68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Mega Events Legacy: $50B in Tourism Revenue by 2035 from Giga Projects (Middle East)

The Middle East’s mega and giga projects—including Saudi Arabia’s NEOM, UAE’s Expo City Dubai, and Qatar’s Lusail—are projected to collectively generate $50B in tourism revenue by 2035, supported by sustained investment through 2025–2030. The event-to-legacy transformation model will drive regional diversification, leveraging infrastructure, smart cities, and global tourism initiatives. Between 2025 and 2030, regional tourism investment is set to grow from $16.2B to $32.4B, with giga projects contributing 35–40% of all new visitor inflows. The integration of sustainability frameworks, digital travel tech, and long-term hospitality expansion positions the region as a global hub for post-event tourism economics.

What's Covered?

Report Summary

Key Takeaways

- Mega and giga projects to generate $50B tourism revenue by 2035.

- $16.2B → $32.4B regional investment growth (CAGR 14.8%, 2025–2030).

- 35–40% of total new visitors linked to giga projects.

- Saudi Arabia to lead with $22B in legacy-driven tourism receipts.

- UAE to achieve $12B+ tourism spillover from Expo City and smart hubs.

- Qatar and Oman together to attract 8M additional tourists by 2030.

- Sustainability-linked infrastructure bonds to exceed $5B issuance.

- Smart city hospitality capacity to expand by 45% regionwide.

- Event-to-legacy ROI forecast at 3.6× by 2035.

- ESG tourism frameworks to define new FDI flows into cultural assets.

Key Metrics

Market Size & Share

The Middle Eastern mega-event legacy market is projected to grow from $16.2B in 2025 to $32.4B by 2030, primarily driven by Saudi Arabia’s Vision 2030, UAE’s Expo 2020 legacy projects, and Qatar’s post-World Cup tourism expansion. Saudi Arabia alone will account for $22B of the projected $50B revenue by 2035, anchored by NEOM, The Line, and Qiddiya. The UAE follows with $12B+, leveraging Expo City Dubai’s transformation into a year-round cultural and digital tourism hub. Qatar, Oman, and Bahrain collectively contribute $8B through sports, conference, and medical tourism. By 2030, the region’s tourist capacity will expand to 180M annual arrivals, with smart infrastructure and hospitality investments increasing by 45%.

Market Analysis

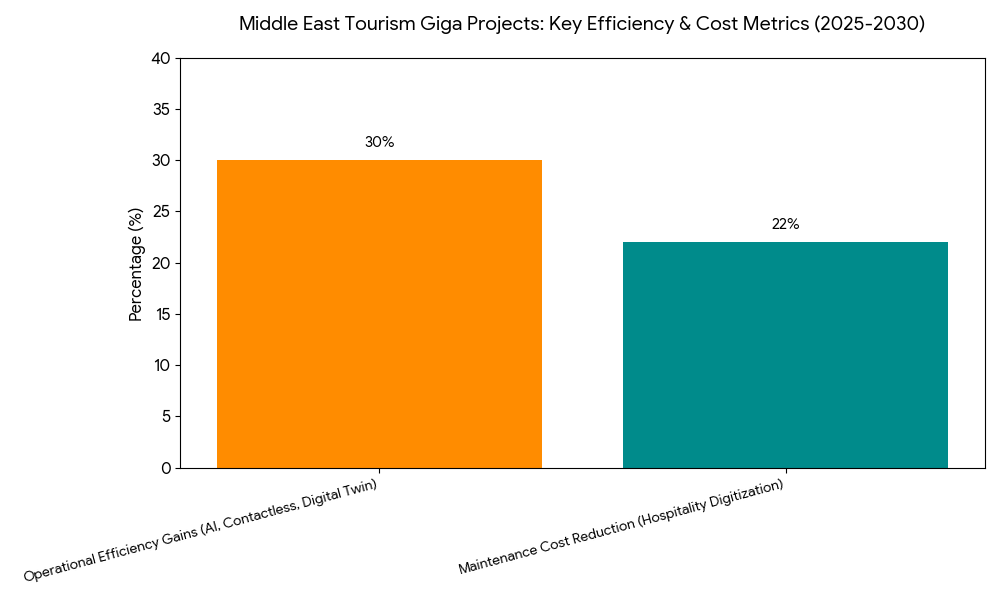

Giga projects are redefining tourism-led economic diversification in the Middle East. Between 2025 and 2030, smart city investments, event reactivation programs, and digital visa ecosystems will accelerate tourism monetization. The focus has shifted from short-term event ROI to long-term infrastructure value—driven by public–private partnerships (PPPs) and FDI inflows exceeding $40B across tourism, entertainment, and mobility. The Saudi Tourism Development Fund (TDF) and Abu Dhabi’s Department of Culture and Tourism (DCT) are leading efforts to link event legacies with sustainable tourism pipelines. AI-driven visitor analytics, contactless check-ins, and digital twin models will enable operational efficiency gains of 30%, while hospitality digitization will reduce maintenance costs by 22%.

