68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Connect With Us

5G-Enabled Smart Ports: Technological Advancements in Saudi Arabian Trade Hubs

Between 2025 and 2030, the 5G-enabled smart ports market in Saudi Arabia and the wider Middle East & Africa (MEA) region expands from $1.2B to $5.9B (CAGR 37.8%). Saudi Arabia’s Vision 2030 logistics transformation drives large-scale adoption of 5G, IoT, AI, and autonomous port systems, positioning the Kingdom as a leading global trade hub. Jeddah Islamic Port and King Abdullah Port lead implementation, achieving 45% automation levels and reducing operational costs by 28%. By 2030, 70% of container movements in Saudi ports will be connected via 5G networks, enabling real-time tracking, digital twin simulations, and predictive logistics across regional maritime ecosystems.

What's Covered?

Report Summary

Key Takeaways

- Market size: $1.2B → $5.9B (CAGR 37.8%).

- Saudi Arabia holds 52% of the MEA smart port investment by 2030.

- 5G-connected container operations reach 70% of total port movements.

- Operational costs decrease by 28% through automation and predictive analytics.

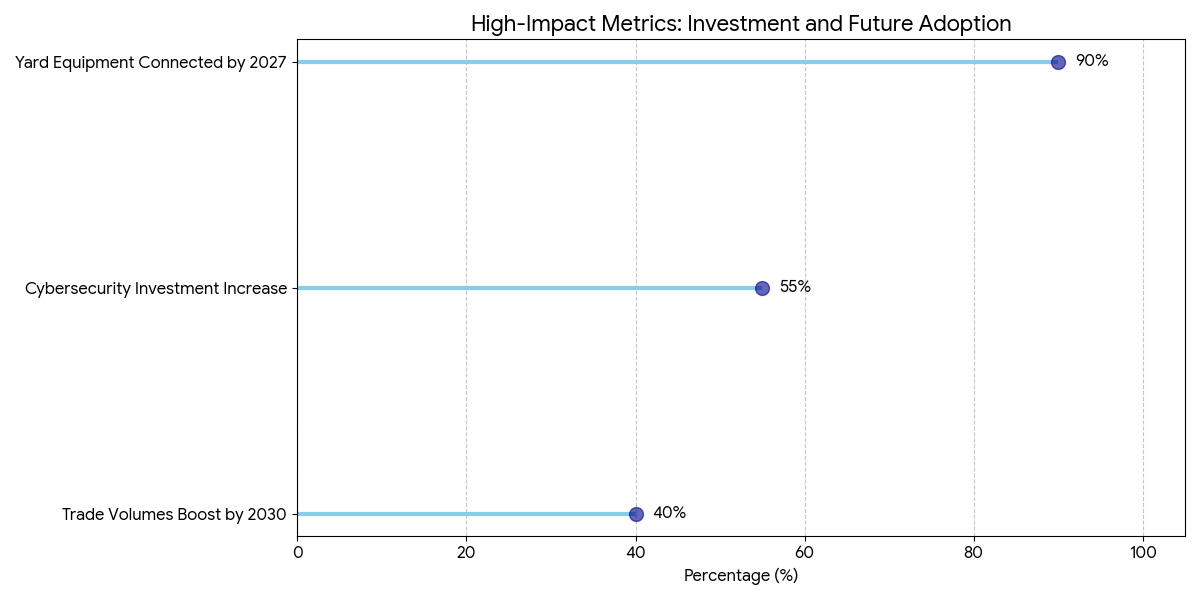

- Port productivity increases by 34%, reducing vessel turnaround times by 22%.

- Digital twin adoption in Saudi ports expands by +40% annually.

- Energy efficiency improves by 30% via smart grid integration.

- IoT sensor networks achieve 90% yard coverage by 2029.

- Cybersecurity investments grow +55%, strengthening maritime data systems.

- Regional trade throughput in smart ports rises by $47B in value by 2030.

