68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

Cold Chain Resilience: Risk Assessment for Pharma Logistics in ASEAN Markets

Between 2025 and 2030, the pharmaceutical cold chain logistics market across ASEAN—led by Thailand, Singapore, and Malaysia—is projected to expand from $4.7B to $11.8B (CAGR 20.3%). The surge is fueled by temperature-sensitive vaccine and biologics demand, infrastructure modernization, and risk management frameworks adopted post-pandemic. Thailand, accounting for 26% of ASEAN’s cold chain capacity, anchors regional resilience with strategic investments in GMP-certified storage, IoT-based monitoring, and multi-modal cold freight corridors. By 2030, cold chain losses are forecast to decline by 48%, strengthening pharma reliability and export competitiveness.

What's Covered?

Report Summary

Key Takeaways

- Market size: $4.7B → $11.8B (CAGR 20.3%).

- Thailand holds 26% of ASEAN cold chain capacity.

- Cold chain losses fall 48% through digital risk control.

- Temperature compliance rates reach 98% by 2030.

- IoT and AI monitoring adoption grows 3.2× in pharma logistics.

- GDP+ storage capacity increases 42% regionwide.

- Thailand–Singapore corridors drive 65% of ASEAN cold cargo volume.

- Cold chain energy efficiency improves 33% via solar-integrated systems.

- Regulatory compliance costs reduced by 22% through automation.

- Regional vaccine logistics revenue exceeds $2.1B by 2030.

Key Metrics

Market Size & Share

The ASEAN pharma cold chain logistics market grows from $4.7B in 2025 to $11.8B by 2030, reflecting 20.3% CAGR. Growth is anchored by Thailand, Singapore, and Malaysia, which together handle over 65% of ASEAN’s cross-border cold freight. Thailand, with its FDA-accredited cold hubs in Bangkok, Rayong, and Chonburi, represents 26% of regional capacity. The region’s temperature-sensitive pharmaceutical exports, particularly biologics, vaccines, and insulin, are expanding 2.8× as healthcare access widens. By 2030, over 98% of pharma shipments will meet cold compliance requirements through real-time IoT temperature sensors, AI anomaly alerts, and blockchain audit trails. Infrastructure investments under Thailand 4.0 and ASEAN Smart Logistics Framework add 18 million cubic meters of cold storage. Regional players such as DKSH, Yusen Logistics, and DHL Global Forwarding are integrating predictive risk models that cut spoilage rates by 48%. GDP+ and GMP-certified facilities become standard, ensuring traceable, compliant delivery across all ASEAN nations. Rising vaccine trade and clinical trial logistics further boost market size, solidifying Thailand’s role as the regional cold chain anchor connecting Southeast Asia to EU and U.S. markets.