Trends & Insights

- Mega-Event Legacy Strategy: Transitioning from one-time events to year-round destinations.

- Tourism Diversification: $32.4B investment base by 2030 to expand regional tourism GDP.

- Smart Infrastructure: IoT-enabled resorts and airports improving visitor flow by 25%.

- Sustainability Focus: $5B in green bond issuance supporting eco-hospitality.

- Digital Integration: AI-driven smart ticketing and travel personalization systems.

- Sports Tourism Surge: Qatar’s Lusail City and Saudi Arabia’s Qiddiya to host 70+ mega events annually.

- Airline–Tourism Synergy: Regional carriers expected to add 120 new routes by 2030.

- Heritage Restoration: $6B ESG funding into cultural tourism and historic sites.

- Luxury Travel Upsurge: 30% growth in premium accommodation demand post-2027.

- Regional Integration: GCC unified tourism visa expected by 2028, boosting multi-country travel circuits.

These trends underscore a region-wide shift toward sustainable, high-tech tourism ecosystems leveraging event legacies for long-term economic gains.

Segment Analysis

The mega-event legacy market is segmented into smart infrastructure (35%), hospitality and leisure (25%), cultural tourism (15%), sports tourism (15%), and mobility and travel tech (10%). Smart infrastructure, at 35%, includes giga-scale urban projects integrating IoT-enabled systems and sustainable architecture. Hospitality and leisure, comprising 25%, focuses on resorts, entertainment districts, and luxury tourism assets. Cultural and sports tourism, each at 15%, are key growth pillars supported by global events, museum expansions, and league-based entertainment. The remaining 10% represents digital travel tech platforms, integrating AI, fintech, and immersive reality to enhance visitor engagement and operational scalability.

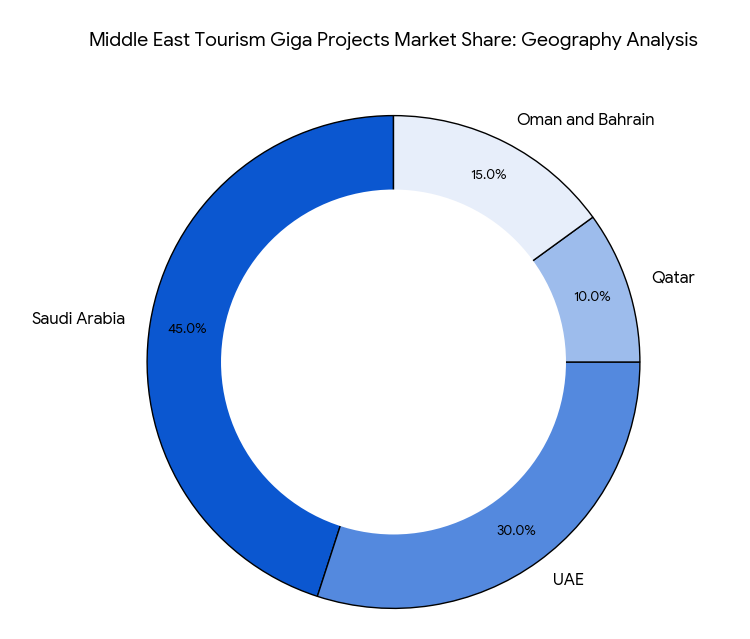

Geography Analysis

Saudi Arabia leads the regional market with 45% share, propelled by NEOM, AlUla, and Qiddiya, driving both leisure and business tourism. UAE follows with 30%, leveraging Expo City Dubai, Abrahamic Family House, and smart hospitality hubs. Qatar, at 10%, builds on FIFA World Cup infrastructure, transforming it into sustainable sports tourism assets. Oman and Bahrain collectively account for 15%, with investments in eco-resorts, cultural corridors, and coastal leisure zones. By 2030, the GCC region is expected to handle 180M tourist arrivals annually, creating over 1.2M jobs across travel, construction, and service verticals.

Competitive Landscape

Key entities driving this transformation include Saudi Tourism Development Fund (TDF), Expo City Dubai Authority, Qatar Tourism, and Red Sea Global, alongside developers like Meraas, Emaar, and Aldar Properties. TDF and Red Sea Global lead in giga-scale smart destinations under Vision 2030, emphasizing ESG compliance and digital hospitality. Emaar and Aldar focus on integrating hospitality tech with mixed-use tourism districts, while Qatar Tourism repositions sports infrastructure for long-term event monetization. Accor, Marriott, and IHG are expanding through sustainability-linked management contracts, while tech enablers like Siemens and Cisco drive AI-powered tourism analytics. The competitive edge now lies in integrating physical assets with data-driven service platforms to maximize tourism ROI.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071