Key Metrics

Market Size & Share

The 5G-enabled smart ports market across Saudi Arabia and MEA grows from $1.2B in 2025 to $5.9B by 2030, driven by strategic government investments under Saudi Vision 2030. Saudi Arabia alone captures 52% of MEA smart port investments, positioning itself as a logistics hub linking Asia, Africa, and Europe. Jeddah Islamic Port, handling over 6 million TEUs annually, and King Abdullah Port, the region’s most advanced private terminal, are pioneering 5G adoption for real-time yard management and predictive maintenance. By 2030, 70% of container movements in Saudi ports will be 5G-connected, supporting AI-assisted scheduling, digital twins, and autonomous cranes. These advancements increase port productivity by 34%, while cutting vessel turnaround time by 22%. Operational costs drop 28%, as predictive analytics optimize fuel use, maintenance, and workforce allocation. Digital twin ecosystems, growing 40% annually, enhance infrastructure planning and cargo flow simulations. Across the MEA region, ports in UAE, Egypt, and South Africa follow Saudi Arabia’s blueprint, adopting 5G-enabled IoT systems and AI logistics hubs. Trade throughput across smart ports is projected to increase by $47B by 2030, as 5G networks enable end-to-end visibility, real-time asset management, and cross-border logistics integration, creating a regional maritime innovation corridor.

Market Analysis

The adoption of 5G technology is transforming the operational backbone of Saudi Arabia’s maritime logistics. The integration of 5G, AI, and IoT enables real-time communication between cranes, vehicles, and port management systems, improving efficiency by 34%. Automation through autonomous guided vehicles (AGVs) and remote crane operations reduces labor costs by 18% and energy consumption by 30%. Digital twin modeling, which simulates port layouts and cargo flows, reduces maintenance downtime by 26%. Saudi ports are aligning with ITU and GSMA 5G standards, creating a blueprint for regulatory compliance across MEA. By 2027, over 90% of yard equipment will be connected to IoT sensor networks, facilitating predictive logistics. Private telecom operators such as STC, Mobily, and Zain KSA, in partnership with Huawei and Ericsson, are building 5G private networks across Jeddah, Yanbu, and Dammam ports. These deployments lower data latency to under 5 milliseconds, essential for autonomous logistics. Cybersecurity investment, increasing 55%, protects against maritime data breaches and ransomware attacks, as port systems become increasingly connected. By 2030, Saudi Arabia’s 5G-enabled port network will serve as the connectivity standard for MEA, boosting trade volumes by 40% and reinforcing its role as the gateway for global cargo routes linking Europe and Asia.

Trends & Insights

Several technological and strategic trends are shaping Saudi Arabia’s 5G-enabled smart port evolution. (1) 5G-Driven Automation: Ports are deploying autonomous trucks, gantry cranes, and drones, reducing manual operations by 35%. (2) Digital Twin Expansion: By 2030, 80% of major Saudi ports will use digital twin platforms for infrastructure monitoring and predictive logistics modeling. (3) IoT Integration: IoT-enabled sensors provide 90% coverage across yards, monitoring container position, crane health, and power systems in real time. (4) AI-Enhanced Scheduling: AI-based algorithms reduce cargo congestion, cutting average vessel waiting time by 22%. (5) Sustainability and ESG Focus: Smart energy systems and electrified yard equipment reduce carbon emissions by 30%, aligning with Vision 2030’s green logistics goals. (6) Cyber Resilience: With cybersecurity risks increasing, ports are investing 55% more annually in data encryption, threat detection, and 5G firewall systems. (7) Regional Integration: Saudi Arabia’s King Salman Global Maritime Center serves as the nerve center for regional 5G maritime coordination, connecting ports in UAE, Egypt, and Oman. (8) Private Network Deployments: The rise of 5G private networks enables faster adoption across multiple logistics layers, facilitating interconnected smart yards. These trends collectively transform Saudi ports into digitally synchronized, low-latency, high-throughput ecosystems, setting new global standards for smart port logistics.