Market Analysis

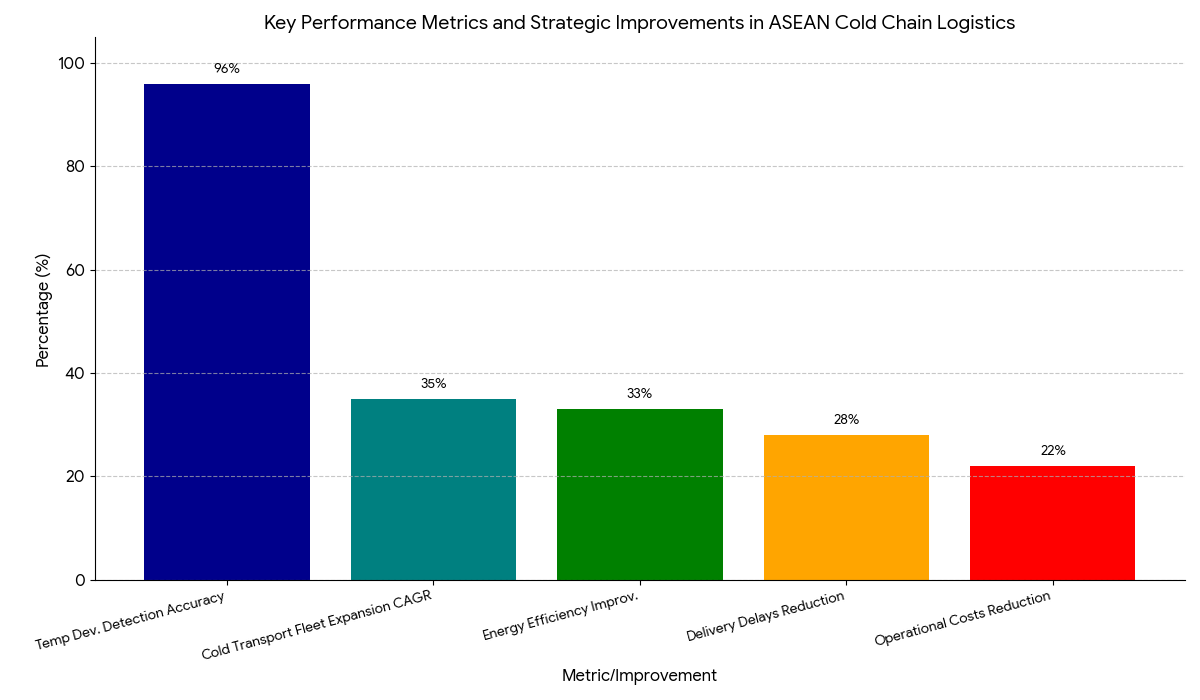

Cold chain resilience is now a strategic investment priority for ASEAN governments and global pharma companies. The average cold chain loss, previously 12% of shipment value, drops to below 6% by 2030 due to digital risk mitigation. IoT-connected sensors and AI-based predictive models are transforming logistics reliability—detecting temperature deviations with 96% accuracy. Thailand leads regional resilience initiatives, operating more than 180 GDP-certified storage facilities, while Singapore focuses on port-centric cold nodes with autonomous transfer systems. Vietnam and Indonesia are fast adopters, expanding cold transport fleets by 35% CAGR through 2030. Investment in AI-driven route optimization reduces delivery delays by 28%, while solar-integrated cold units improve energy efficiency by 33%. Blockchain-based traceability platforms—piloted by DHL and ThaiPost—enhance cross-border transparency, ensuring pharmaceutical shipments remain compliant with WHO GDP and PIC/S standards. The sector’s profitability improves through reduced product wastage, automation-driven labor savings, and regulatory compliance automation, which lowers operational costs by 22%. The ASEAN cold chain’s shift from fragmented storage to integrated smart networks will establish a regional gold standard in pharma logistics resilience and quality assurance by 2030.

Trends & Insights

Key trends defining ASEAN’s cold chain resilience evolution include:

(1) Digital Cold Chain Monitoring: Real-time temperature tracking across 80% of shipments by 2030.

(2) AI Predictive Maintenance: Machine learning models anticipate compressor and vehicle failures, cutting downtime by 36%.

(3) Green Cold Storage: Solar-assisted refrigeration reduces energy cost by 33%.

(4) Pharma 4.0 Integration: Blockchain-backed traceability systems ensure zero-fraud auditability.

(5) Multi-Modal Synergy: Sea-air cold transport networks expand regional efficiency by 27%.

(6) Data-Driven Compliance: Automated risk dashboards cut regulatory reporting time by 42%.

(7) Thailand’s Vaccine Hubs: Bangkok and Rayong become ASEAN’s key biopharma export centers.

(8) Insurance Integration: Data-backed risk assessment reduces claim cycles by 40%.

(9) Talent Development: Cold chain logistics training programs rise 2.5×, improving labor quality.

(10) Sustainability Mandates: ESG-linked logistics funding tied to emission reduction KPIs.

These trends collectively transform ASEAN’s cold chain ecosystem into a digitally integrated, risk-mitigated, and sustainable pharma logistics network led by Thailand’s strategic leadership.

Segment Analysis

The ASEAN cold chain logistics market segments into pharma storage (38%), cold transportation (34%), and last-mile distribution (28%). Pharma storage dominates, with Thailand and Singapore developing regional biopharma warehouses equipped with temperature automation and AI climate sensors. Cold transportation grows fastest at CAGR 22.5%, driven by multi-modal corridors linking Bangkok, Kuala Lumpur, and Ho Chi Minh City. Last-mile delivery, traditionally fragmented, is consolidating under tech-enabled operators such as Kerry Logistics, NinjaVan, and CJ Logistics, which deploy temperature-tracking delivery boxes for precision control. Thailand’s Ministry of Industry incentivizes green cold fleet adoption, reducing fuel use by 29%. Vaccine distribution, accounting for 24% of total cold shipments, grows 3.3× during 2025–2030. AI-integrated risk analytics platforms monitor 24,000+ pharma routes daily, detecting anomalies instantly. By 2030, cold logistics automation penetration will exceed 78%, reinforcing ASEAN’s position as a high-trust global manufacturing and distribution hub for biologics, vaccines, and clinical supplies.

Geography Analysis

Within ASEAN, Thailand leads with 26% market share, serving as the core distribution hub between Mainland Southeast Asia and global pharma networks. Singapore (22%) maintains dominance in high-value biologics logistics, integrating AI-enabled port storage facilities and smart customs systems. Malaysia (17%) strengthens its pharmaceutical export connectivity to the EU via Penang Free Industrial Zone. Vietnam and Indonesia, representing 26% collectively, expand rapidly through infrastructure modernization and private-sector investments in GMP warehouses and refrigerated transport fleets. Philippines and Myanmar, though smaller, benefit from regional logistics partnerships via ASEAN PharmaLink. Germany’s technology export partnerships, particularly in cold automation and refrigeration control, support ASEAN’s modernization. By 2030, ASEAN’s integrated cold chain network will achieve cross-border temperature compliance of 98%, establishing Thailand as a central node for regional pharma reliability, linking Asian manufacturers to European and U.S. markets with traceable, ESG-aligned logistics systems.

Competitive Landscape

The regional competitive landscape is dominated by multinational logistics firms, regional 3PLs, and technology enablers. DHL Global Forwarding, Kuehne+Nagel, and Yusen Logistics lead with a combined 48% market share through integrated cold networks spanning Bangkok–Singapore–Ho Chi Minh routes. Thai logistics players, including SCG Logistics and JWD Group, are investing in solar-powered warehouses and IoT-controlled transport units, improving operational margins by 18%. Singapore’s SATS ColdHub and Malaysia’s Pharmaniaga focus on vaccine and biosimilar handling. Tech firms like Siemens Logistics, Carrier Transicold, and Thermo King provide AI and refrigeration hardware integration across fleets. Startups such as ColdChainConnect and LogiTech ASEAN offer SaaS-based visibility platforms for small-scale operators. Regional funding programs—like ASEAN Cold Logistics Fund (2026)—will allocate over $600M toward resilience technology and training. By 2030, competition will hinge on energy efficiency, automation depth, and compliance traceability, positioning Thailand as the regional benchmark for cold chain resilience and risk governance in pharma logistics.

v

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071