive & Manufacturing Clusters: PV/BESS hybrids for LEC reduction; short‑duration islanding for outage resilience.

• Ports & Logistics: land‑constrained; CHP/shore‑power hybrids; strong value on black‑start and rapid resynchronization.

• Data‑rich Campuses: advanced OT cybersecurity, segmentation, and continuous monitoring; strict SLA enforcement.

Buyer guidance: classify loads by criticality; choose DER mix via co‑optimization; standardize protection settings; adopt zero‑trust controls; and negotiate outcome‑based SLAs that include availability, failover times, cyber KPIs, and LEC targets.

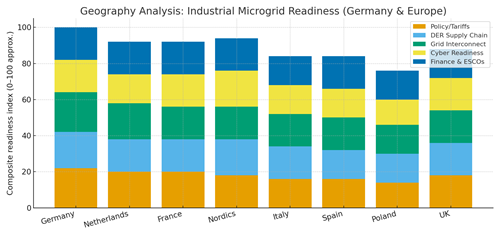

Geography Analysis (Germany & Europe)

Germany leads on industrial density, interconnect processes, and vendor ecosystems; the Netherlands and France follow closely. The Nordics excel in controls and low‑carbon power. Italy and Spain improve with tariff modernization and ESCO financing; Poland and parts of Eastern Europe scale as supply chains deepen and grid operators formalize interconnect playbooks. The stacked criteria (policy/tariffs, DER supply chain, grid interconnect, cyber readiness, finance/ESCOs) show complementary strengths that influence siting, sequencing, and contracting.

Implications: launch portfolios in high‑readiness markets to establish reference plants; export standardized designs to follower markets; and harmonize SLA KPIs to enable regional benchmarking and multi‑vendor competition.

Competitive Landscape (Ecosystem & Delivery Models)

Competition spans EMS/DERMS vendors, inverter/BESS OEMs, CHP and switchgear suppliers, EPC integrators, and OT‑security providers. Differentiators include grid‑forming capability, black‑start reliability, cyber posture (IEC‑62443 mapping, segmentation, patch orchestration), and outcome‑based service depth. Vendors that offer turnkey design‑build‑operate with performance guarantees on availability, failover time, and LEC will capture share. Strategic moves: pre‑qualified equipment lists, protection‑setting libraries, and standardized EMS templates; cyber tabletop exercises and red‑team testing embedded in commissioning; and portfolio‑level MRV that verifies energy, resilience, and cyber KPIs. Ecosystems that pair electrical excellence with cybersecurity discipline will win Europe’s industrial microgrid race through 2030.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1445

$ 1345

$ 1432

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

.png)