Segment Analysis

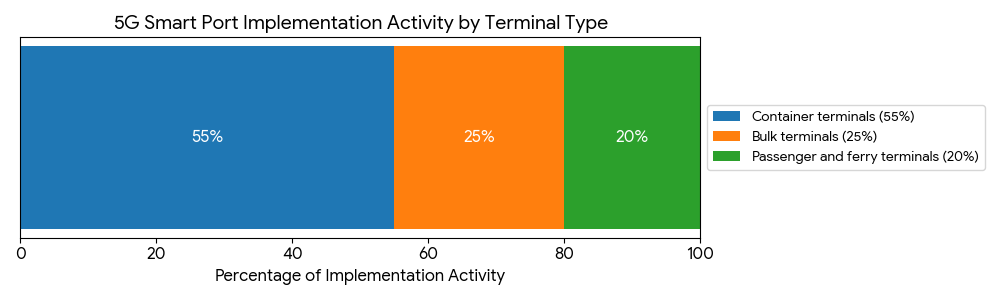

The 5G-enabled smart port ecosystem in Saudi Arabia and MEA can be segmented into infrastructure, operations, and data analytics. Infrastructure accounts for 45% of the market, comprising 5G base stations, edge computing centers, and IoT sensors. The operations segment holds 35%, focusing on automation systems, autonomous guided vehicles (AGVs), smart cranes, and AI-driven logistics control centers. Data analytics and cybersecurity make up the remaining 20%, enabling predictive maintenance, real-time cargo tracking, and data security compliance. Container terminals represent 55% of implementation activity, as these hubs benefit most from automation and connectivity. Bulk terminals account for 25%, integrating 5G-enabled sensors for cargo weight management and temperature control. Passenger and ferry terminals hold 20%, focusing on smart boarding systems and facial recognition-based entry. By 2030, Saudi Arabia’s ports are expected to operate at 45% automation, with Jeddah Islamic Port and King Abdullah Port leading adoption. The total IoT node count across these facilities will exceed 2.5 million sensors by 2030. Meanwhile, regional logistics providers in UAE, Egypt, and South Africa are investing in similar systems, creating an interconnected MEA smart port corridor that supports seamless, low-latency trade data exchange between terminals.

Geography Analysis

Saudi Arabia dominates the MEA 5G-enabled smart ports market, accounting for 52% of total investment by 2030. Jeddah Islamic Port, King Abdullah Port, and King Abdulaziz Port are leading the country’s digital port transformation. Jeddah achieves 45% operational automation, while Yanbu becomes a digital twin testbed for 5G maritime networks. UAE follows with 25% of MEA investment, driven by Dubai’s DP World initiatives at Jebel Ali Port, which aims to be the first fully autonomous 5G-connected terminal in the region. Egypt contributes 10%, focusing on integrating 5G logistics hubs at Port Said and Alexandria. South Africa represents 8%, deploying 5G-connected cold chain infrastructure at Durban Port. The rest of MEA, including Oman, Morocco, and Bahrain, collectively account for 5%, targeting cross-border interoperability projects funded by the World Bank and GCC Infrastructure Funds. By 2030, MEA’s total trade throughput through 5G-enabled ports will exceed $47B, improving supply chain transparency, predictive analytics, and energy efficiency. Saudi Arabia’s ports alone are expected to process 35 million TEUs annually, supported by IoT and edge analytics that reduce downtime by 25%. The region’s growing focus on digital logistics ensures that MEA ports evolve into global innovation hubs, competing directly with Singapore, Rotterdam, and Shanghai in connected port operations.

