68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Global Solar Storage: Battery Innovations & Grid Integration Challenges

Between 2025 and 2030, solar energy in North America is expected to grow exponentially, accompanied by a corresponding rise in energy storage capacity, which is crucial for addressing the intermittency of solar power. With solar storage playing a pivotal role in energy grid optimization, advancements in battery technologies and the integration of solar with storage systems will be at the forefront of the energy transition in the USA and Canada. Key players in the energy sector, from utilities to independent power producers, will leverage innovations in battery technologies like lithium-ion, sodium-ion, flow batteries, and zinc-air batteries to develop storage systems capable of supporting large-scale solar deployments. While lithium-ion batteries continue to dominate the market due to their high efficiency and energy density, other technologies, such as sodium-ion and flow batteries, are expected to capture increasing market share by 2030. These technologies will offer a competitive edge in specific applications where lithium-ion may not be as efficient or cost-effective. The deployment of solar-storage systems will face challenges in terms of cost reduction, scalability, grid integration, and long-term sustainability, especially for emerging technologies that have yet to be scaled up.

What's Covered?

Report Summary

Key Takeaways

1) Solar-storage integration will be critical to meet renewable energy targets in North America by 2030.

2) Lithium-ion will dominate, but sodium-ion and flow batteries will capture increasing market share in grid-scale storage.

3) By 2030, USA solar storage capacity is expected to exceed 70 GW, driven by large-scale solar deployments.

4) Sodium-ion and flow batteries will be key for reducing storage costs and offering long-term reliability.

5) Grid modernization and energy storage integration policies will be essential for accommodating growing solar capacity.

6) Battery cost reductions will play a pivotal role in driving adoption of solar-storage systems.

7) The USA will lead the market, but Canada and Mexico will also see significant growth in solar-storage capacity.

8) Regulatory frameworks will evolve to support large-scale solar-storage integration with grid systems.

Key Metrics

Market Size & Share

North America’s solar-storage market is poised for substantial growth, with the USA leading the charge. By 2030, solar-storage capacity in the USA is projected to reach 70 GW, driven by both large-scale solar deployments and innovations in battery storage technologies. The adoption of solar-storage systems will be supported by regulatory frameworks, policy incentives, and declining battery costs. California, Texas, and Florida will play significant roles, given their high solar potential and supportive grid infrastructure. The overall solar-storage market share will also be influenced by advancements in sodium-ion, flow, and zinc-air batteries, which offer advantages in specific applications where lithium-ion is less cost-effective. As more utilities and private players adopt solar-storage technologies, the overall market for energy storage will expand rapidly, helping to address the intermittency challenges of solar power.

Market Analysis

Solar-storage systems are expected to grow rapidly in North America due to falling costs and technological advancements. The cost of battery storage will continue to decrease, with lithium-ion batteries remaining the dominant technology through 2030, but sodium-ion and flow batteries will capture an increasing market share as their cost-effectiveness improves. By 2030, sodium-ion batteries are expected to represent around 12% of the market share, while flow batteries will capture around 12%, as well. Storage costs will continue to decline, with the cost per kWh falling from around $100–150 in 2025 to $50–60 by 2030. The efficiency and performance of batteries will also improve, with the expected lifespan of batteries increasing from 5,000 cycles in 2025 to 8,000 cycles in 2030. As technology advances, these batteries will provide more reliable and cost-effective storage options for grid applications, reducing the need for backup power and improving the overall reliability of the energy grid.

Trends & Insights (2025–2030)

• Solar-storage integration will be essential to balancing supply and demand, especially with intermittent renewable energy sources like solar.

• Technological advancements in sodium-ion, flow, and zinc-air batteries will provide long-term cost-effective storage solutions.

• Grid modernization efforts, including digital grid management and energy storage, will help accommodate the rising penetration of solar power.

• Battery storage costs will continue to fall, and the adoption of long-duration storage will be crucial for addressing peak demand.

• Policy incentives, including subsidies for energy storage and carbon pricing, will drive the growth of solar-storage projects.

• The focus will shift from centralized to distributed solar-storage systems, with energy storage used to support local energy grids and reduce energy costs.

• Lithium-ion will continue to dominate the storage market, but other technologies will capture significant market share in specific applications.

• Demand for solar-storage integration will grow with the increasing need for decarbonization and grid stability.

Segment Analysis

• Residential & Commercial: Geared toward off-grid and backup power applications, these systems will grow in regions with high solar potential and energy pricing volatility.

• Utility-Scale Solar: Large-scale solar-storage systems will play a key role in balancing grid supply and demand, especially in high-penetration solar regions.

• Industrial Applications: Industrial-scale energy storage solutions will be deployed to optimize energy consumption and reduce demand charges.

• EV Charging Stations: The integration of solar-storage systems in EV charging stations will provide a sustainable, off-grid solution for growing EV infrastructure.

• Microgrids: Solar-storage integration will play a major role in powering microgrids, especially in remote areas with limited grid access. Segment growth is driven by the combination of falling battery costs, rising carbon pricing, and increasing renewable energy generation targets.

Geography Analysis (USA & North America)

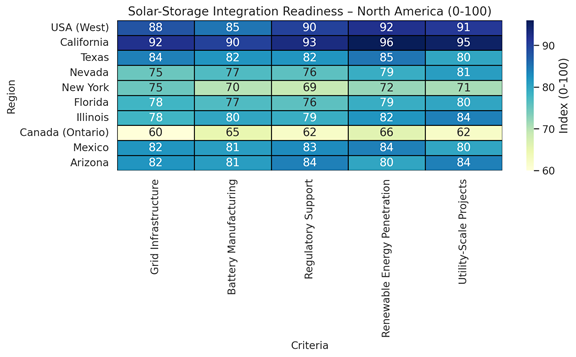

The USA, particularly California, Texas, and Florida, will lead the solar-storage integration efforts in North America, given their high solar potential and grid readiness. California will continue to be a major adopter of solar-storage systems due to its ambitious renewable energy goals and robust grid infrastructure. Texas, with its growing renewable energy sector, will also see significant growth in solar-storage deployments, especially for utility-scale systems. Florida and New York are expected to follow with growth in residential and commercial storage applications. In Canada, Ontario will be a key region for solar-storage adoption, with growing interest from both utility-scale and residential sectors. Mexico's solar potential will lead to increased interest in solar-storage systems, particularly for rural and off-grid applications.

Competitive Landscape (Ecosystem & Delivery Models)

The solar-storage ecosystem consists of developers, manufacturers of battery systems, EPC contractors, and service providers for installation and O&M. Leading battery technology providers in North America include Tesla, LG Chem, and BYD, while EPC contractors like Fluence and NextEra Energy are actively involved in large-scale deployments. Innovations in battery chemistries, such as sodium-ion and flow batteries, will increase market competition, with emerging players in the sector expected to capture a growing share of the market. The competitive landscape will also be shaped by partnerships between solar developers and storage solution providers. Companies that can integrate solar and storage systems into a seamless offering, with lower costs and improved performance, will have a competitive edge. Additionally, companies focusing on energy management software and digital grid solutions will play a key role in optimizing the integration of solar-storage systems with the grid.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071