68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Esports + Gaming Travel Payments: $3B Market by 2032 in Southeast Asia

The Esports and Gaming Travel Payments ecosystem in Southeast Asia is set to expand from $1.1B in 2025 to $3.0B by 2032, achieving a CAGR of 15.2%. The growth is driven by the convergence of gaming tourism, digital wallets, and cross-border fintech innovation. By 2032, over 40 million esports travelers will engage in global events, fueling demand for instant, multi-currency, and crypto-compatible payment systems. Governments across ASEAN are also investing in payment interoperability frameworks, positioning Southeast Asia as a $3B hub for esports travel finance.

What's Covered?

Report Summary

Key Takeaways

- Market size: $1.1B → $3.0B (CAGR 15.2%).

- 40M+ esports travelers projected by 2032.

- Digital wallets to account for 55% of all transactions.

- Crypto payments to reach 12% of market volume by 2030.

- Transaction fees to decline 35% with blockchain adoption.

- Cross-border remittances reduced from T+3 to instant settlement.

- Airline–esports partnerships expected to increase 5x by 2032.

- Average spend per gamer traveler to hit $550 per trip.

- Thailand & Indonesia to command 45% of market share.

- ASEAN interoperability to enable unified payment regulation by 2028.

Key Metrics

Market Size & Share

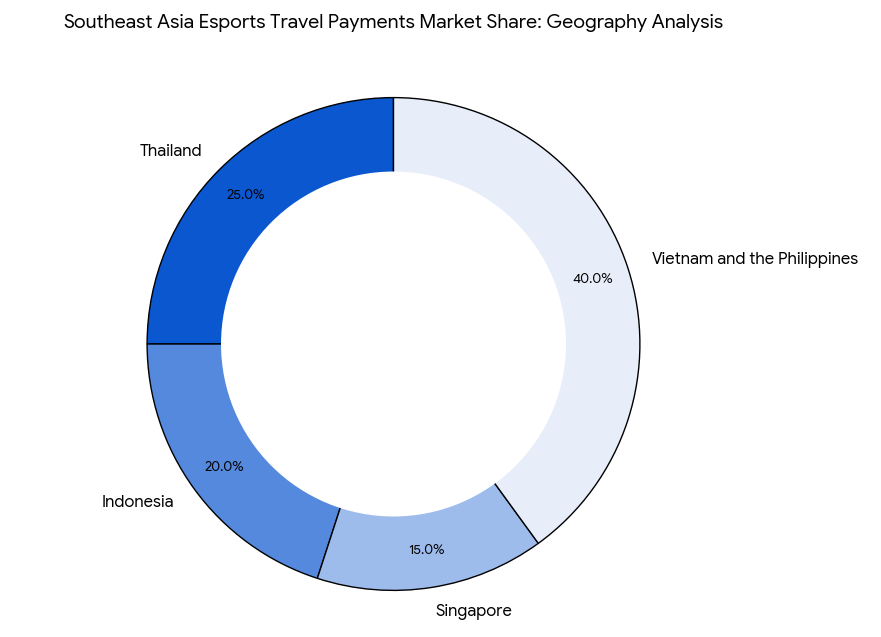

The Esports and Gaming Travel Payments market across Southeast Asia will grow from $1.1B in 2025 to $3.0B by 2032, supported by a surge in international gaming events and cross-border digital travel ecosystems. Thailand and Indonesia together will capture 45% of the market, while Singapore (15%) will lead in fintech innovation. Malaysia, Vietnam, and the Philippines will collectively contribute 30% through rising youth participation and increased esports infrastructure. The market will benefit from the ASEAN Payments Connectivity initiative, which targets real-time settlements and multi-currency processing by 2028. By 2032, 55% of all payments in esports travel will be digital-wallet-based, and 12% crypto-enabled, reducing processing costs and improving cross-border liquidity for event organizers.

Market Analysis

The esports travel payments ecosystem is evolving from fragmented systems to a fully digitized, real-time payment model. Between 2025 and 2032, blockchain integration and digital currency adoption will drive transaction cost reductions of up to 35%. The emergence of AI-driven payment routing, tokenized ticketing, and instant settlement rails will enhance liquidity management for both players and event firms. Travel fintechs like AirAsia MOVE, GrabPay, and ShopeePay are partnering with esports organizers to offer seamless travel + gaming bundles. Additionally, banks and card networks are collaborating with crypto exchanges to enable hybrid payment systems, further accelerating adoption. Rising consumer preference for real-time refunds, instant cashouts, and in-game-linked travel credits will reshape Southeast Asia’s digital payment infrastructure over the next decade.

Trends & Insights

- Crypto Inclusion: 12% of total transactions in esports travel to use digital currencies by 2030.

- AI-Powered Settlements: Payment routing AI reduces delays by 40%.

- Multi-Currency Optimization: ASEAN interoperability to cover 8+ currencies by 2028.

- Embedded Fintech Models: Integration of payment APIs into gaming platforms and travel portals.

- NFT-Based Ticketing: Expected to represent 6% of all esports event passes by 2030.

- Loyalty Tokenization: Gamers to earn tokenized air miles redeemable in esports marketplaces.

- Payment Fraud Reduction: AI-powered KYC and AML tools to cut fraud by 45%.

- Corporate Sponsorship Surge: Brand-funded esports tourism programs to rise 5x.

- Real-Time Refunds: Near-instant cross-border refund systems for cancelled events.

- Virtual Economy Convergence: In-game currencies linked to travel and payment ecosystems.

Together, these trends highlight how gaming, fintech, and travel are merging to create a high-speed digital payments ecosystem across the region.

Segment Analysis

The market is divided into digital wallets (35%), payment gateways (30%), blockchain-based systems (20%), and travel fintech APIs (15%). Digital wallets, led by GrabPay, ShopeePay, and GCash, dominate due to their multi-country reach and real-time transfer features. Payment gateways handle multi-currency card processing, accounting for 30% of total market value. Blockchain-powered payment systems, contributing 20%, are increasingly used for cross-border settlements, stablecoin remittances, and crypto rewards. The remaining 15% comes from API-driven travel fintechs, integrating ticket booking, hotel, and payment systems under one interface. These unified systems are crucial for reducing payment friction and boosting conversion rates for gaming events.

Geography Analysis

Thailand dominates the regional esports travel payment ecosystem with 25% market share, driven by large-scale tournaments like PUBG Global Series and Arena of Valor World Cup. Indonesia, with 20% share, is expanding through strong digital wallet penetration and fintech investment. Singapore (15%) leads in cross-border payment innovation, serving as the financial backbone for ASEAN integration. Vietnam and the Philippines are emerging hotspots for mobile-first gaming and blockchain-enabled travel payments. By 2032, ASEAN interoperability will allow instant transfers across all major currencies in the region, positioning Southeast Asia as the global epicenter for esports travel finance.

Competitive Landscape

Key players include GrabPay, AirAsia MOVE, ShopeePay, GCash, Wise, Binance Pay, and Alipay+. Grab and Shopee dominate regional payment ecosystems through embedded fintech ecosystems. AirAsia MOVE integrates travel, gaming, and crypto payments under a single ecosystem. Binance Pay and Wise are leading the transition to real-time cross-border settlements with zero-commission transfers. GCash continues to expand across the Philippines and Indonesia, focusing on gaming-specific payment APIs. The market’s next phase will emphasize tokenized ticketing, AI-driven risk management, and multi-chain payment systems, enabling esports and travel platforms to operate seamlessly in a borderless, real-time economy.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071