Competitive Landscape

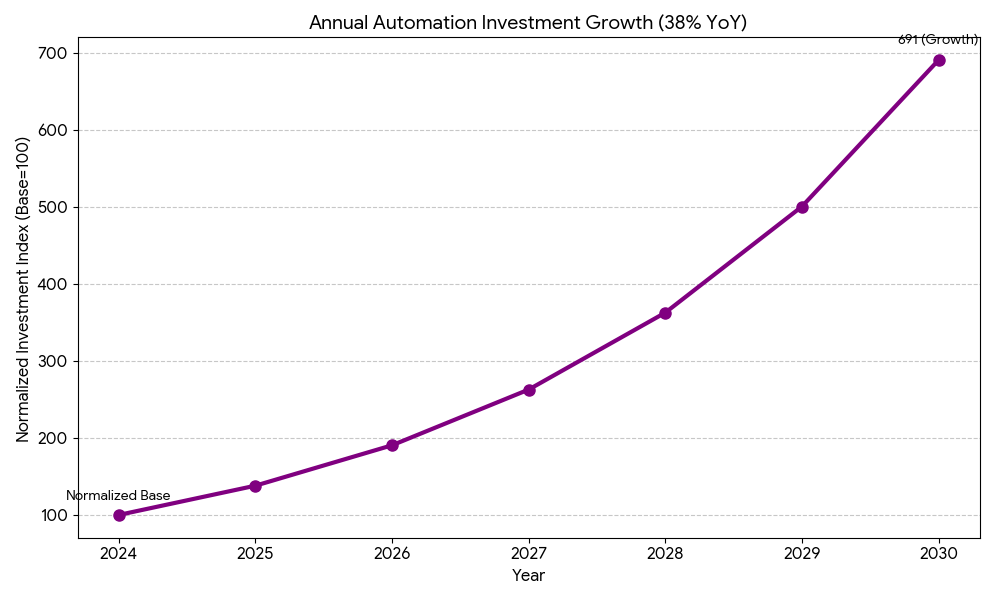

The competitive landscape of 5G-enabled smart ports in Saudi Arabia and MEA is defined by collaborations among telecom operators, port authorities, and technology vendors. STC, Zain KSA, and Mobily lead telecom infrastructure deployments, jointly investing over $2.1B in private 5G networks. Huawei, Ericsson, and Nokia provide 5G equipment and IoT integration platforms for real-time yard operations. Port operators like Saudi Ports Authority (Mawani), DP World, and Red Sea Gateway Terminal (RSGT) spearhead implementation of AI logistics control centers and autonomous yard fleets. IBM, Cisco, and Aramco Digital supply edge computing and cloud analytics, enabling data synchronization across multiple ports. Startups such as Navis Maritime Cloud and PortX Solutions specialize in digital twin modeling and predictive maintenance analytics. By 2030, Saudi Arabia’s smart port ecosystem will include over 150 interconnected service vendors, forming a multi-layered digital network of suppliers, integrators, and logistics partners. Cybersecurity firms like Darktrace and Fortinet expand their presence, securing maritime networks against 5G-enabled threats. With annual automation investment growth of 38%, competition now centers on AI optimization, latency reduction, and data interoperability. The result is a globally competitive 5G maritime infrastructure, establishing Saudi Arabia as the logistics technology capital of the Middle East by 2030.

Report Details

Proceed To Buy

Want a More Customized Experience?

- Request a Customized Transcript: Submit your own questions or specify changes. We’ll conduct a new call with the industry expert, covering both the original and your additional questions. You’ll receive an updated report for a small fee over the standard price.

- Request a Direct Call with the Expert: If you prefer a live conversation, we can facilitate a call between you and the expert. After the call, you’ll get the full recording, a verbatim transcript, and continued platform access to query the content and more.

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071

Request Custom Transcript

Related Transcripts

68 Circular Road, #02-01 049422, Singapore

Revenue Tower, Scbd, Jakarta 12190, Indonesia

4th Floor, Pinnacle Business Park, Andheri East, Mumbai, 400093

Cinnabar Hills, Embassy Golf Links Business Park, Bengaluru, Karnataka 560071