68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Outbound Indian Travelers: $80B in Annual Spend by 2035

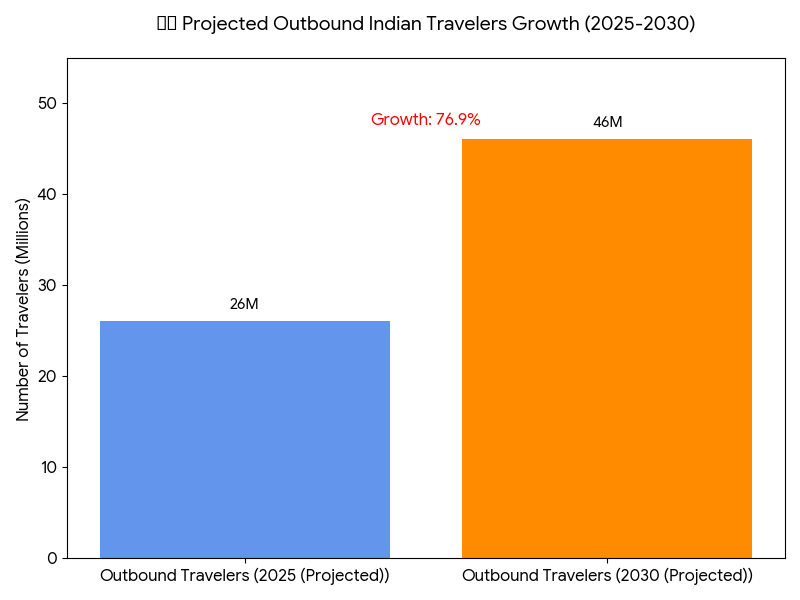

India’s outbound travel market is undergoing a historic expansion, projected to grow from $38B in 2025 to $65B by 2030, before crossing $80B in annual spend by 2035. This surge is fueled by rising disposable incomes, visa liberalization, and digital-first booking ecosystems. Between 2025 and 2030, outbound trips are expected to increase from 26 million to 46 million, driven by leisure, education, and medical tourism. With evolving travel fintech, payment digitization, and airline connectivity, India will emerge as Asia’s largest outbound traveler source by 2030.

What's Covered?

Report Summary

Key Takeaways

- Market size: $38B → $65B (CAGR 11.3%), reaching $80B by 2035.

- Outbound trips to grow from 26M in 2025 to 46M by 2030.

- Leisure travel to account for 54% of total spend by 2030.

- Education and medical travel together make up 22% of spending.

- Average spend per traveler to increase from $1,450 → $1,780.

- Digital payment adoption to reach 85% of all travel transactions.

- Air capacity for outbound routes to expand by 35% by 2030.

- Top destinations: UAE, Thailand, Singapore, UK, and USA.

- India’s share in global outbound tourism spend to hit 4.8% by 2030.

- Visa liberalization to add 6M new annual outbound travelers by 2030.

Key Metrics

Market Size & Share

India’s outbound travel market is expanding rapidly, growing from $38B in 2025 to $65B by 2030, marking a CAGR of 11.3%. By 2035, total annual spend is projected to reach $80B, driven by the rising upper-middle class and millennial travelers seeking global experiences. Leisure tourism will remain dominant, contributing 54% of all spending, while education travel (12%) and medical travel (10%) continue to expand as specialized segments. The UAE, Thailand, and Singapore are top short-haul destinations, while the U.S. and Europe attract premium travelers. India’s share in global outbound tourism will reach 4.8%, supported by rising air traffic capacity, multi-currency fintech adoption, and improved visa agreements across key markets.

Market Analysis

Outbound Indian travel is shifting from group-based leisure tours to independent and digitally managed journeys. By 2030, 46 million Indian travelers are expected to take outbound trips, compared to 26 million in 2025, with a strong preference for Asia-Pacific destinations due to proximity and value. Digital travel booking penetration will exceed 90%, as players like MakeMyTrip, Cleartrip, and EaseMyTrip integrate AI-powered personalization and instant payments. The adoption of UPI-based international payment rails and travel credit fintechs like Niyo and Wise will make cross-border transactions more efficient. Airlines are expected to expand outbound capacity by 35%, while hospitality brands are creating tailored programs for Indian travelers emphasizing wellness, shopping, and experiential travel.

Trends & Insights

- UPI Global Expansion: UPI integration in 20+ countries by 2030, easing digital payments.

- Millennial & Gen Z Travelers: Accounting for 65% of outbound spend growth.

- Visa-Free Corridors: ASEAN and Schengen markets to see 6M incremental travelers.

- Experiential Luxury: Wellness, gastronomy, and shopping trips replacing conventional packages.

- Digital Ecosystems: AI-driven OTAs and super apps dominating bookings.

- Medical Tourism Growth: 10% CAGR from India-to-Thailand, UAE, and Singapore.

- Sustainability Focus: Carbon-conscious travelers choosing eco-certified hotels.

