68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Environmental Consulting and Sustainability Management Frameworks: ESG Compliance & Supply Chain Decarbonization Strategies

From 2025 to 2030, North American organizations will navigate a step-change in sustainability management as disclosure requirements expand, supplier expectations tighten, and capital markets reward credible transition plans. The consulting and services market unites three engines of demand: (1) ESG compliance and disclosure across multiple frameworks; (2) supply‑chain decarbonization with granular product and site‑level data; and (3) data platforms and MRV automation that convert sustainability workflows into auditable, repeatable processes. Enterprises are moving beyond one‑off reports toward integrated operating systems that connect finance, procurement, operations, and IT. The winners will operationalize governance, embed decarbonization into sourcing and capex, and instrument supply chains with verifiable data flows. Compliance sets the floor. Public companies confront rising expectations for greenhouse‑gas accounting, climate risk, and sustainability governance; private firms feel pull-through from customers, lenders, and insurers. Meanwhile, supply‑chain decarbonization becomes the cost‑effective frontier: category‑level roadmaps, supplier segmentation, and performance‑based contracts reduce emissions per unit cost. Service providers that pair strategy with execution target setting, data architecture, vendor enablement, and financing unlock durable value.

What's Covered?

Report Summary

Key Takeaways

1) Compliance is necessary but not sufficient tie disclosure to operating KPIs and investment decisions.

2) Treat supply‑chain decarbonization as a sourcing program: segment suppliers and pay for verified performance.

3) Build an MRV backbone (meters, IoT, data lakes, audit trails) before scaling claims and incentives.

4) Prioritize product‑level footprints (LCA/PCF) for margin defense and customer retention.

5) Create financeable roadmaps: link measures to payback, incentives, and green‑capex structures.

6) Adopt contract levers: low‑carbon material clauses, energy‑attribute procurement, and abatement SLAs.

7) Institutionalize governance with RACI, internal price on carbon, and board‑level risk oversight.

8) Invest in change‑management and supplier enablement tooling without adoption stalls benefits.

Key Metrics

Market Size & Share

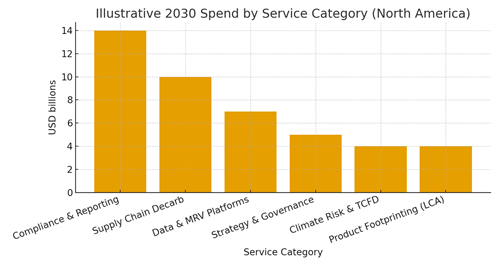

North America’s sustainability services market grows as compliance pressures and customer expectations converge. Our illustrative scenario shows expansion from roughly USD 19B in 2025 to ~USD 44B by 2030. Early spending concentrates on disclosure and governance build‑outs, but the mix shifts toward execution: supply‑chain decarbonization, product‑level footprinting, and data/MRV automation. Verticals with complex supply networks consumer, retail, electronics, and industrial equipment scale fastest, followed by healthcare and logistics as procurement standards harmonize.

Share dynamics change across the decade. Compliance/reporting falls as a share of wallet while supply‑chain programs and MRV toolchains rise. Buyers increasingly prefer integrated offerings consulting plus platform plus implementation over fragmented projects. Market leaders build repeatable playbooks for categories (steel, chemicals, packaging, transport) and couple them with financing and utility programs to accelerate adoption. By 2030, product‑level claims become a commercial necessity, pulling LCAs into core product development and sales workflows.

Market Analysis

Spend skews toward five categories by 2030: compliance/reporting, supply‑chain decarbonization, data/MRV platforms, strategy/governance, and climate risk/LCA. Our illustrative mix highlights the pivot from reporting to execution. Buyers fund supplier enablement (data sharing, energy procurement, process optimization), expand product footprinting to defend margins, and operationalize climate‑risk analytics to protect assets and supply continuity. Platforms matter when they reduce manual work, enforce data lineage, and connect to ERP/PLM/SCM, while consultancies differentiate via category expertise and delivery capacity.

Key risks: change‑management fatigue, supplier resistance, and data quality gaps. Mitigations include phased roadmaps with quick wins, incentives for verified supplier improvements, and MRV‑first architectures with built‑in QA/QC. Outcome‑based contracts abatement SLAs, shared‑savings structures, and index‑linked material clauses align incentives and reduce delivery risk.

Trends & Insights (2025–2030)

Data to decisions: automated MRV and audit trails integrate with procurement and finance to trigger price adjustments and supplier scorecards. Product first: LCA/PCF labeling becomes a prerequisite for key channels; design‑for‑low‑carbon spreads through PLM. Incentive stacking: utilities, tax credits, and green loans bundle into programmatic decarbonization. Supplier enablement: curated toolkits, financing, and training reduce friction in long‑tail vendors. Assurance maturation: third‑party attestation of data lineage and claims becomes mainstream, lowering reputational risk. AI assistants: anomaly detection, gap‑filling of activity data, and supplier nudging improve throughput with fewer analysts.

Segment Analysis (Buyer Profiles)

Consumer/Retail: prioritize product footprints and supplier energy programs; pursue low‑carbon materials contracts. Industrial & Electronics: focus on process efficiency, power procurement, and supplier segmentation; adopt internal carbon pricing. Healthcare/Pharma: emphasize compliance, cold‑chain optimization, and supplier qualification; strong need for MRV. Logistics: fuel switching, route optimization, and warehouse energy upgrades; data integration with telematics. SMBs: packaged playbooks via utilities and platforms; financeable bundles reduce upfront costs.

Geography Analysis (USA & North America)

Readiness concentrates in the U.S. Northeast and West, where disclosure norms, customer pressure, and utility programs converge. Canada’s leading provinces combine policy support with mature energy markets and data infrastructure. The Midwest and South/Gulf accelerate through manufacturing supply chains and utility programs, while Mexico’s industrial corridors gain traction via export requirements and OEM mandates. Buyers should align rollouts with local incentives, utility options, and supplier density, sequencing programs where the ROI and data availability are strongest.

Competitive Landscape (Ecosystem & Intermediaries)

The ecosystem blends global consultancies, specialist boutiques, software platforms, utilities/ESCOs, auditors, and data providers. Differentiation rests on category expertise, implementation capacity, platform interoperability, and assurance‑ready data models. Partnerships between consultancies and platforms bring end‑to‑end offerings diagnostics to delivery while utilities and financiers provide incentive stacking and green‑capex solutions. Vendors that contract for outcomes (abatement delivered, verified data coverage, product‑label enablement) will capture durable share. Expect consolidation around platform‑enabled delivery networks and category playbooks that scale across sectors and regions.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

$ 1445

$ 1345

$ 1432

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

.png)