- Airline Alliances: 35% route growth through IndiGo, Air India, and Emirates codeshares.

- BNPL & Forex Fintechs: Travel financing tools reducing friction for younger consumers.

- Outbound Cruises & Luxury Rail: Expected 2.5x growth by 2030 as niche segments expand.

These dynamics position India as one of the top five outbound travel markets globally by the end of the decade.

Segment Analysis

The outbound market can be segmented into leisure travel (54%), education (12%), medical (10%), business (14%), and VFR—visiting friends & relatives (10%). Leisure travel dominates, with holiday packages and cruises being key growth segments, fueled by middle-class income growth. Education travel benefits from the rising number of Indian students abroad—expected to exceed 2.2 million by 2030. Medical tourism is gaining traction due to affordable healthcare in ASEAN and visa flexibility. Business travel, post-pandemic, has rebounded with a 9.2% annual increase, while VFR travel remains stable due to diaspora ties with North America, the Gulf, and Europe.

Geography Analysis

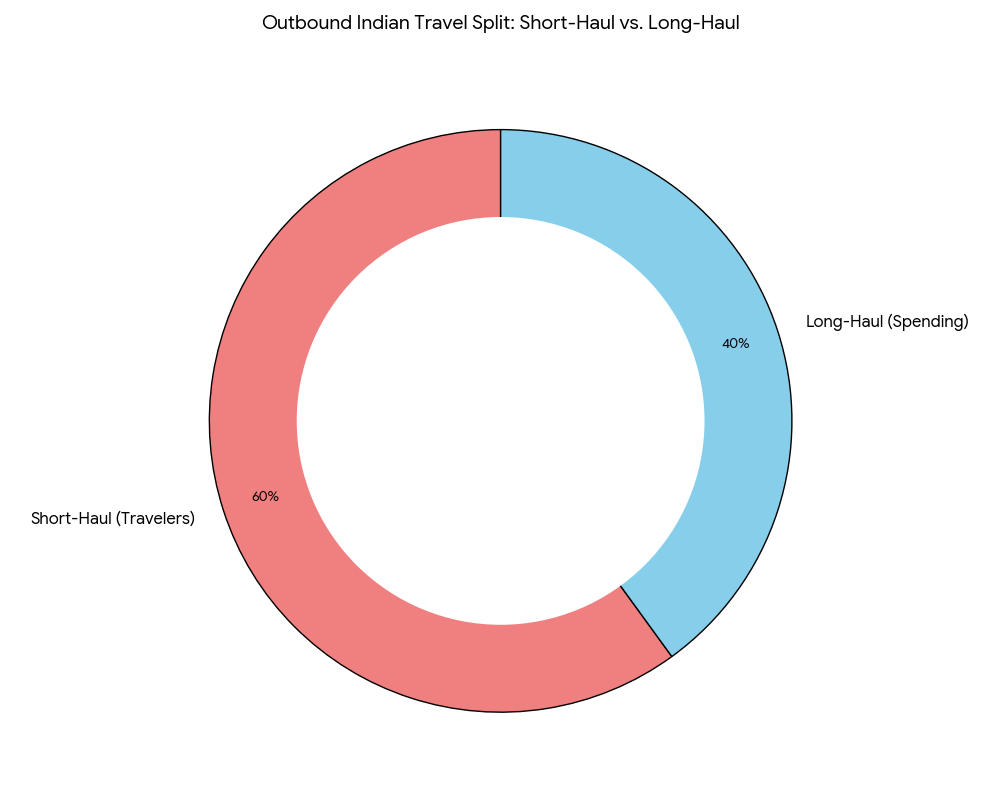

Short-haul destinations like the UAE, Thailand, Singapore, Malaysia, and Indonesia attract 60% of outbound travelers, primarily due to proximity, visa convenience, and low-cost carriers. Long-haul destinations—UK, USA, France, and Australia—represent 40% of total spending, dominated by affluent travelers and students. UAE remains India’s largest outbound market, capturing 17% share by 2030, followed by Thailand (12%) and Singapore (9%). Emerging destinations such as Vietnam, Japan, and Turkey are growing at >20% CAGR, appealing to younger audiences seeking experiential and digital-friendly travel environments.

Competitive Landscape

Leading industry players include MakeMyTrip, EaseMyTrip, Cleartrip, Yatra, and Thomas Cook India, all shifting toward AI and UPI-integrated platforms. Airlines like IndiGo, Air India, and Emirates are increasing direct connectivity, especially to Europe and East Asia. Fintech travel platforms such as Niyo Global, Wise, and Revolut dominate cross-border payments, while Visa and Mastercard expand multi-currency travel card adoption. Hospitality majors—IHG, Marriott, Accor, and Taj—are localizing services to cater to Indian travelers abroad. Strategic alliances between travel OTAs, airlines, and fintechs will be key in enabling seamless, high-value travel ecosystems as India becomes a top global outbound travel contributor.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071